- United States

- /

- Trade Distributors

- /

- NasdaqGS:FTAI

FTAI Aviation (FTAI): Assessing Valuation After Strategic AI Partnership With Palantir Technologies

Reviewed by Simply Wall St

FTAI Aviation (FTAI) just announced a multi-year partnership with Palantir Technologies to deploy artificial intelligence across its global maintenance operations. The move aims to streamline scheduling, inventory, and supply chain tasks by using advanced digital tools.

See our latest analysis for FTAI Aviation.

FTAI Aviation’s fresh AI partnership comes on the heels of some powerful signals: a credit rating upgrade from S&P, notable insider buying, and bullish institutional commentary. While shares recently eased back from their highs, the one-year total shareholder return stands at -8.4%. However, the stock has soared over the long run, with a three-year total return of 885% and a five-year total return of nearly 937%. For investors, momentum is still very much a story to watch as FTAI leans into digital transformation and ramped-up demand.

If FTAI’s combination of bold strategy and rapid turnaround piques your interest, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Against this backdrop of strategic advances and recent market volatility, the central question emerges: Is FTAI Aviation trading at an attractive valuation, or have expectations for future growth already been fully reflected in the current share price?

Most Popular Narrative: 30.7% Undervalued

FTAI Aviation’s most-followed narrative suggests the stock has significant upside, with a fair value calculation well above its latest close. This stands in strong contrast to recent market underperformance and points to major catalysts powering a bullish investment thesis.

Significant operational leverage is expected from FTAI's ramp in vertical integration, as evidenced by recent acquisitions (e.g., Pacific Aerodynamic) and in-house repair/production capabilities. These moves are driving cost efficiencies, increased margin per shop visit, and expanded gross and EBITDA margins, all of which are likely to boost future EPS growth.

Want to know what assumptions drive this ambitious narrative? The calculation hinges on aggressive growth forecasts and a leap in profit margins rarely seen in the sector. Explore the bold projections analysts are using, as this valuation is not business as usual.

Result: Fair Value of $227.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on legacy engine platforms and potential setbacks in expanding major carrier deals could challenge these bullish projections.

Find out about the key risks to this FTAI Aviation narrative.

Another View: Valuing FTAI by Earnings Ratio

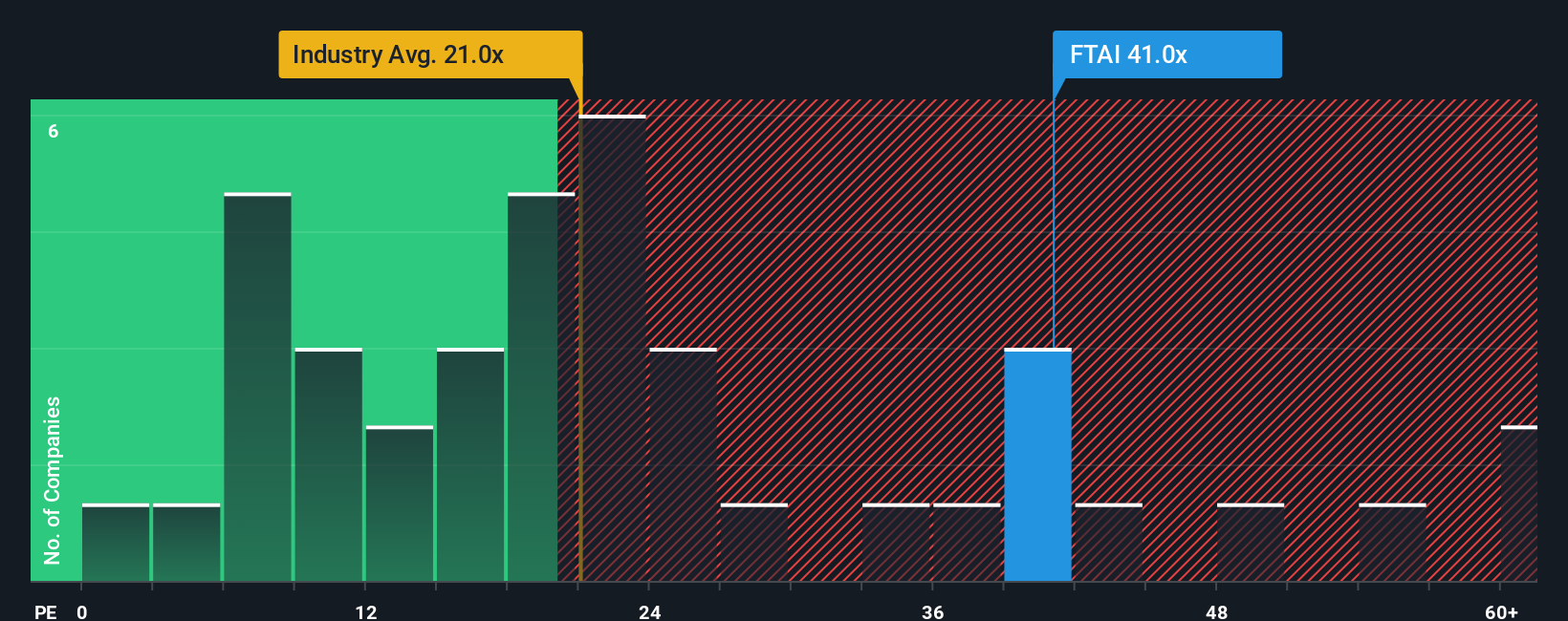

While growth forecasts suggest the stock is undervalued, looking at the price-to-earnings ratio tells a different story. FTAI trades at 35.7 times earnings, which is almost double the average for US Trade Distributors at 18.8 times. Even compared to its fair ratio of 58.3, the current valuation may carry heightened expectations and risks if earnings stumble. Is this premium justified, or does it increase the risk of disappointment if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FTAI Aviation Narrative

If you'd rather dive into the numbers independently or want a fresh take on FTAI's outlook, you can build your own valuation story in just a few minutes: Do it your way

A great starting point for your FTAI Aviation research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize the advantage by acting now to give yourself the edge with fresh opportunities from our handpicked stock screeners below, all powered by real-time data.

- Uncover high-potential value with these 926 undervalued stocks based on cash flows and see which companies look fundamentally mispriced right now.

- Catch the momentum in tomorrow's tech by checking out these 26 AI penny stocks as they shape game-changing innovation in artificial intelligence.

- Tap into steady income streams by browsing these 16 dividend stocks with yields > 3%, highlighting businesses offering attractive yields and robust payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTAI

FTAI Aviation

Owns, acquires, and sells aviation equipment for the transportation of goods and people worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives