- United States

- /

- Electrical

- /

- NasdaqCM:FLUX

Will Flux Power (FLUX) Dilution Shift the Balance Between Growth Funding and Shareholder Value?

Reviewed by Sasha Jovanovic

- On October 1, 2025, Flux Power Holdings filed for a follow-on equity offering totaling US$12 million, including both common stock and pre-funded equity warrants.

- This move signals the company's intent to bolster its capital base, which can support ongoing initiatives or operational needs but may influence existing shareholder interests.

- We'll assess how this capital-raising effort could impact Flux Power Holdings' investment narrative, particularly regarding its capacity to fund growth and manage risks.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Flux Power Holdings Investment Narrative Recap

For shareholders of Flux Power Holdings, the core thesis centers on the company’s push for profitable growth driven by solutions for the electrification of industrial equipment, all while facing ongoing risks tied to supply chain costs and financial resilience. The $12 million equity raise may ease pressure from historically low cash reserves, supporting short-term funding of growth initiatives. However, this step does not materially reduce the lingering risks from past financial restatements or the auditor’s recent going concern doubts.

Of recent corporate actions, the 2025 auditor’s report expressing concern about Flux Power Holdings’ ability to continue as a going concern stands out as closely linked to the capital raise. While the new equity could improve liquidity, investor confidence may hinge on how effectively these funds help address structural financial weaknesses and restore trust following years of cumulative losses and heightened scrutiny. The real challenge investors should be aware of is that, despite these efforts, the company still faces ongoing scrutiny from auditors and listing authorities if…

Read the full narrative on Flux Power Holdings (it's free!)

Flux Power Holdings' outlook projects $110.7 million in revenue and $8.6 million in earnings by 2028. This reflects a 20.6% annual revenue growth rate and a $16.3 million increase in earnings from the current -$7.7 million.

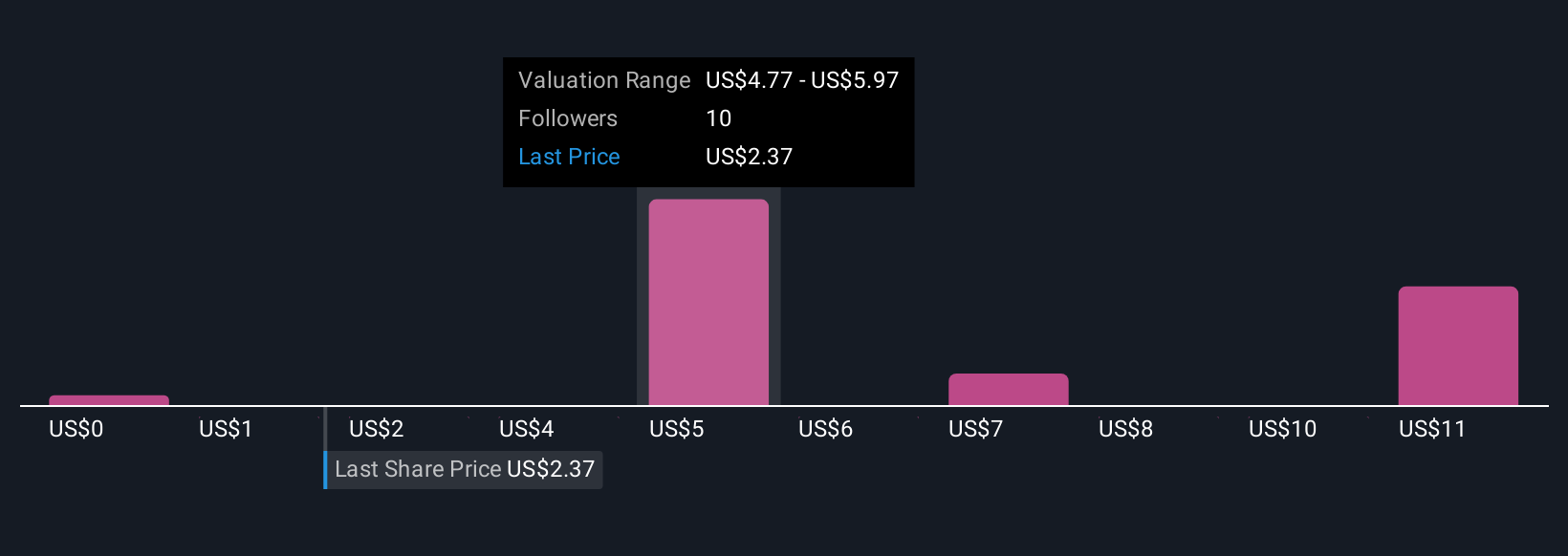

Uncover how Flux Power Holdings' forecasts yield a $5.75 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from five Simply Wall St Community members span from US$151,280 to US$1,512,803, reflecting highly varied outlooks. While the latest equity raise targets short-term capital needs, lingering doubts about financial stability remain a focal point for market participants seeking a clearer investment case.

Explore 5 other fair value estimates on Flux Power Holdings - why the stock might be a potential multi-bagger!

Build Your Own Flux Power Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flux Power Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Flux Power Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flux Power Holdings' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FLUX

Flux Power Holdings

Through its subsidiary, designs, develops, manufactures, and sells lithium-ion energy storage solutions in North America.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives