- United States

- /

- Trade Distributors

- /

- NasdaqGS:FTAI

Did FTAI Aviation’s (FTAI) Dividend Hike and Expansion Plans Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- FTAI Aviation recently reported mixed third-quarter results, with earnings per share falling short of analyst expectations but revenue reaching US$667.06 million, up from US$465.79 million a year earlier, and net income growing to US$117.72 million from US$86.48 million.

- Alongside the earnings announcement, the company also raised its quarterly dividend to US$0.35 per share and unveiled expansion plans in aerospace products and maintenance operations, signaling management’s confidence in ongoing growth.

- We'll explore how the increased dividend and expansion in maintenance operations may shift the outlook for FTAI Aviation's investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

FTAI Aviation Investment Narrative Recap

To be a shareholder in FTAI Aviation, you need to believe in the ongoing demand for mid-life aircraft engine maintenance, the resilience of legacy engine platforms, and the company’s ability to successfully grow its Maintenance, Repair and Exchange (MRE) programs. The recent mixed Q3 results, higher revenue but earnings per share below expectations, do not materially change the main short-term catalyst, which remains the scale-up and recurring revenue growth potential of the SCI partnership model. The biggest risk continues to be the company's exposure to changing propulsion technologies and potential concentration in aging engine platforms.

The announcement of an increased quarterly dividend to US$0.35 per share is especially relevant in this context, as it underscores management’s confidence in near-term cash flows and profitability despite a volatile quarter. Dividends, while attractive to income-focused investors, also put added focus on the company’s ability to continually generate and distribute free cash flow as it invests in expansion and asset-light initiatives tied to its SCI growth engine. Yet, with these moves, investors should not lose sight of...

Read the full narrative on FTAI Aviation (it's free!)

FTAI Aviation's outlook anticipates $3.7 billion in revenue and $1.1 billion in earnings by 2028. This projection is based on 19.8% annual revenue growth and a $683.5 million increase in earnings from the current $416.5 million.

Uncover how FTAI Aviation's forecasts yield a $222.60 fair value, a 29% upside to its current price.

Exploring Other Perspectives

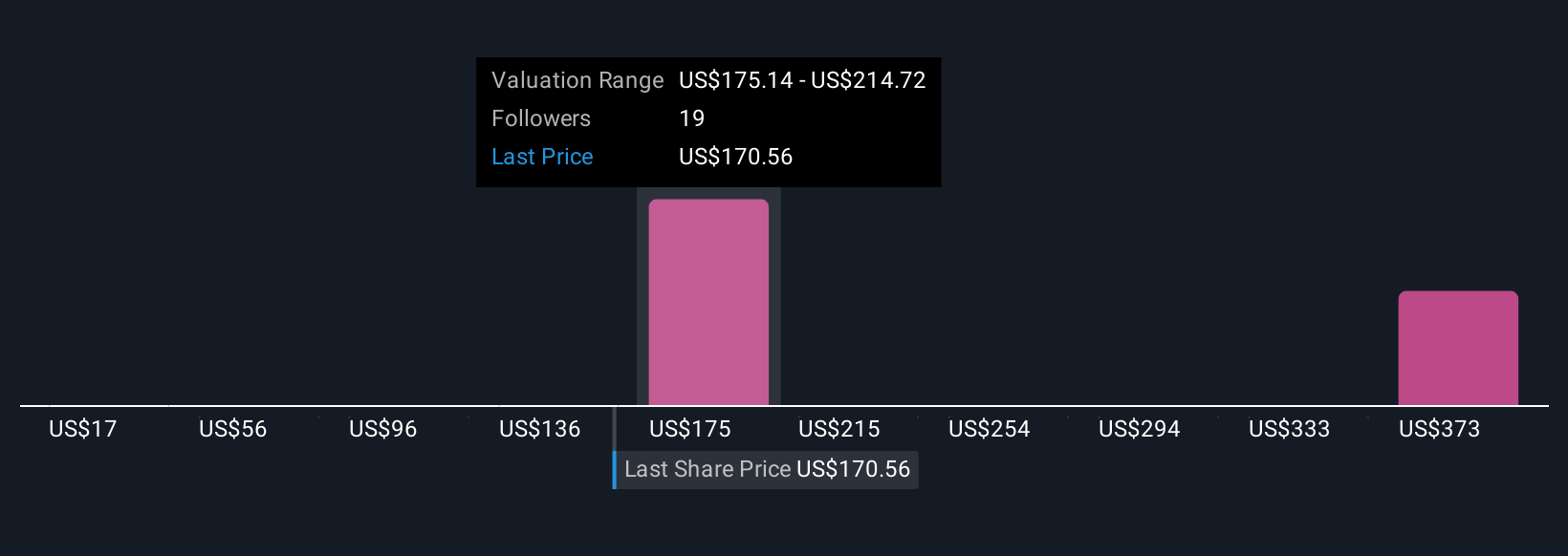

Three individual investors from the Simply Wall St Community estimate fair value for FTAI Aviation in a broad range from US$16.83 to US$222.60 per share. While many focus on expansion in MRE and SCI partnerships as growth drivers, future demand for mid-life engines remains a key point of disagreement shaping these diverse outlooks.

Explore 3 other fair value estimates on FTAI Aviation - why the stock might be worth as much as 29% more than the current price!

Build Your Own FTAI Aviation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FTAI Aviation research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FTAI Aviation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FTAI Aviation's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTAI

FTAI Aviation

Owns, acquires, and sells aviation equipment for the transportation of goods and people worldwide.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives