- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

What Does Plug Power’s New Hydrogen Contracts Mean for Shares After a 33% Drop?

Reviewed by Bailey Pemberton

- Ever wondered if Plug Power’s low share price actually means it is undervalued, or if there is more to the story? Let’s dig into what those numbers really signal for investors who are looking for opportunities.

- The stock has been on a rollercoaster lately, rising 4.2% in the last week but dropping by 33.1% over the past month and down 15.0% year-to-date, all while sitting well below its highs of recent years.

- This latest bout of volatility follows headlines about Plug Power signing new hydrogen supply contracts and ongoing expansion efforts in clean energy infrastructure, which has put the company in the spotlight. However, uncertainty around industry-wide government incentives and project timelines has fueled both optimism and caution in the market.

- Plug Power currently scores a 2 out of 6 on our valuation score, suggesting there is still a lot for investors to weigh up. In this article, we will break down each approach to valuing Plug Power, and reveal a smarter method to assess fair value near the end.

Plug Power scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Plug Power Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting future cash flows and discounting them back to the present. This approach aims to capture the company's potential for value creation over time by using what analysts expect Plug Power to generate in the years ahead.

For Plug Power, the most recent reported free cash flow (FCF) stands at a negative $904 million, signaling cash outflows as the business invests for growth. Projections indicate continued negative cash flows in the next few years. However, analysts estimate the company could turn positive, with FCF projected to rise to $257 million by 2029. These forecasts are based on a combination of analyst consensus for the first five years and extrapolations beyond that period.

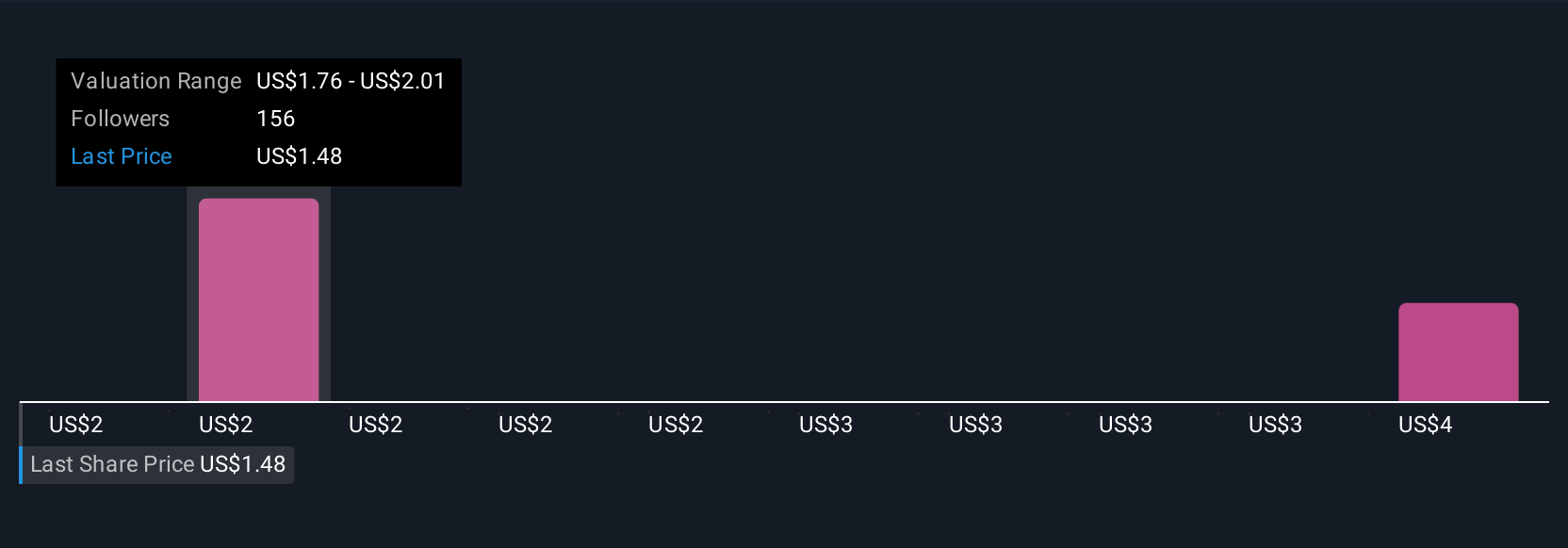

Using the DCF method, the model arrives at an intrinsic fair value of $7.05 per share. With the current share price sitting noticeably lower, this suggests Plug Power may be trading at a substantial 71.9% discount to its estimated fair value. This wide margin indicates the stock could be significantly undervalued based on long-term cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Plug Power is undervalued by 71.9%. Track this in your watchlist or portfolio, or discover 932 more undervalued stocks based on cash flows.

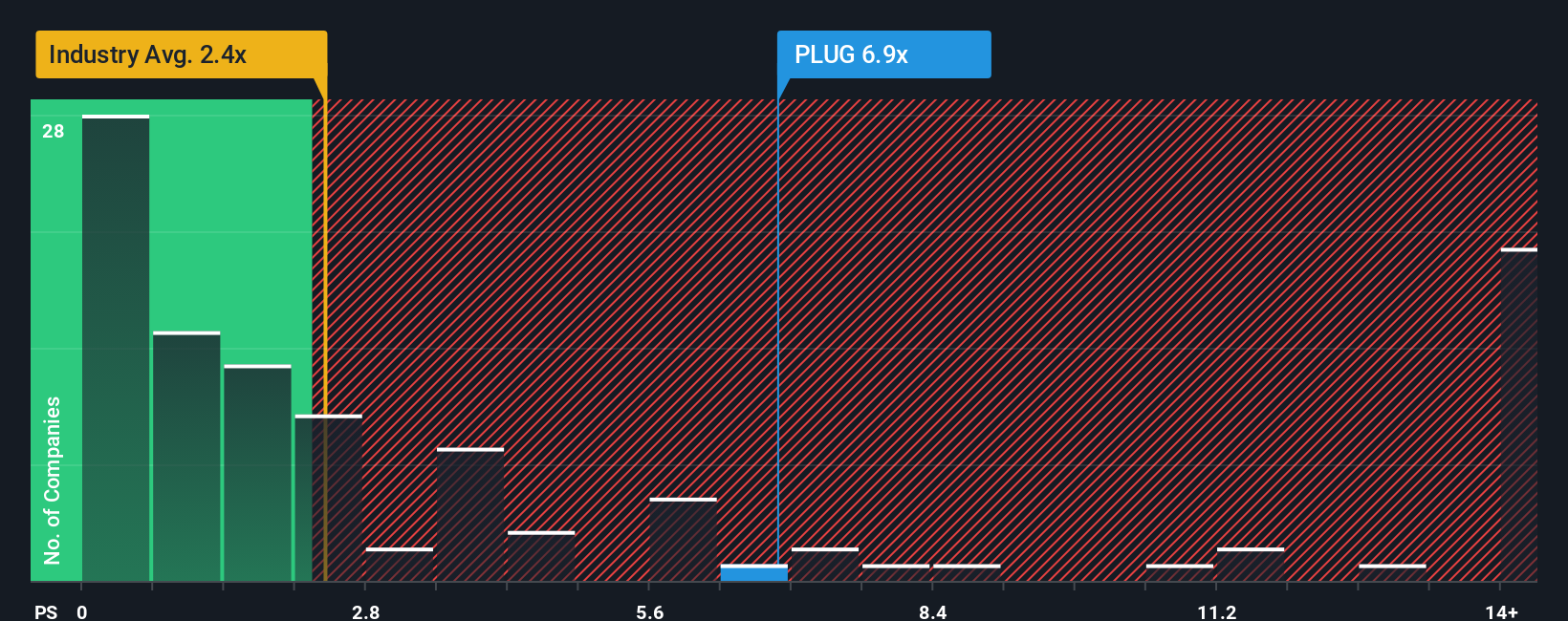

Approach 2: Plug Power Price vs Sales (P/S)

For companies that are not yet profitable, like Plug Power, the Price-to-Sales (P/S) multiple is often a more suitable way to gauge valuation. This metric looks at how much investors are willing to pay for each dollar of revenue. It can be especially useful for high-growth or early-stage firms where earnings might not yet reflect their full potential.

The "normal" or fair P/S ratio for a stock can vary widely based on expectations for future growth and the risks the company faces. Companies expected to outpace their peers may warrant a higher P/S, while elevated risk or lower margins could push it lower.

Currently, Plug Power trades at a P/S ratio of 4.0x, which is higher than both the average for its Electrical industry peers (3.26x) and the broader industry average (1.94x). At first glance, this premium pricing might seem concerning to value investors.

This is where Simply Wall St's Fair Ratio comes into play. The Fair Ratio, calculated specifically for Plug Power, stands at 0.15x. Unlike a simple peer comparison, the Fair Ratio incorporates the company’s actual and forecast growth, profit margins, risk factors, industry norms, and market capitalization. This makes it a more tailored benchmark for assessing true valuation.

Comparing the Fair Ratio of 0.15x to Plug Power's current 4.0x P/S reveals that the stock is trading substantially above what would be expected given all these factors. This suggests the company may be significantly overvalued by this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Plug Power Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a straightforward approach for investors to connect the story they believe about a company, such as Plug Power’s future prospects, risks, and catalysts, to a set of financial outcomes like forecasts of revenue growth, profit margins, and ultimately an estimated fair value.

Narratives uniquely tie your view of the company’s journey to a dynamic financial forecast, making the reasoning behind a fair value both transparent and personal. On Simply Wall St’s Community page, millions of investors use Narratives to not only share their perspectives but also to easily visualize how changing assumptions can impact whether a stock is undervalued or overvalued compared to the current price.

What sets Narratives apart is that they update automatically when new information, such as news announcements or earnings results, comes in, ensuring that your investment thesis always reflects the latest data.

For Plug Power, this means that one investor might build a bullish Narrative around improving policy support and margin expansion (pointing to a $5.00 price target), while another might focus on recurring losses and competition (with a fair value closer to $0.55). Both views can be tested instantly to gauge whether now is the right time to buy or sell.

Do you think there's more to the story for Plug Power? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success