- United States

- /

- Industrials

- /

- NasdaqGS:HON

Is Honeywell a Bargain After Recent Supply Chain Moves and Market Dip?

Reviewed by Bailey Pemberton

- Wondering if Honeywell International is a bargain right now? Let's dig into what's behind the numbers and see if this industrial giant is trading for less than it's worth.

- Despite a steady long-term climb, Honeywell's shares have slipped in the short term, dropping 8.4% over the past week and 6.0% for the month, though they're still up 1.9% over the last year.

- Recent headlines have pointed to supply chain adjustments and strategic acquisitions by Honeywell, both of which have caught investors' attention. These developments are influencing sentiment and could help explain the quick shifts in the stock's price recently.

- On our six-point valuation check, Honeywell scores 4 out of 6 for being undervalued, suggesting some room for optimism. However, valuation numbers are just the start. Up next, we'll break down what drives these results and reveal a smarter approach to finding real value in Honeywell's stock.

Find out why Honeywell International's 1.9% return over the last year is lagging behind its peers.

Approach 1: Honeywell International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by forecasting a company's future cash flows and discounting them back to their present value, essentially estimating what those future dollars are worth today. This method helps investors judge whether a stock is priced attractively compared to its fundamental worth.

For Honeywell International, analysts report a current Free Cash Flow of approximately $6.3 Billion. Over the next decade, free cash flows are projected to grow, reaching an estimated $8.9 Billion by 2035. It is important to note that while analysts supply estimates for up to five years, later-year projections are extrapolated based on ongoing growth assumptions.

Using these projections, the DCF model calculates an intrinsic value of $223.04 per share. Compared to recent market prices, this values the stock at an implied 11.9% discount, which suggests Honeywell is currently undervalued using this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Honeywell International is undervalued by 11.9%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Honeywell International Price vs Earnings

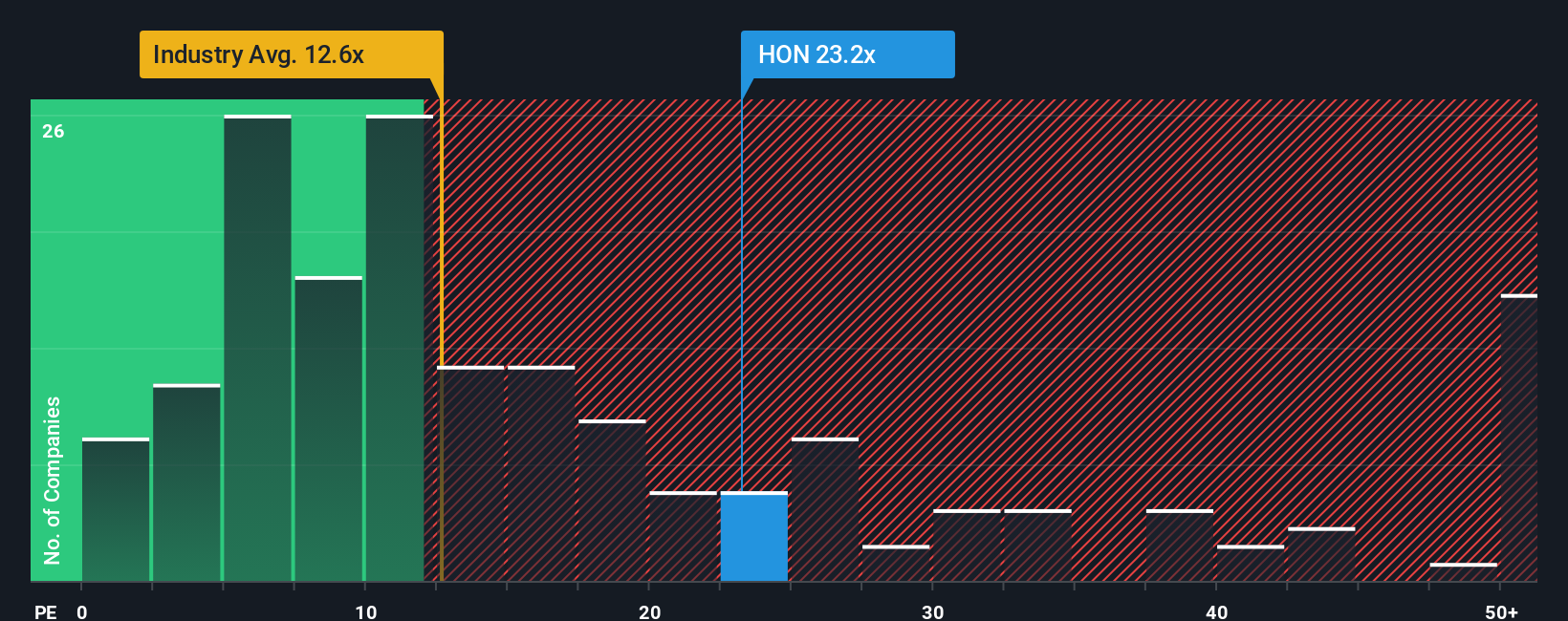

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Honeywell International, as it relates a company's share price to its earnings per share. This makes it especially suitable for companies with stable, positive earnings and helps investors gauge whether the market price reflects the firm's profit-generating ability.

What counts as a "normal" or "fair" PE ratio depends on factors like a company’s expected growth and risk profile. Higher growth expectations and lower risk typically justify higher PE ratios, while slower growth or greater uncertainty should result in lower values.

Honeywell International’s current PE ratio is 20.4x, which is above the Industrials industry average of 13.6x but still below the average PE of its peers at 28.4x. To provide a more precise benchmark, Simply Wall St’s proprietary “Fair Ratio,” which accounts for Honeywell’s earnings growth, industry, profit margins, market cap and risk, is calculated at 26.4x. Unlike peer or industry comparisons, the Fair Ratio customizes the valuation benchmark for Honeywell's unique characteristics. This means investors get a more tailored sense of the stock's value.

Comparing Honeywell’s actual PE ratio of 20.4x to its Fair Ratio of 26.4x suggests that the stock is trading at an attractive valuation and could be undervalued based on its earnings potential and fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Honeywell International Narrative

Earlier, we alluded to an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personalized investment story, where you outline your perspective on Honeywell International by connecting the company’s business changes, future revenue, earnings, and margin assumptions with a fair value estimate of the stock.

Unlike static ratios or analyst averages, Narratives let you clearly express what you think will drive Honeywell’s value. This approach links your story directly to a visual and trackable financial forecast and target price. It is easy and accessible for anyone, and millions of investors are already sharing their views using Narratives on Simply Wall St’s Community page.

Narratives help you decide when to buy or sell by showing how your fair value compares to the latest market price, updating automatically as news, earnings, or company changes occur. For example, using recent analyst targets, one investor might believe Honeywell deserves a future fair value of $290.00 based on rapid margin growth and successful separations, while another might see $203.00 as fair given trade headwinds and margin pressure. Narratives empower you to ground your investment choices in your beliefs and respond quickly as fresh data emerges.

Do you think there's more to the story for Honeywell International? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honeywell International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HON

Honeywell International

Engages in the aerospace technologies, industrial automation, building automation, and energy and sustainable solutions businesses in the United States, Europe, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives