- United States

- /

- Machinery

- /

- NasdaqGM:HLMN

Hillman Solutions (HLMN): Margin Surge Reinforces Bullish Narratives Despite Valuation Concerns

Reviewed by Simply Wall St

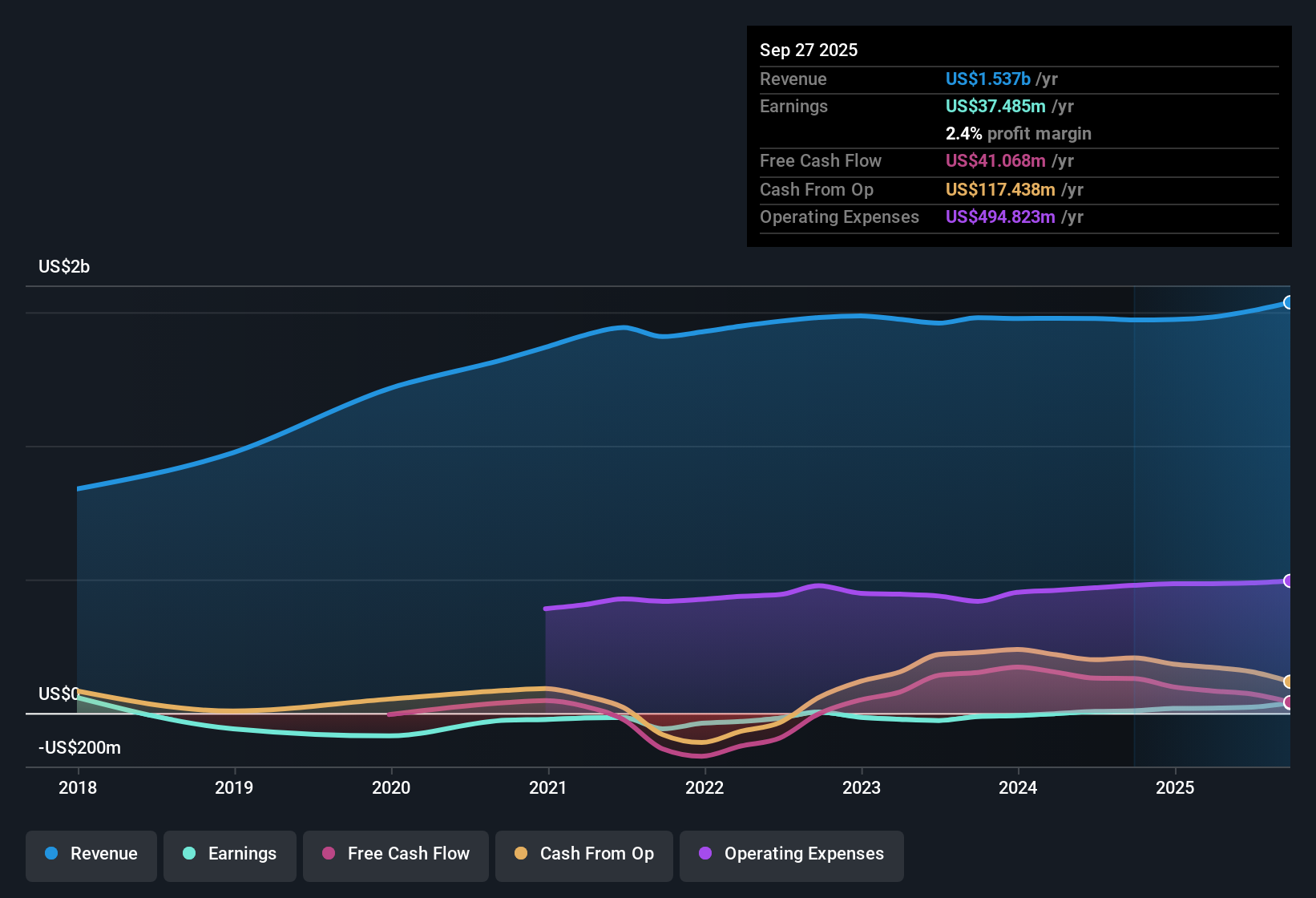

Hillman Solutions (HLMN) reported net profit margins of 2.4%, up from last year’s 0.6%, reflecting a notable improvement in profitability. The company delivered a profit growth of 346.7% over the past year, significantly outpacing its five-year average of 57.2% per year. It has now maintained profitable results for several consecutive years. With forecasts pointing to annual earnings growth of 30.3%, investors are weighing the potential for continued momentum against persistent concerns about the company’s higher valuation multiples and the strength of its financial position.

See our full analysis for Hillman Solutions.Next, we compare these headline results with the prevailing market views to see how the latest numbers fit with the narratives shaping investor sentiment.

See what the community is saying about Hillman Solutions

Guidance Hinges on Margin Expansion

- Analysts are projecting a jump in profit margins from 1.4% today to 5.8% by 2028, even though recent margin pressures have been a focal point for critics.

- Consensus narrative notes this margin growth would depend on successful acquisition integrations and cost control. The company claims these are progressing, but acquisition-related risks remain a key test in hitting these targets.

- While the Street expects automation and retailer partnerships to bolster operating leverage, ongoing tariff and supply chain challenges could keep margins below these projections if not well managed.

- Analysts' consensus view holds that recurring revenue from strong home repair demand could safeguard margins. However, exposure to higher debt and the risk of integration missteps could still offset much of this benefit.

- What is surprising is the optimism for margin improvement at a time when gross margins may still be diluted by recent bolt-on deals such as Intex, which carry lower profitability than Hillman's legacy operations.

- Despite efficiency gains, the consensus narrative highlights high retail dependency as a source of continued price pressure. In practice, robust revenue does not guarantee wider margins without strict cost discipline.

Modest Revenue Trajectory Falls Short of Market

- Hillman Solutions is forecast to grow revenue at only 5.4% per year, trailing the US market average of 10.5% per year, setting a more muted growth backdrop than top-line bulls might hope.

- Analysts' consensus view points out that, while recurring revenue streams in home improvement lend stability, the slower projected revenue expansion may limit upside if new business wins or market share gains stagnate.

- Consensus narrative highlights the multi-country supply strategy and e-commerce gains as positives for resilience and incremental growth, but leaves open the question of whether these efforts will close the gap with the sector’s faster movers.

Valuation Premium Reflects High Hurdles

- Shares change hands at a Price-to-Earnings Ratio of 87.7x, considerably higher than the US Machinery industry average of 24.7x, yet the stock still trades below the analyst price target of $12.38, with the latest price at $9.02.

- Analysts' consensus view warns that, even after factoring in earnings growth forecasts and improved profitability, Hillman's elevated valuation multiple demands the company keeps outperforming operationally. Any missteps could trigger a swift re-rating.

- What is surprising is that, despite significant margin progress and a below-target share price, the premium PE means valuation support among analysts is guarded. Investors will likely keep watching for any indication that future benchmarks might be missed.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hillman Solutions on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the data? Bring your insights to life and shape a unique perspective in just a few minutes: Do it your way.

A great starting point for your Hillman Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Despite profit growth, Hillman Solutions faces persistent valuation headwinds, slower revenue expansion compared to the market, and ongoing concerns about its debt and financial resilience.

If you want to shift focus to companies with stronger financial footing and lower debt risks, check out solid balance sheet and fundamentals stocks screener (1981 results) built to weather uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hillman Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HLMN

Hillman Solutions

Provides hardware-related products and related merchandising services in the United States, Canada, Mexico, Latin America, and the Caribbean.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives