- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

Does Fluence Energy’s 58.8% Surge Signal a New Opportunity After Major Contract Wins?

Reviewed by Bailey Pemberton

- Wondering whether Fluence Energy’s current price makes it a buy, hold, or sell? You’re not alone, as questions around its valuation are heating up among investors looking for the next opportunity.

- After a strong 58.8% jump over the past month, the stock is up 22.9% year to date. It has dipped slightly by 1.0% this past week, which could signal shifting sentiment or a pause after recent gains.

- Markets have been reacting to ongoing developments in the renewable energy and storage sector, where Fluence is a key player. Notably, news about increased government support for energy infrastructure and major contract wins have fueled optimism and provided fresh momentum for the stock.

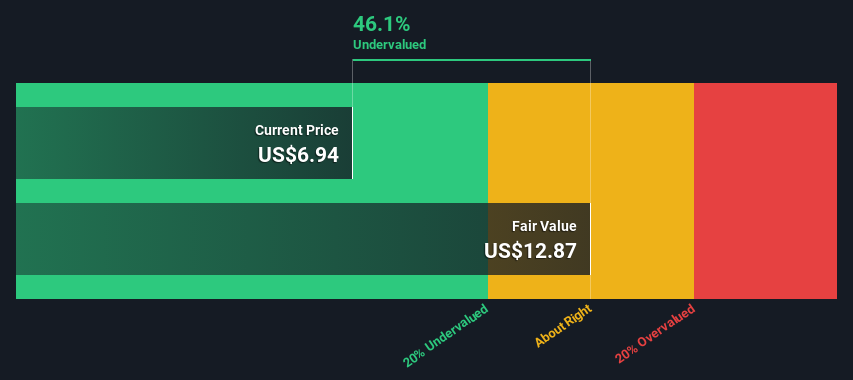

- Based on our checks, Fluence Energy earns a 3 out of 6 valuation score, meaning it appears undervalued in half the metrics we track. In the next sections, we will break down the classic valuation models. Keep an eye out for a more complete approach to understanding what the numbers really mean at the end of the article.

Find out why Fluence Energy's 0.6% return over the last year is lagging behind its peers.

Approach 1: Fluence Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting future cash flows and then discounting them back to today's dollars. This approach helps investors judge what a business might be worth compared to its current market price.

For Fluence Energy, the starting point is its most recent Free Cash Flow, which stood at -$421.8 million for the last twelve months. Analysts project that in about five years, the company’s cash flow is expected to turn positive and grow rapidly. Simply Wall St extrapolates these projections out to 2030 and beyond. By 2030, Free Cash Flow is estimated to reach $152.7 million, painting a picture of a business shifting from heavy investment mode toward generating consistent cash. Analyst coverage provides detailed forecasts for the next five years. After that, projections are extended based on expected industry growth rates.

Based on these calculations, the DCF model produces an estimated intrinsic value of $16.29 per share for Fluence Energy. However, this result suggests the stock is trading at a 27.6% premium to its calculated fair value, indicating it is currently overvalued relative to its future cash flow prospects.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fluence Energy may be overvalued by 27.6%. Discover 876 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Fluence Energy Price vs Sales

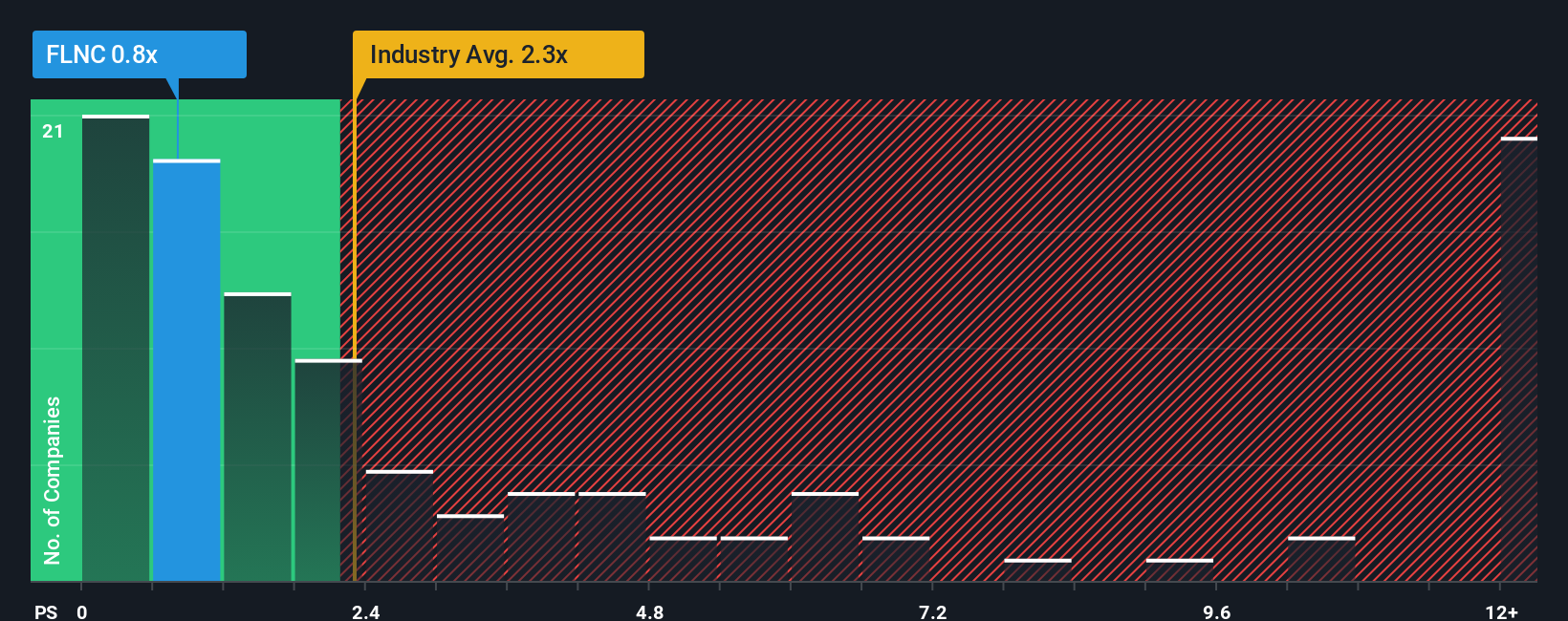

For companies in high-growth and often unprofitable sectors like renewable energy, the Price-to-Sales (PS) multiple is a practical way to gauge valuation. Since Fluence Energy is not yet profitable, PS gives investors a view of how the market values each dollar of revenue the company generates, rather than focusing on the bottom line.

The "right" PS multiple depends on a range of factors, including projected revenue growth and risks unique to both the business and its industry. Companies with faster expected growth or lower perceived risk often justify higher PS multiples. More mature or riskier firms might trade closer to industry norms.

Currently, Fluence Energy trades at a PS ratio of 1.1x. This is well below the industry average of 2.2x and the peer average of 4.7x. However, raw comparisons can be misleading, which is why Simply Wall St also calculates a “Fair Ratio” for each company. For Fluence, the Fair Ratio is 2.0x. This metric accounts for factors like the company’s future growth potential, profit margins, risk profile, industry trends, and size. This provides a more tailored benchmark than the industry or peer numbers alone.

With Fluence’s current PS multiple sitting far below its Fair Ratio, the stock looks undervalued based on this analysis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fluence Energy Narrative

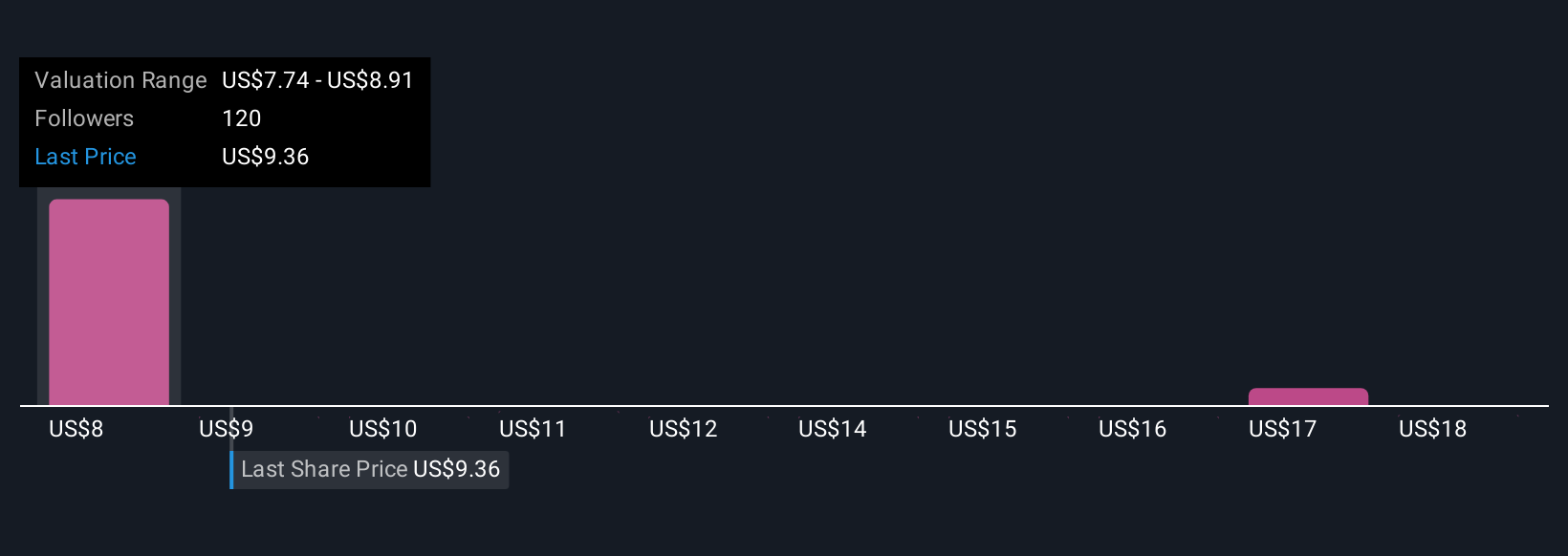

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple but powerful concept: it's your story or perspective about a company, expressed through the assumptions you make about its future, such as growth, margins, and profitability, which then leads to your fair value estimate.

With Narratives, you connect the dots between Fluence Energy’s story, your unique financial forecast, and the resulting valuation, all in an accessible, step-by-step tool available to millions of investors on Simply Wall St’s Community page. Narratives make investing more intuitive by guiding you through what you believe will happen and showing how your outlook stacks up against the current market price, helping you decide if now is the right time to buy or sell.

What’s more, every Narrative updates dynamically as new information like earnings or news releases hit the market, so you can quickly adapt your view. For example, some investors are forecasting Fluence Energy’s fair value as high as $17.75 per share based on strong sector momentum, while others take a more conservative stance with a fair value as low as $7.74 due to regulatory uncertainty and competitive risks. This demonstrates how different perspectives create different outcomes.

Do you think there's more to the story for Fluence Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives