- United States

- /

- Machinery

- /

- NasdaqGM:HLMN

A Fresh Look at Hillman Solutions (HLMN) Valuation After Recent Institutional Buying and Analyst Upgrades

Reviewed by Simply Wall St

Hillman Solutions (HLMN) has caught investor attention after Stratos Wealth Partners, T. Rowe Price, and Nuveen LLC all increased their holdings. This activity coincides with several analyst upgrades and a more optimistic outlook for the stock.

See our latest analysis for Hillman Solutions.

Institutional investors increasing their exposure and a series of analyst upgrades appear to have given Hillman Solutions new momentum, with the stock posting a robust 20.7% share price return over the last 90 days. While the one-year total shareholder return is still in negative territory, rising nearly 20% over three years suggests renewed optimism may be taking hold as risk perceptions shift and the outlook improves.

If recent institutional moves have you thinking about other opportunities, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading at a sizable discount to analyst price targets and fresh upgrades fueling investor interest, the question is whether Hillman Solutions remains undervalued or if the market has already accounted for the company’s improving prospects.

Most Popular Narrative: 24.1% Undervalued

With Hillman Solutions trading at $9.35, the most widely tracked narrative points to a fair value of $12.31. This sets up a debate between market skepticism and bullish analyst assumptions.

Hillman's expansion in omni-channel retailing and e-commerce integration, boosting direct-to-store delivery capabilities and proprietary digital inventory management, positions the company to capture a wider addressable market and increase efficiency, which should positively impact both revenue and margins.

Want to unravel what’s driving this sizable value gap? Discover the ambitious growth story hiding in Hillman’s forecast. There’s more to this narrative than just a low price. The financial bedrock fueling this optimism might surprise you.

Result: Fair Value of $12.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent demand softness or margin pressures from reliance on major retailers could still present challenges to Hillman’s optimistic growth narrative in the future.

Find out about the key risks to this Hillman Solutions narrative.

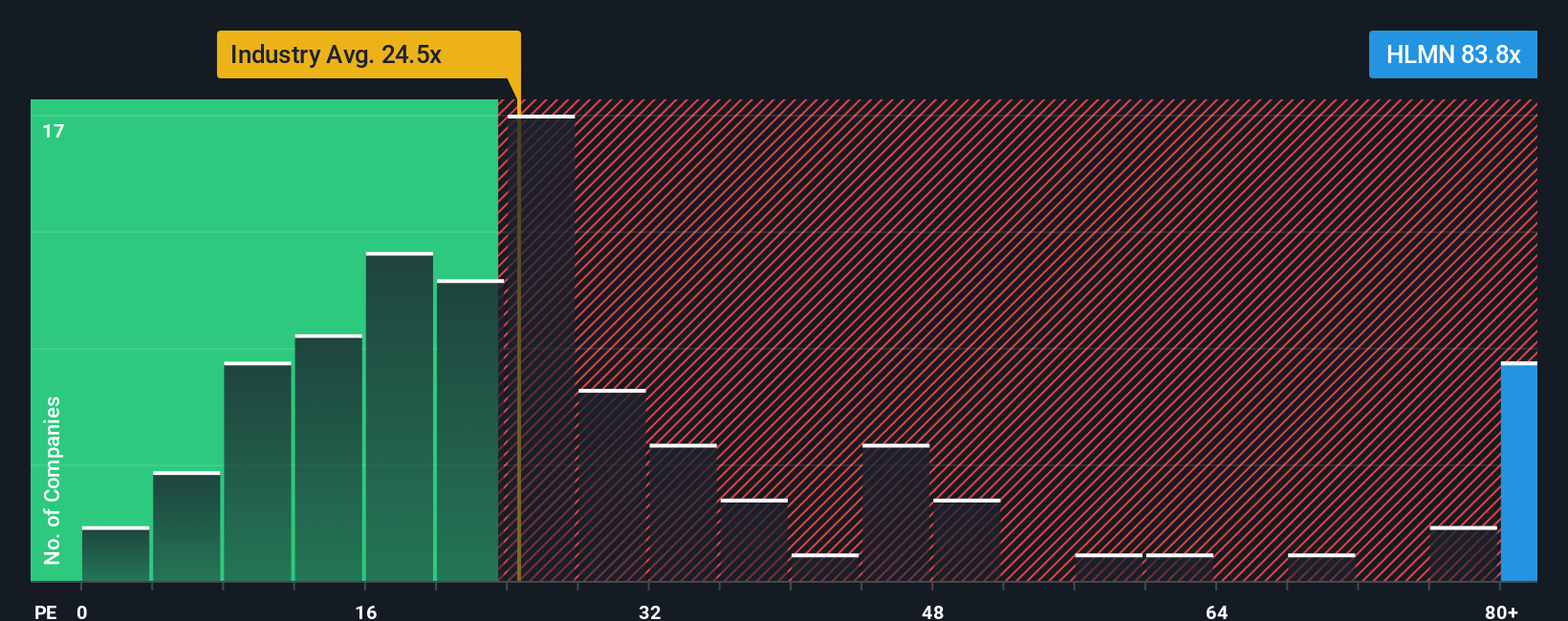

Another View: Multiples Tell a Different Story

Looking at how Hillman Solutions trades compared to earnings, the company appears pricey. Its price-to-earnings ratio is an eye-catching 85.1 times, much higher than both the industry average of 24.6 and the peer average of 30.4. This is also well above its fair ratio of 35.5 times. This gap suggests the stock’s valuation could shift sharply if growth expectations change. Are investors being too optimistic, or is the market missing something?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hillman Solutions Narrative

If you have a different perspective or want to examine the numbers firsthand, you can shape your own Hillman Solutions narrative in just a few minutes. Do it your way

A great starting point for your Hillman Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Add fresh insights to your investing toolkit and move ahead of the crowd with Simply Wall Street’s tailored screeners below.

- Capture high yields and steady cash flow improvements by checking out these 24 dividend stocks with yields > 3%, which boasts yields above 3% and sustainable payouts for income-focused investors.

- Take a smart shortcut to tomorrow’s AI leaders by starting with these 26 AI penny stocks, where innovative companies are pushing the boundaries of machine intelligence and automation.

- Find strong value plays with potential upside in these 834 undervalued stocks based on cash flows, featuring stocks with attractive cash flow profiles and room for growth in undervalued segments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hillman Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HLMN

Hillman Solutions

Provides hardware-related products and related merchandising services in the United States, Canada, Mexico, Latin America, and the Caribbean.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives