- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

Europe’s Largest Battery Storage Project Might Change The Case For Investing In Fluence Energy (FLNC)

Reviewed by Sasha Jovanovic

- LEAG Clean Power GmbH and Fluence Energy GmbH recently announced plans to construct Europe’s largest battery energy storage system in Jänschwalde, Germany, utilizing Fluence’s Smartstack platform for a four-hour, 1 GW/4 GWh solution supporting grid services and renewable integration.

- This project marks Fluence’s largest single storage installation globally and underscores the company’s expanding footprint in supporting Germany’s transition to renewable energy and grid reliability.

- We’ll explore how participating in Europe’s largest battery storage project may reshape Fluence Energy’s investment narrative and growth prospects.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Fluence Energy Investment Narrative Recap

For Fluence Energy, holding the stock often means believing in the continued expansion of utility-scale battery storage driven by grid modernization, renewable integration, and global decarbonization efforts. The announcement of Europe’s largest battery energy storage project enhances Fluence’s visibility and could boost sentiment, but the most important short-term catalyst, resumption of paused contract activity following recent U.S. tariff hikes, remains unchanged. The biggest risk still centers on supply chain and policy-driven revenue delays, which are not directly addressed by this European project.

Among Fluence’s recent announcements, the opening of its manufacturing facility in Houston for thermal management systems is particularly relevant. This move reflects an ongoing effort to diversify supply chains and scale up domestic production, tying directly to one of the critical catalysts: improving supply resilience and positioning the business to recover as tariff-related contract pauses are resolved.

By contrast, investors should still be aware of how ongoing reliance on Chinese cell production may expose Fluence to future...

Read the full narrative on Fluence Energy (it's free!)

Fluence Energy's outlook anticipates $4.2 billion in revenue and $97.9 million in earnings by 2028. Achieving these targets would require annual revenue growth of 19.5% and an earnings increase of $116.3 million from the current earnings of -$18.4 million.

Uncover how Fluence Energy's forecasts yield a $10.53 fair value, a 49% downside to its current price.

Exploring Other Perspectives

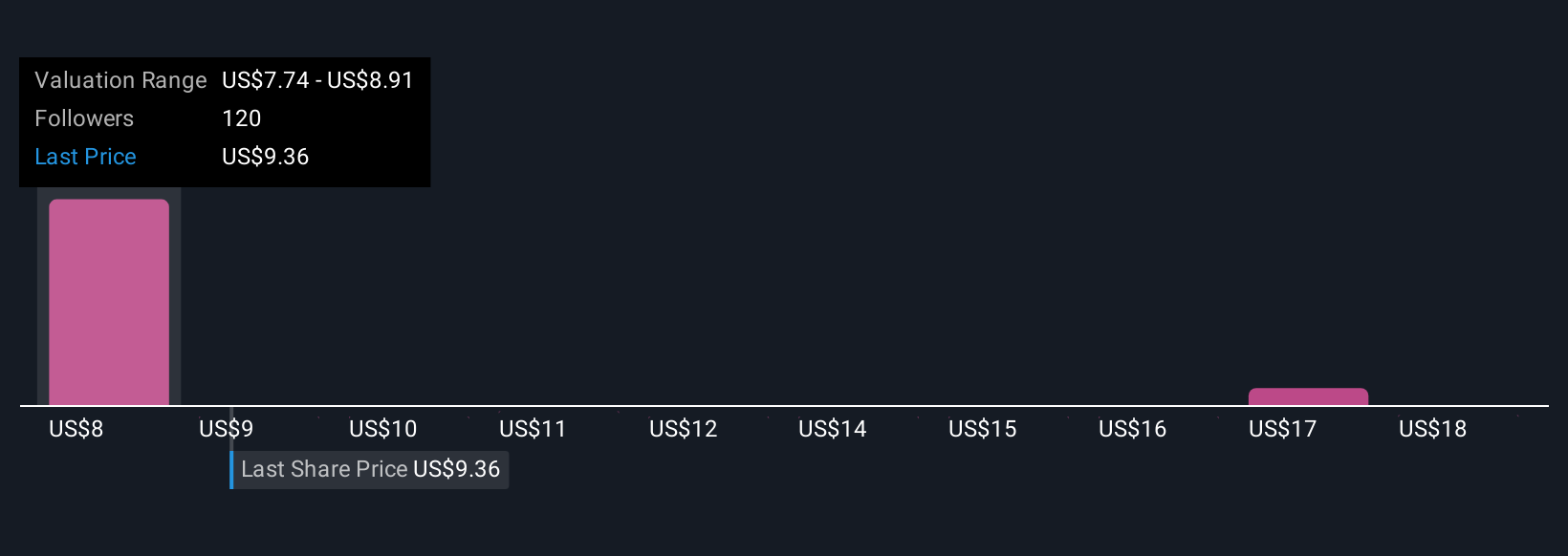

Seven member estimates in the Simply Wall St Community put Fluence’s fair value between US$10.53 and US$25.75 per share, covering both low and high expectations. However, paused contracts amid tariff hikes continue to raise questions about timing of revenue recovery and earnings volatility, inviting readers to consider all viewpoints before taking action.

Explore 7 other fair value estimates on Fluence Energy - why the stock might be worth 49% less than the current price!

Build Your Own Fluence Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fluence Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fluence Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fluence Energy's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives