- United States

- /

- Machinery

- /

- NasdaqCM:MVST

A Look at Microvast Holdings (MVST) Valuation Following Q3 Results and Updated Growth Guidance

Reviewed by Simply Wall St

Microvast Holdings (MVST) has released its third quarter 2025 results, revealing higher year-over-year revenue and a shift from a net profit last year to a net loss this quarter. The company is also keeping its annual revenue growth forecast unchanged.

See our latest analysis for Microvast Holdings.

Microvast Holdings’ Q3 financials landed just as the stock has been experiencing major swings. After a huge rally earlier in the year, its 1-month share price return now stands at -40.5%. Despite this recent volatility, long-term investors have seen a remarkable 1-year total shareholder return of 520.7%, suggesting that momentum, though choppy, is still strong relative to prior years. The combination of robust revenue growth and the latest impairment charges is clearly prompting a reevaluation of both risk and opportunity.

If Microvast’s wild ride has you scanning for other interesting movers, this could be the perfect moment to broaden your scope and discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst targets, but recent losses weighing on sentiment, investors now have to ask if Microvast is an overlooked bargain or if the market already anticipates future growth.

Most Popular Narrative: 44.6% Undervalued

The latest narrative sets Microvast Holdings' fair value at $6.50, which is well above its last close of $3.60. This gap is fueling renewed debate among investors about the company’s upside potential compared to recent market prices.

Strategic capacity expansion, including the new 2 GWh line at the Huzhou facility scheduled for Q4 2025, enables Microvast to capture accelerating order flow from the global electrification push. This expansion directly supports volume growth and operating leverage and is likely to enhance future revenue and gross margins.

Want to know why the market’s missing the mark? The fair value calculation hinges on bold revenue expansions and ambitious margin improvements few would expect. Think you know what drives confidence behind this target? Explore the numbers fueling this valuation shock.

Result: Fair Value of $6.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, future gains could be challenged if execution stumbles on new battery technology or if ongoing concentration in China increases supply chain risks.

Find out about the key risks to this Microvast Holdings narrative.

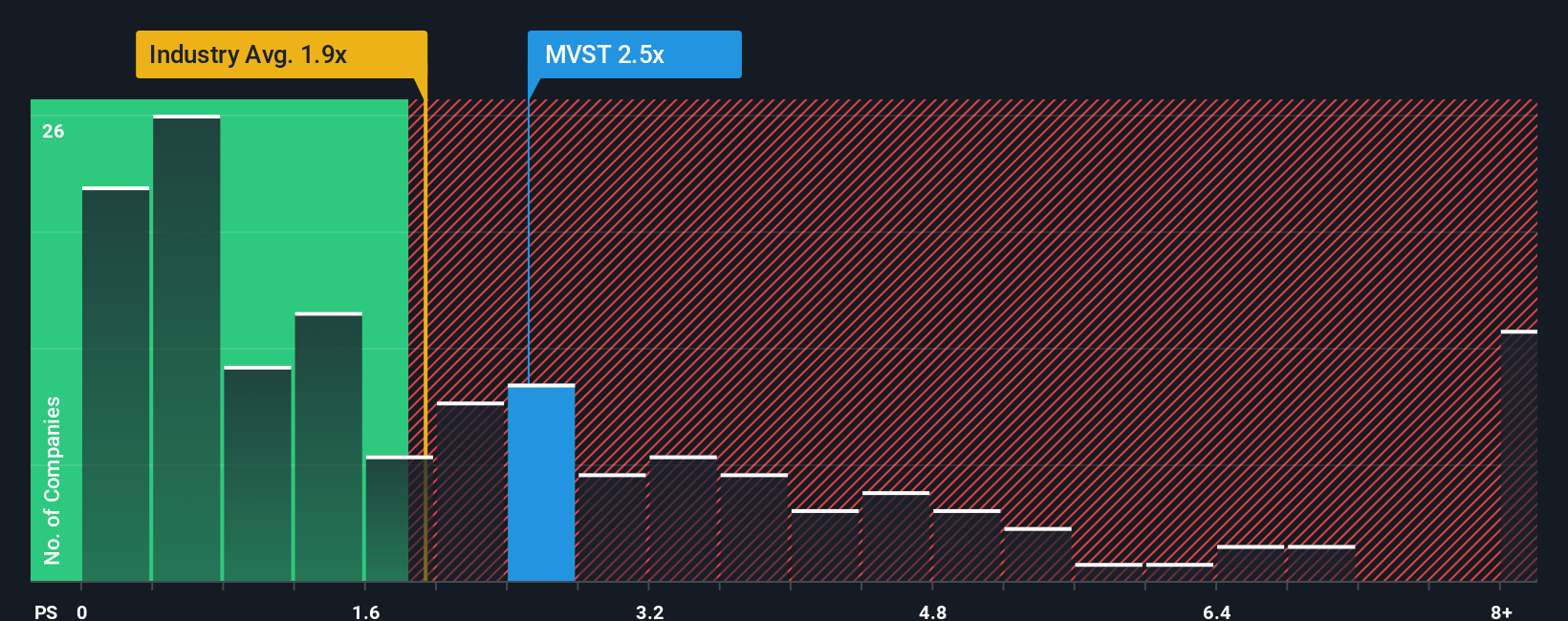

Another View: Price-to-Sales Comparison Raises Questions

Looking through a different lens, Microvast trades at a 2.6x price-to-sales ratio. This is much higher than both the industry average of 1.8x and its peers at 0.7x, suggesting the stock is relatively expensive on this basis. However, compared to the fair ratio of 3.6x, there is still room before shares could be considered truly overvalued. Is the market overpricing growth, or is it seeing real upside others might miss?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Microvast Holdings Narrative

Not convinced by the prevailing story or want to crunch the numbers yourself? Shape your own take in just minutes, your way: Do it your way

A great starting point for your Microvast Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Don’t let these trends pass you by. Now is your chance to spot powerful growth stories and income plays before the crowd catches on. Get started below.

- Capitalize on the digital revolution and see which innovators stand out with these 26 AI penny stocks.

- Strengthen your portfolio with steady cash flow from these 15 dividend stocks with yields > 3% offering yields above 3%.

- Position yourself ahead of the curve by uncovering fresh value in these 898 undervalued stocks based on cash flows driven by sustainable cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MVST

Microvast Holdings

Provides battery technologies for electric vehicles and energy storage solutions.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives