- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Plug Power (PLUG): Assessing Valuation After Project Suspensions, Asset Monetization, and Quarterly Results Update

Reviewed by Simply Wall St

Plug Power's (PLUG) third-quarter results have put the spotlight on the company's evolving strategy. While revenue came in below expectations, the company posted a slightly narrower loss than anticipated and shared key updates that are shaping its next moves.

See our latest analysis for Plug Power.

Plug Power's share price has seen notable volatility alongside broader market swings and the company's own headline-making updates. Recent news, including plans to monetize assets and pause several hydrogen plant projects, has fueled fresh scrutiny and a sharp 33.97% drop in the 30-day share price return. Still, despite headwinds, the past year delivered a 12.8% total shareholder return, a sign that longer-term investors have weathered recent declines even as short-term momentum fades and risk perceptions shift.

If recent moves in the renewable energy space have you rethinking your portfolio, it might be the perfect moment to discover fast growing stocks with high insider ownership.

After these headline-making management decisions and sharp price swings, the real question for investors is whether Plug Power's recent struggles have created an undervalued entry point or if the market has fully priced in its uncertain road to recovery.

Most Popular Narrative: 19.1% Undervalued

Plug Power's most widely followed narrative points to a fair value well above the last close price, reflecting optimism about its turnaround prospects and strategic positioning. This analysis is grounded in supportive policy tailwinds and anticipated operational improvements that could reshape margins and future growth.

Operational improvements such as gross margin enhancements from Project Quantum Leap, restructuring, facility consolidation, and favorable hydrogen supply agreements are already yielding sharply better margins and targeting breakeven gross margin by Q4. This can lead directly to improved net margins and earnings.

What’s behind this eye-catching valuation? The narrative hinges on game-changing profit margin shifts and ambitious growth rates that could surprise even the most seasoned analysts. Feeling bold enough to find out if these projections stand up to scrutiny? See which aggressive assumptions power this price target.

Result: Fair Value of $2.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent negative cash flow or delays in large hydrogen projects could quickly challenge the optimistic margin and growth assumptions that support this outlook.

Find out about the key risks to this Plug Power narrative.

Another View: Multiples Paint a Cautious Picture

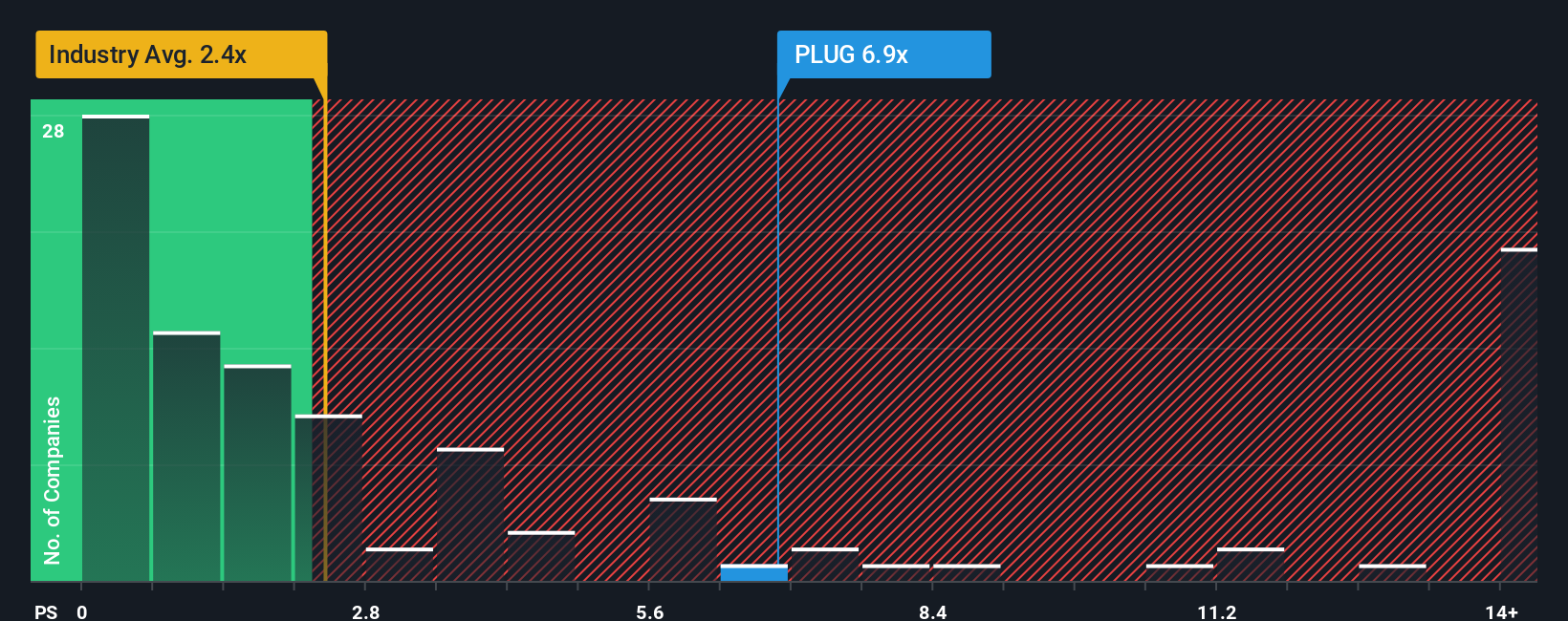

While valuation optimism is driven by future growth and margin targets, a closer look at Plug Power's current sales ratio raises questions. Its price-to-sales ratio is 4.6x. This means investors are paying far more for each dollar of revenue than both peers, at 3.4x, and the industry average, at 2x. Compared to the fair ratio of 0.2x, Plug's valuation appears stretched and this underscores significant expectations built into the price. Does this gap reflect untapped potential, or does it signal valuation risk if growth falls short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Plug Power Narrative

If you see things differently or want to dig even deeper, you can craft your own Plug Power story in just a few minutes. Do it your way.

A great starting point for your Plug Power research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for Even More Winning Ideas?

Smart investors never settle for one opportunity, and the best picks often hide in plain sight. Take action now and find your next standout stock.

- Uncover fresh value by tapping into these 908 undervalued stocks based on cash flows that boast strong cash flows and might be trading for less than they're worth.

- Capture growth early from the innovators behind tomorrow's advancements with these 26 AI penny stocks as they drive artificial intelligence forward.

- Build reliable income streams by reviewing these 16 dividend stocks with yields > 3% featuring companies with consistently high dividend yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives