- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:MRCY

Is Mercury Systems’ Surge After Defense Partnerships Supported by Valuation in 2025?

Reviewed by Bailey Pemberton

Thinking about whether to buy, hold, or sell Mercury Systems? You are definitely not alone right now. The stock has been making headlines, and not just for its one-year climb of 137.6%. In just the past week, Mercury’s shares have jumped 5.1%, adding to a strong 6.9% gain over the past month and a stunning 87.7% run year-to-date. That kind of trajectory tends to split opinions. Is it the start of a new chapter or just a high point in a volatile story?

Recent interest has been fueled by talks around Mercury’s renewed focus on innovation in the defense electronics market. Announcements about key partnerships with major defense contractors and the ongoing expansion of its modular technology platform have given investors new reasons to feel optimistic about future growth. The big question remains: is the price justified, or are we seeing more enthusiasm than substance?

When it comes to valuation, the numbers tell a cautionary tale. Out of the six key checks analysts use to determine undervaluation, Mercury Systems scores just one, meaning it is currently undervalued in only one area. So, while the momentum looks attractive, there is a gap between perception and fundamental value that is worth digging into.

This is exactly where our breakdown of valuation methods comes in, helping you weigh the facts against the excitement. Stay with us, because there is a smarter way to interpret these numbers that we will explore by the end of the article.

Mercury Systems scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Mercury Systems Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular valuation tool that estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to their present value. This helps investors gauge whether a stock is trading above or below its fair value, using realistic future expectations.

For Mercury Systems, the latest reported Free Cash Flow stands at $107.75 million. Analyst projections estimate cash flow growth over the next five years, with further forecasts extending a decade ahead using gradual, lower growth rates. By 2028, Free Cash Flow is expected to reach $128.25 million, and ten-year extrapolations suggest this figure could grow to around $234.81 million by 2035. Estimates beyond five years rely more heavily on trend assumptions than direct analyst input.

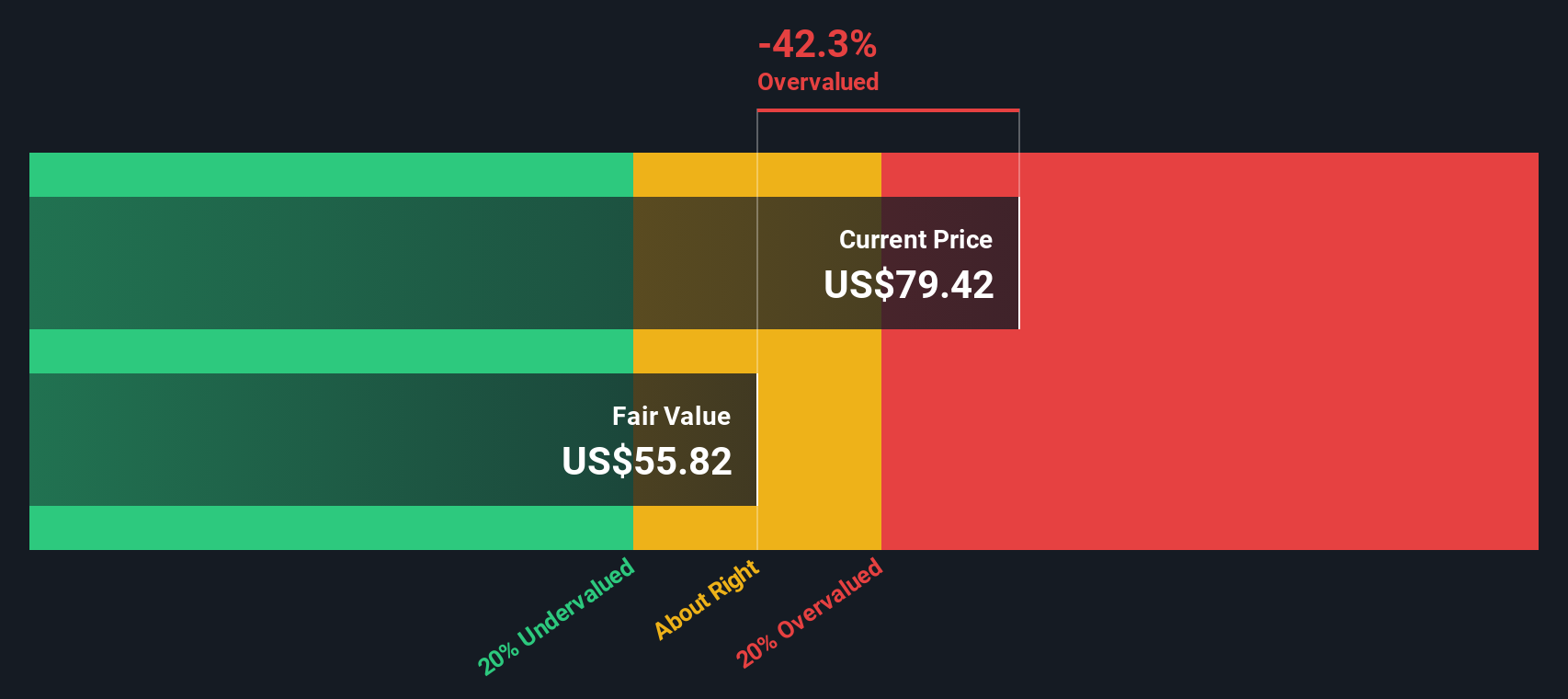

Based on these cash flow projections and the DCF model, Mercury Systems’ estimated intrinsic value is $55.73 per share. However, the current share price implies a premium of around 42.5%, meaning the stock is considered significantly overvalued by this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mercury Systems may be overvalued by 42.5%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Mercury Systems Price vs Sales

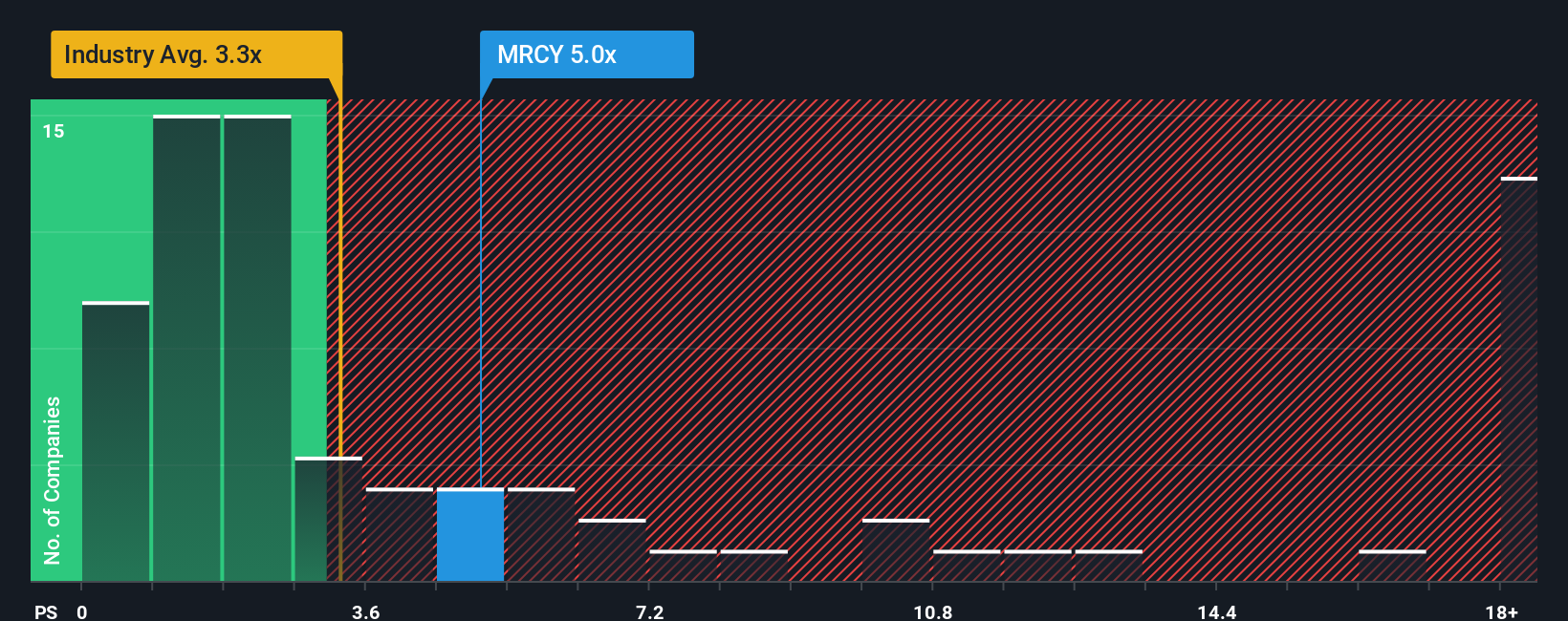

For companies like Mercury Systems operating in the Aerospace & Defense industry, especially those not currently posting positive earnings, the price-to-sales (P/S) ratio serves as a practical and widely used valuation metric. The P/S ratio helps investors compare how much the market is willing to pay for each dollar of sales, making it particularly useful for companies in phases of investment or lower-profitability years when profits do not tell the whole story.

Growth expectations and company-specific risk factors heavily influence what counts as a “normal” or “fair” P/S ratio. Businesses with rapidly expanding sales and strong market positions typically command higher ratios, while those facing greater risks or slower sales growth might deserve lower multiples.

Right now, Mercury Systems trades at a P/S ratio of 5.23x, which is notably higher than the industry average of 3.15x and also above the average for close peers at 14.78x. But instead of relying only on these wide benchmarks, Simply Wall St provides a “Fair Ratio” based on a more nuanced analysis. The Fair Ratio for Mercury Systems stands at 1.65x, representing what a balanced valuation should be when taking into account the company’s sales growth outlook, profit margins, market cap, risk profile, and industry standards.

The beauty of the Fair Ratio is that it tailors expectations specifically for Mercury Systems, rather than lumping it in with every other Aerospace & Defense company regardless of size or strategy. This makes it a sharper tool for investors wanting more than a cookie-cutter comparison.

With Mercury’s current P/S at 5.23x compared to its Fair Ratio of 1.65x, the stock screens as significantly overvalued using this approach.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mercury Systems Narrative

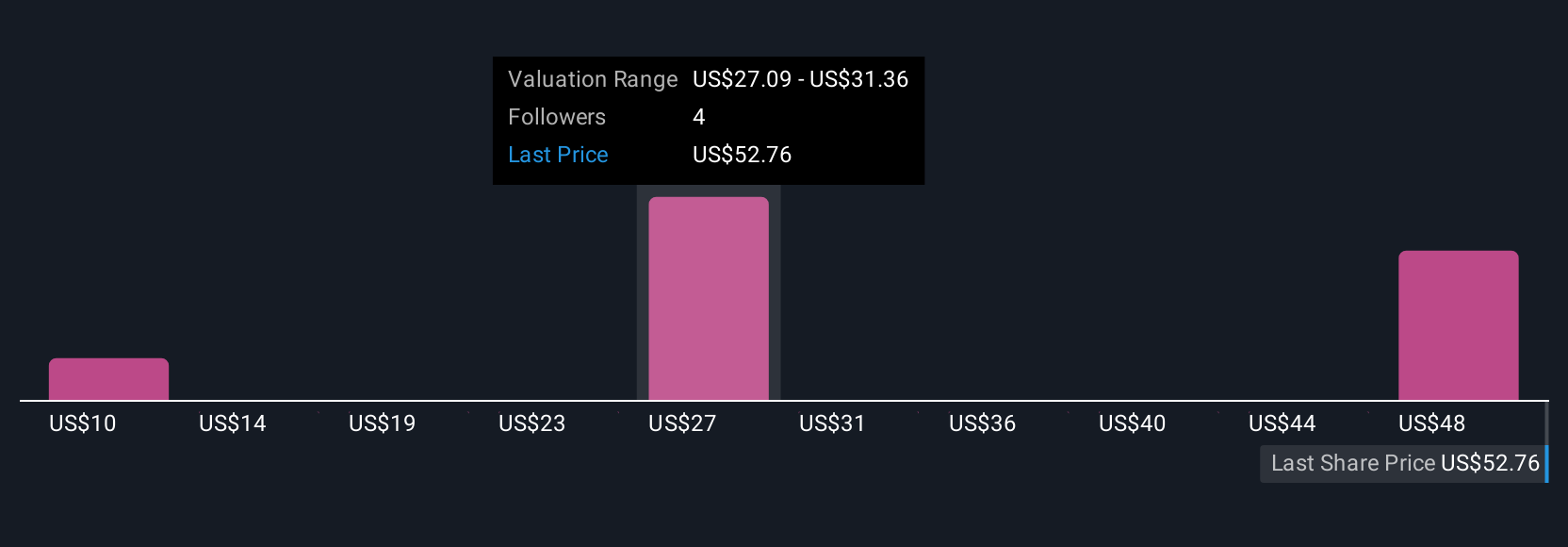

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives, a dynamic approach that connects the story you believe about Mercury Systems to your own financial forecast and fair value estimate.

A Narrative is simply your personal view of the company and its future, captured in numbers like expected revenues, margins, and risk assumptions. Rather than just accepting analyst predictions or the latest price trends, a Narrative lets you outline why you think Mercury Systems should be valued a certain way, reflecting your unique perspective on its growth opportunities or risks.

This approach transforms investing from following headlines to building your own case, with a transparent link from the company’s story to your forecast and then to a calculated fair value. Narratives are easily created and tracked via Simply Wall St’s Community page, where millions of investors compare and refine their perspectives in real time.

You can immediately see when your Narrative says Mercury is undervalued or overvalued, because it compares your fair value to the current share price. Every time news or earnings emerge, Narratives update automatically to keep your reasoning current.

For example, some investors believe Mercury’s strong contracts make it worth as much as $100, while others set a much more cautious fair value near $39, highlighting how Narratives help surface both bullish hopes and bearish concerns in one powerful tool.

Do you think there's more to the story for Mercury Systems? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRCY

Mercury Systems

A technology company, manufactures and sells components, products, modules, and subsystems for defense prime contractors, original equipment manufacturers, government, and commercial aerospace companies.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)