- United States

- /

- Machinery

- /

- NasdaqGS:NDSN

Nordson (NDSN): Exploring Valuation Following Recent Modest Share Price Pullback

Reviewed by Simply Wall St

See our latest analysis for Nordson.

After a solid stretch earlier this year, Nordson’s momentum has cooled off a bit, with its 1-year total shareholder return currently negative despite a year-to-date share price gain of 12%. This serves as a reminder that short-term price bumps do not always translate into long-term outperformance. However, the fundamentals continue to provide a steady backdrop for investors.

If you’re interested in what’s trending beyond the usual picks, this could be the perfect time to explore fast growing stocks with high insider ownership.

With shares trailing some analyst targets and annual growth in both revenue and net income, the question remains: Is Nordson undervalued at current levels, or has the market already priced in its future expansion?

Most Popular Narrative: 10% Undervalued

With Nordson closing at $230.27, the most widely followed narrative values shares at $256.30, implying a fair value that notably surpasses the current price and suggesting the market may be underestimating the company’s future earnings potential.

Demand for advanced technology solutions is accelerating, especially in semiconductor packaging and electronics assembly, as customers ramp capacity for AI, cloud, and advanced consumer devices. Nordson's exposure to the back end of these markets and its ongoing new product launches are expected to drive sustained revenue growth and market share gains.

What’s powering this upside? A critical shift in Nordson’s product mix, along with big bets on new technologies and margin expansion, are the narrative’s secret weapon for a higher fair value. The precise numbers behind these forecasts might surprise you.

Result: Fair Value of $256.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in automotive and polymer segments or rising R&D costs without sufficient innovation progress could challenge Nordson’s expected margin expansion.

Find out about the key risks to this Nordson narrative.

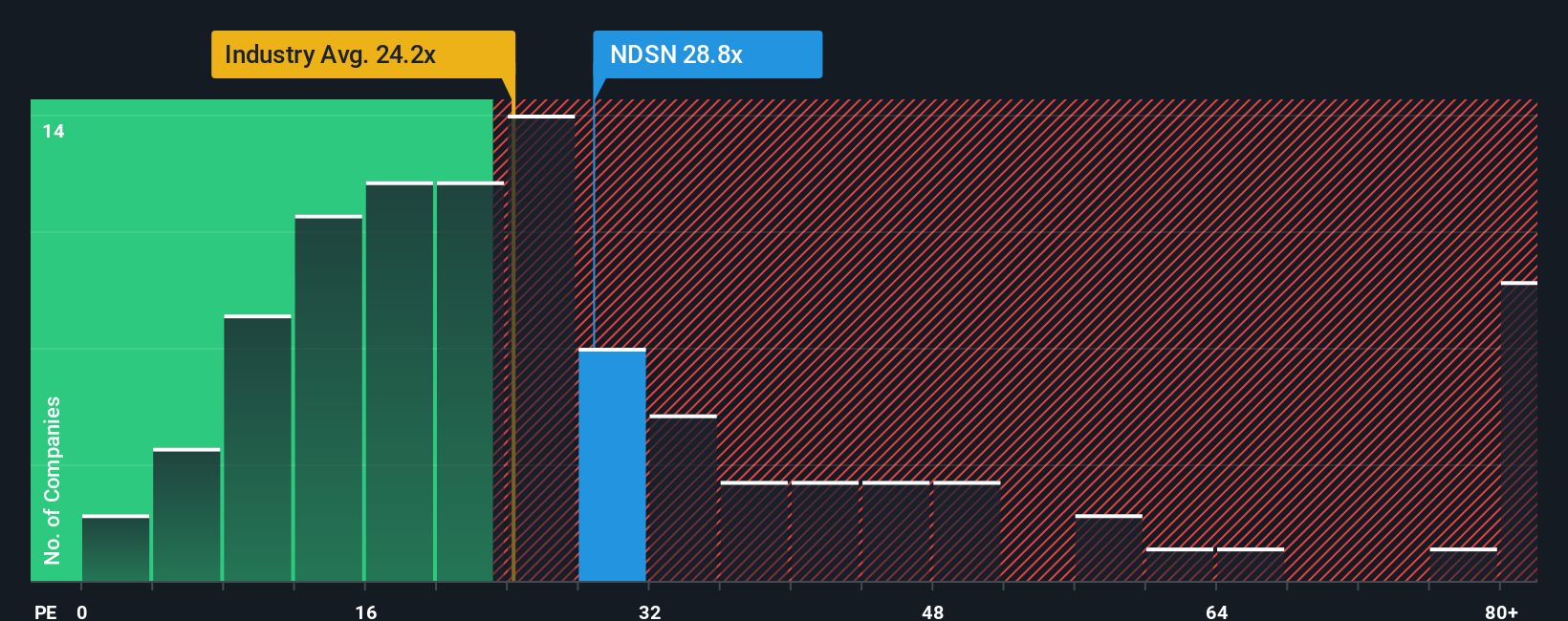

Another View: Looking Through the Lens of Earnings Ratios

Yet a different story emerges when we look at what investors are paying for each dollar of Nordson’s profits. Nordson’s earnings multiple stands at 28.4x, which is higher than both the US Machinery industry average of 24.1x and the peer group’s 23x. The market’s current fair ratio for Nordson, based on the company’s future expectations, is estimated at 24.9x. This exposes investors to the risk of a valuation pullback if sentiment shifts, especially since price multiples often revert in volatile environments.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nordson Narrative

If you’re the type who likes to chart your own course or dig into the numbers yourself, you can get hands-on and craft your own view in just a few minutes. Do it your way.

A great starting point for your Nordson research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

No investor should limit themselves to just one opportunity. Let Simply Wall Street Screener show you compelling stocks beyond the familiar names. Act now and spot trends before the crowd does.

- Jumpstart your search for future disruptors by checking out these 25 AI penny stocks, which are shaping advancements across industries with artificial intelligence.

- Get ahead of the curve on income opportunities and secure your position with these 16 dividend stocks with yields > 3%, offering yields above the market average.

- Uncover trusted value plays by tapping into these 879 undervalued stocks based on cash flows, where proven fundamentals put tomorrow’s winners in focus today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDSN

Nordson

Nordson Corporation engineers, manufactures, and markets products and systems to dispense, apply, and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives