- United States

- /

- Machinery

- /

- NasdaqGS:NDSN

A Fresh Look at Nordson (NDSN) Valuation Following Positive Analyst Coverage and Growth Momentum

Reviewed by Simply Wall St

Nordson (NDSN) has caught investors’ attention after recent analyst coverage began with a positive outlook. Commentary turned more optimistic following solid quarterly results and promising business trends for the company.

See our latest analysis for Nordson.

Nordson’s share price has steadily climbed this year, up more than 15% year-to-date, reflecting renewed confidence as the company pivots firmly toward growth. Notably, while the 1-year total shareholder return remains slightly negative, momentum appears to be picking up as acquisition news and upbeat results reinforce expectations for further upside.

If you’re seeking more stocks with growth and leadership stories unfolding, don’t miss the opportunity to discover fast growing stocks with high insider ownership

Still, the key question for investors now is whether Nordson’s recent gains leave further value on the table, or if the company’s promising future is already reflected in today’s share price. Is there still a buying opportunity, or has the market already priced in the next stage of growth?

Most Popular Narrative: 7.9% Undervalued

With the narrative setting Nordson’s fair value at $256.30, compared to a recent close of $235.95, there is a noticeable valuation gap that could hint at further upside if forecasts are achieved. The following perspective is shaping consensus views of the company’s future trajectory.

Demand for advanced technology solutions is accelerating, especially in semiconductor packaging and electronics assembly, as customers ramp capacity for AI, cloud, and advanced consumer devices. Nordson's exposure to the back end of these markets and its ongoing new product launches are expected to drive sustained revenue growth and market share gains.

Curious which bold internal forecasts could propel Nordson above its current value? This narrative hinges on ambitious earnings and revenue growth, as well as a future profit multiple not seen in most industrial plays. See what is driving these high expectations.

Result: Fair Value of $256.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent market softness or delays in large system orders could challenge Nordson's upbeat forecasts and result in slower than expected growth ahead.

Find out about the key risks to this Nordson narrative.

Another View: Multiples Suggest a Premium Valuation

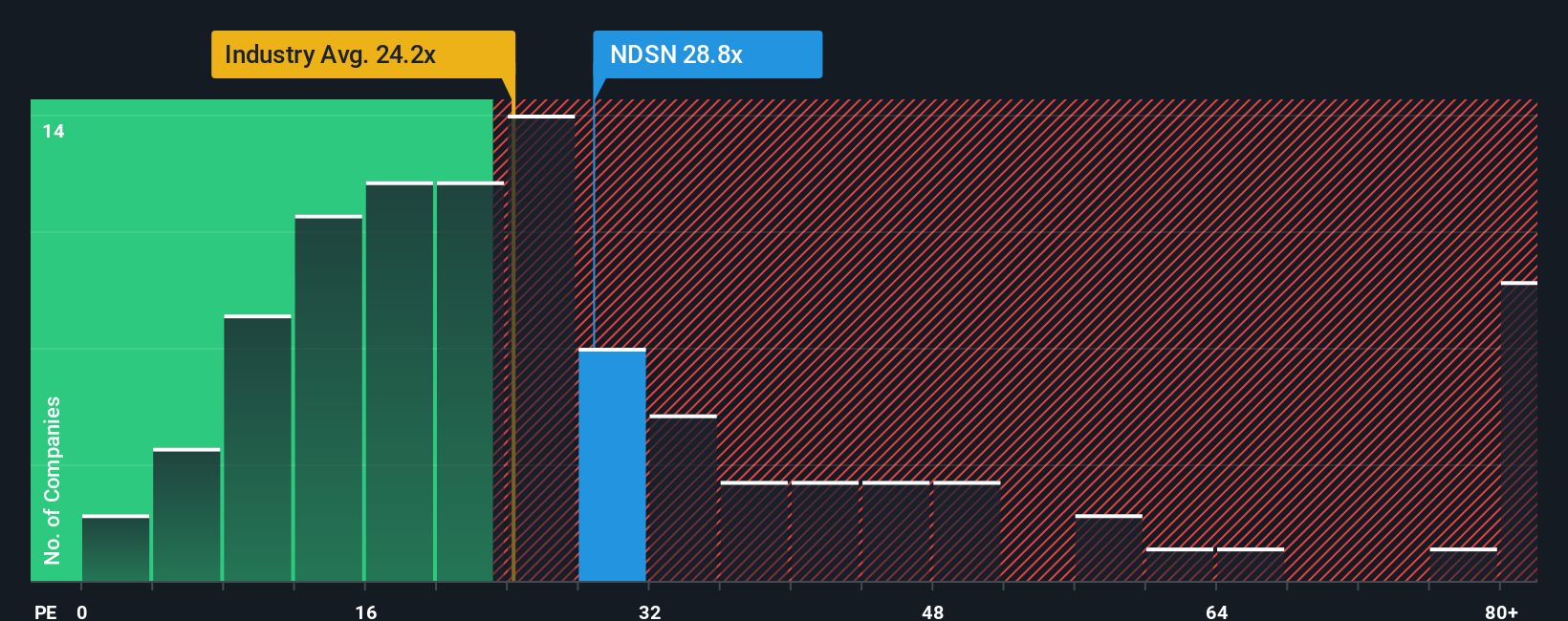

While the earlier fair value analysis offers an optimistic angle, our second look uses the classic earnings multiple for perspective. Nordson’s price-to-earnings ratio stands at 29.1x, noticeably above both the industry average of 24.5x and a fair ratio of 24.6x. This means investors are paying a premium compared to peers, potentially adding risk if future growth falls short. Are investors right to pay up, or does this premium leave less room for upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nordson Narrative

If you see the story differently, or want to dig into the numbers and draw your own conclusions, you can quickly build your own view in just a few minutes with Do it your way

A great starting point for your Nordson research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let an opportunity slip past you. Catch the wave of tomorrow’s top performers by using Simply Wall Street’s tailored screeners that fit your goals.

- Tap into the growth surge in AI by checking out these 27 AI penny stocks that are pushing boundaries in automation, computing power, and industry transformation.

- Build a resilient income stream by scanning these 17 dividend stocks with yields > 3% which consistently reward shareholders with strong yields and stability for your portfolio.

- Capitalize on undervalued potential by reviewing these 876 undervalued stocks based on cash flows, positioned for gains that the broader market might be missing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDSN

Nordson

Nordson Corporation engineers, manufactures, and markets products and systems to dispense, apply, and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives