- United States

- /

- Electrical

- /

- NasdaqCM:POLA

Did You Miss Polar Power's (NASDAQ:POLA) Whopping 355% Share Price Gain?

Polar Power, Inc. (NASDAQ:POLA) shareholders might be rather concerned because the share price has dropped 53% in the last month. But over the last year the share price has taken off like one of Elon Musk's rockets. Few could complain about the impressive 355% rise, throughout the period. So we wouldn't blame sellers for taking some profits. Only time will tell if there is still too much optimism currently reflected in the share price.

Check out our latest analysis for Polar Power

Because Polar Power made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Polar Power saw its revenue shrink by 77%. This is in stark contrast to the splendorous stock price, which has rocketed 355% since this time a year ago. It's pretty clear the market isn't basing its valuation on fundamental metrics like revenue. While this gain looks like speculative buying to us, sometimes speculation pays off.

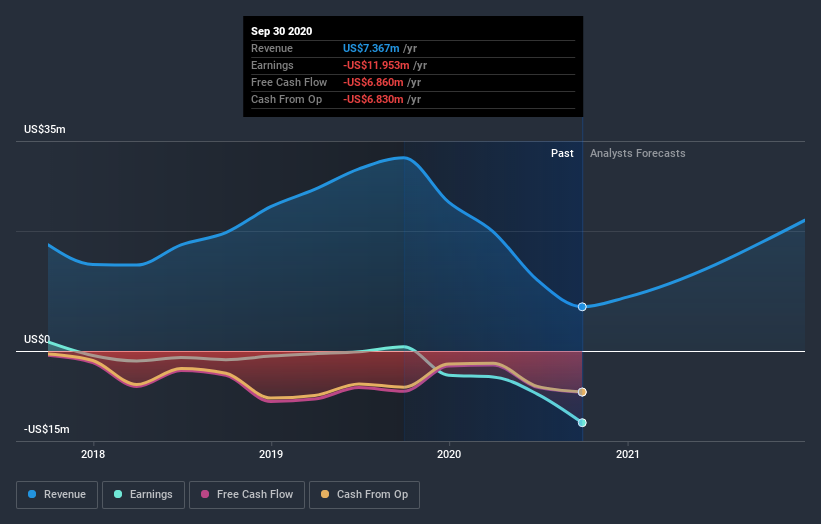

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on Polar Power

A Different Perspective

Pleasingly, Polar Power's total shareholder return last year was 355%. That's better than the annualized TSR of 29% over the last three years. The improving returns to shareholders suggests the stock is becoming more popular with time. It's always interesting to track share price performance over the longer term. But to understand Polar Power better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Polar Power (at least 2 which are a bit unpleasant) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Polar Power or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:POLA

Polar Power

Designs, manufactures, and sells direct current (DC) power generators, renewable energy, and cooling systems in the United States, Canada, Australia, the South Pacific Islands, Asia, Europe, the Middle East, the United Kingdom, and South Africa.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives