- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Plug Power’s $375 Million Bond Raise and Share Limits Could Be a Game Changer for PLUG

Reviewed by Sasha Jovanovic

- Plug Power recently raised US$375 million through a convertible bond offering to reduce debt and support its growth ambitions, following a strategic shift after suspending several clean hydrogen projects due to the cancellation of a major Department of Energy loan.

- This development leaves Plug Power with less than 0.4% of its authorized shares available and prompts a January 2026 shareholder vote to double its authorized common stock, potentially enabling further capital raising and expansion efforts.

- We’ll explore how this substantial bond raise and capital allocation shift could reshape Plug Power’s investment narrative and future outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Plug Power Investment Narrative Recap

To invest in Plug Power, you need confidence in its ability to capture long-term hydrogen adoption while managing persistent losses and frequent capital raises. The recent US$375 million convertible bond offering strengthens short-term liquidity but does not materially alter the key catalyst, margin improvement through operational discipline, or the biggest risk, which remains ongoing cash burn and potential dilution due to continued funding needs.

Amid these funding moves, Plug Power’s halt of multiple clean hydrogen projects, after the loss of a major Department of Energy loan, stands out. This announcement underscores how delays or cancellations in government-supported pipeline projects could limit revenue realization and earnings visibility, showing that project funding and execution remain central to Plug’s near-term prospects.

By contrast, investors should be aware that the company’s financial flexibility still hinges on the outcome of the upcoming shareholder vote to authorize more shares...

Read the full narrative on Plug Power (it's free!)

Plug Power's outlook anticipates $1.2 billion in revenue and $124.7 million in earnings by 2028. This requires 22.2% annual revenue growth and a $2.1 billion improvement in earnings from current earnings of -$2.0 billion.

Uncover how Plug Power's forecasts yield a $2.79 fair value, a 43% upside to its current price.

Exploring Other Perspectives

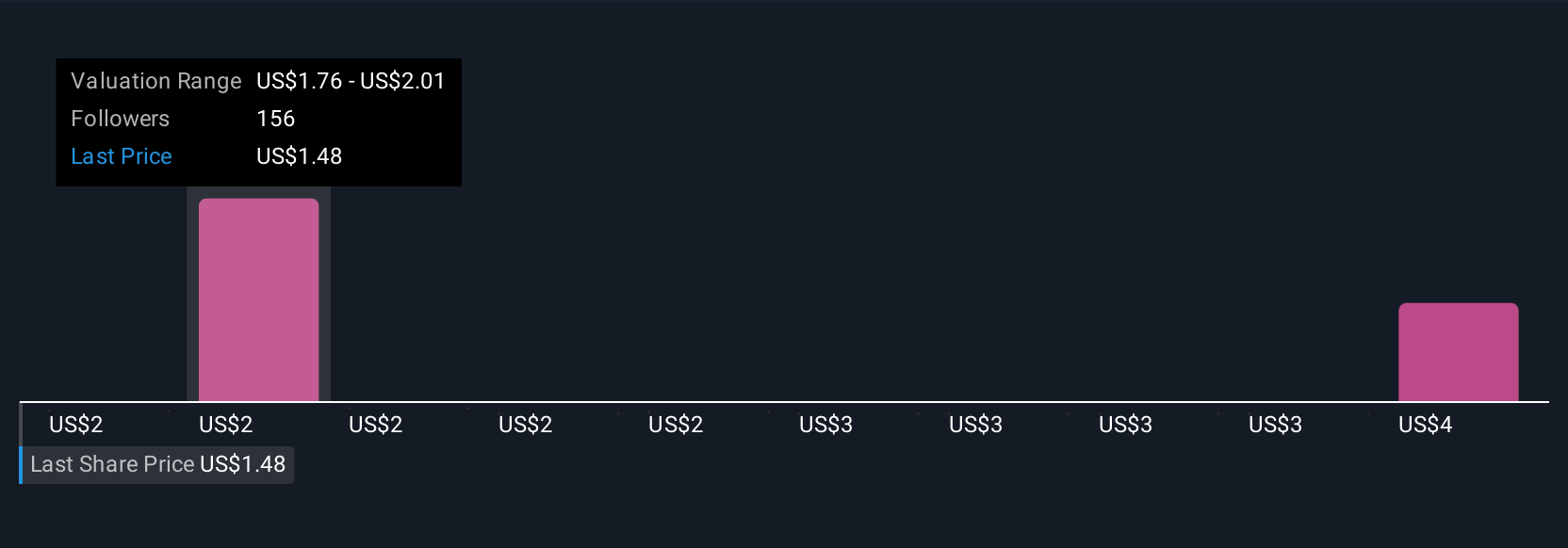

Simply Wall St Community members produced 22 fair value estimates for Plug Power, ranging from US$1.49 to US$7.05 per share. While opinions vary, the recurring risk of dilution and financing needs raises important questions about how future outcomes could impact shareholder value. Consider these viewpoints to see how expectations can differ.

Explore 22 other fair value estimates on Plug Power - why the stock might be worth 24% less than the current price!

Build Your Own Plug Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Plug Power research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Plug Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Plug Power's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success