- United States

- /

- Construction

- /

- NasdaqCM:LMB

Limbach Holdings (LMB) Profit Margin Improves to 6.4%, Reinforcing Bullish Valuation Narratives

Reviewed by Simply Wall St

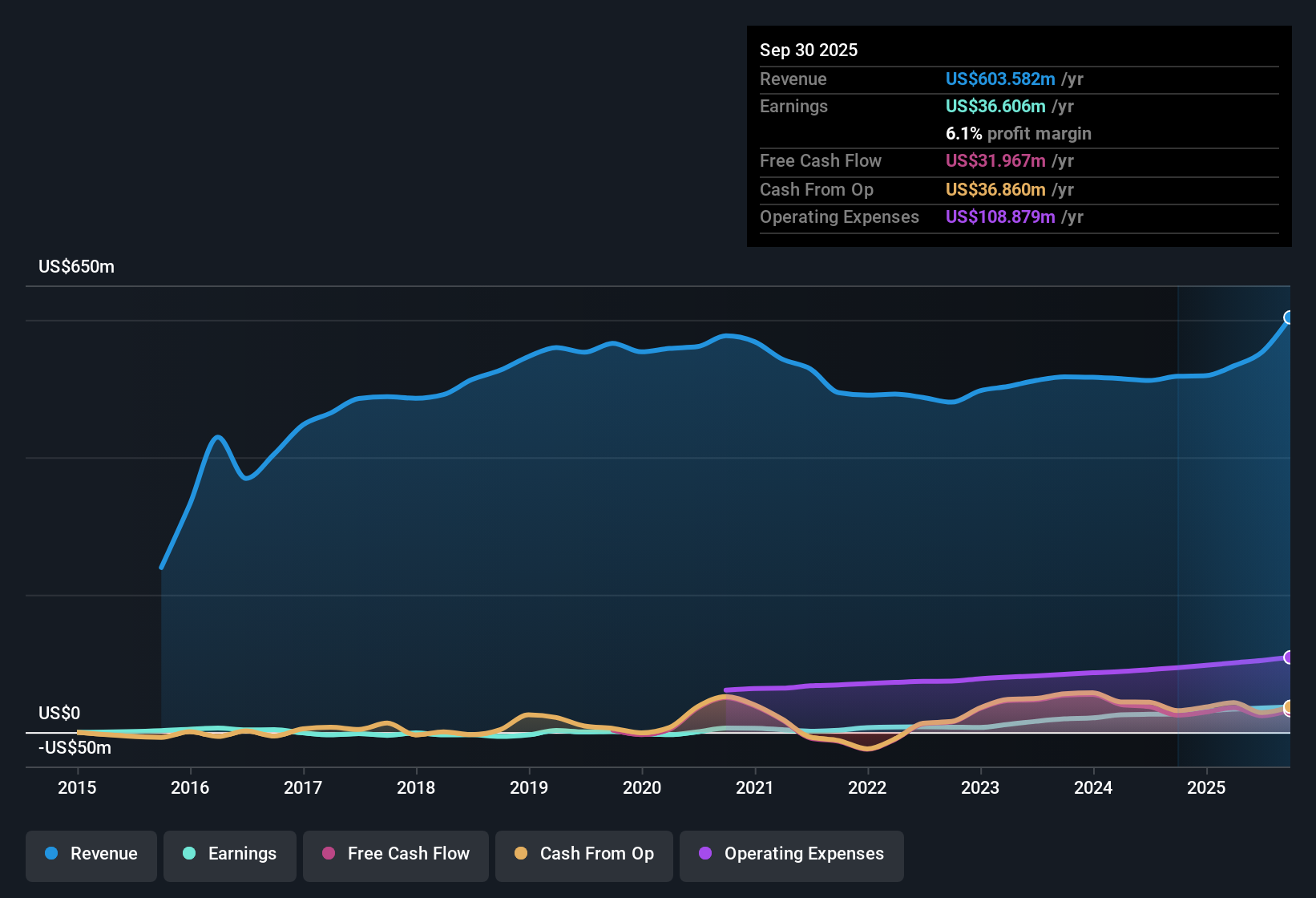

Limbach Holdings (LMB) posted net profit margins of 6.4%, improving from 5.1% last year, as annual earnings jumped 35.8%. The company’s five-year average annual earnings growth came in at 47.4%, with revenue forecast to grow 11.3% per year and annual earnings expected to rise 19.2% per year, both outpacing the broader US market. Investors are likely to see higher profitability, rapid growth, and a price-to-earnings ratio below industry peers as a favorable setup for the current valuation outlook.

See our full analysis for Limbach Holdings.Next up, we will see how these impressive headline numbers compare with the current narratives in the market. We will also explore where the community agrees and where opinions might diverge.

See what the community is saying about Limbach Holdings

Recurring Service Contracts Top 75% of Revenue

- Owner Direct Relationship (ODR) service contracts now make up more than 75% of total revenue, representing a substantial shift away from volatile new construction projects toward highly recurring income streams.

- Analysts' consensus view highlights that this pivot to recurring ODR service work, paired with digital building solutions, is heavily supporting predictability and market share gains.

- Consensus notes the move enables Limbach to weather slower construction cycles, driving steadier top-line and margin growth as capital programs and ODR work replace one-off projects.

- Key catalysts include investment in energy efficiency and smart building upgrades, which expand Limbach's reach into fast-growing retrofit and facility management markets.

- Consensus narrative underscores that these recurring revenue segments put Limbach on firmer footing for sustainable growth, bolstering the argument for strong future performance. 📊 Read the full Limbach Holdings Consensus Narrative.

Pioneer Power Acquisition Puts Margin Targets to the Test

- The acquisition of Pioneer Power is expected to challenge near-term profitability, with guidance that integration efforts will dilute gross margins for at least 1 to 2 years as the acquired business ramps up toward Limbach's higher-margin ODR model.

- Analysts' consensus view argues the acquisition presents both risk and opportunity:

- While management aims to upgrade Pioneer Power to Limbach’s margin profile, consensus highlights that ODR segment margins declined from 30.6% to 29% year over year, signaling that integration progress may be slower or costlier than bulls expect.

- Consensus further notes that the short-term margin dip from Pioneer Power could mask underlying operating improvements if synergies take longer than planned to materialize.

Valuation Still Looks Attractive Versus Peers

- Limbach's price-to-earnings ratio stands at 27.7x, meaningfully below both the US construction industry average of 34.2x and direct peer group average of 32x, signaling relative undervaluation at the current share price of $84.00.

- Analysts' consensus view points to analyst price targets of $133.75, a 59% premium to the current share price, reflecting confidence that above-market growth and expanding margins are not fully priced in.

- The consensus acknowledges some disagreement, as analyst targets range from $120.00 to $156.00, yet all are well above the prevailing market price, echoing conviction in the growth outlook even as integration risks remain.

- This setup supports the case for multiple expansion if Limbach hits long-term margin and earnings benchmarks while continuing to outpace sector fundamentals.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Limbach Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Share your perspective and build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Limbach Holdings.

See What Else Is Out There

While Limbach’s Pioneer Power acquisition could compress margins and delay operating improvements, integration risks may disrupt near-term profitability and steady performance.

If you want to zero in on companies with more consistent growth and smoother earnings trends, check out stable growth stocks screener (2073 results) for proven performers that deliver stability through all market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LMB

Limbach Holdings

Operates as a building systems solution company in the United States.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives