- United States

- /

- Trade Distributors

- /

- NasdaqGS:FAST

Will Fastenal’s (FAST) New CFO Appointment Reshape Its Global Finance Strategy and Growth Priorities?

Reviewed by Sasha Jovanovic

- Fastenal Company recently appointed Max Tunnicliff as Chief Financial Officer and Senior Executive Vice President, effective November 10, 2025, following Sheryl A. Lisowski's tenure as Interim CFO since April 2025.

- Tunnicliff joins Fastenal after holding senior finance leadership roles at Beko Europe and Whirlpool Corporation, bringing broad international experience in financial reporting, supply chain finance, and strategic planning.

- We will explore how Tunnicliff’s extensive background in global finance leadership could influence Fastenal’s investment outlook and growth priorities.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Fastenal Investment Narrative Recap

To be a Fastenal shareholder, you need to believe in the company’s ability to drive sales growth through expanding technology, digital sales, and supply chain diversification, despite a competitive environment and ongoing margin pressures. The recent CFO appointment of Max Tunnicliff brings global financial experience but is unlikely to materially change the key short-term catalyst, advances in Fastenal Managed Inventory (FMI) technology, or the main risk of operating margin pressures for now.

The opening of Fastenal’s new distribution center in Magna, Utah, stands out as highly relevant. This move supports the company’s efficiency goals, a core catalyst tied to its distribution expansion and operational improvements, areas where financial leadership continuity should help maintain momentum as Fastenal tackles scaling challenges and cost control.

However, despite these strengths, investors need to watch for how persistent cost pressures might limit Fastenal’s ability to...

Read the full narrative on Fastenal (it's free!)

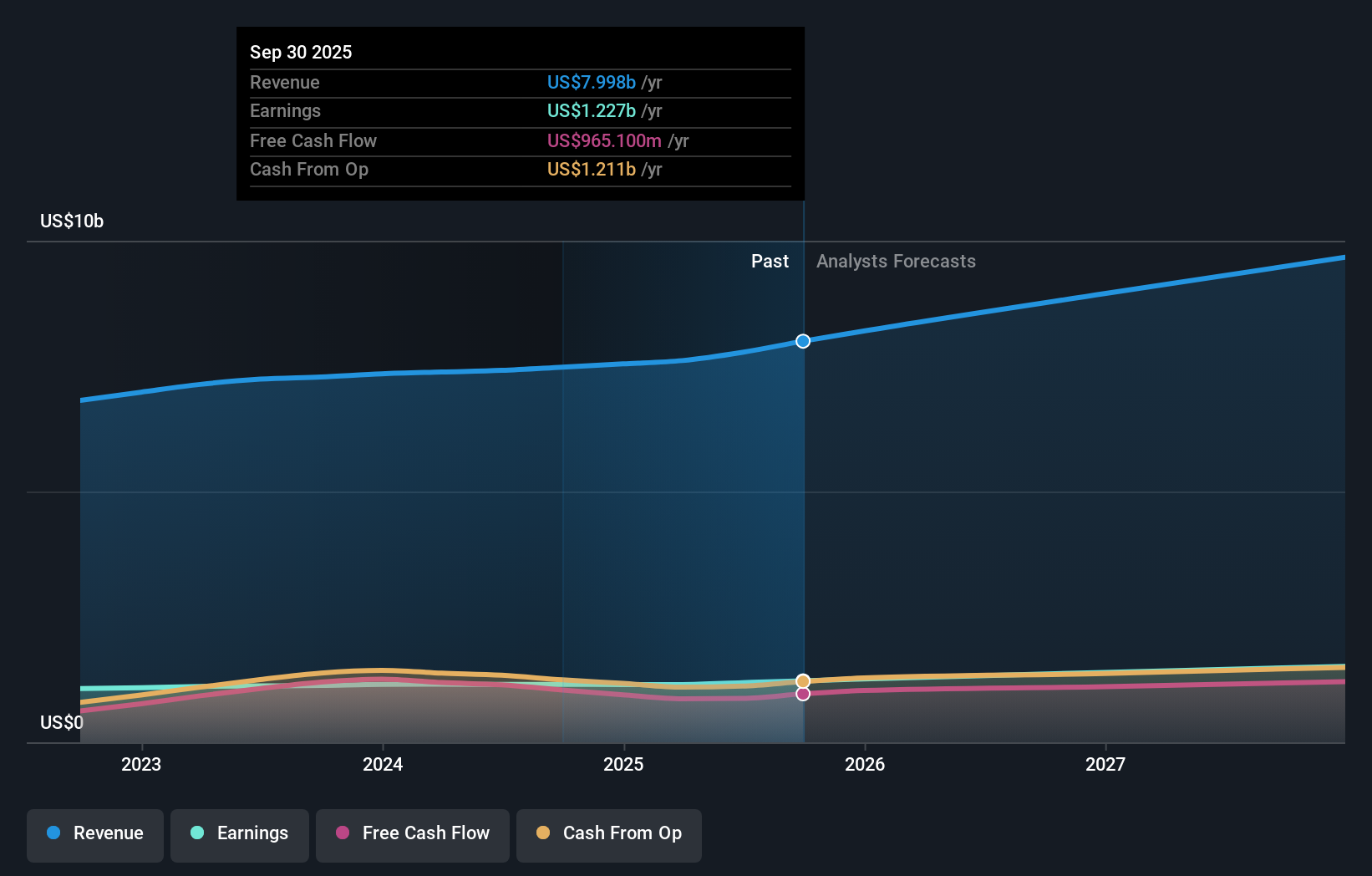

Fastenal's forecast projects $9.9 billion in revenue and $1.6 billion in earnings by 2028. This outlook assumes 8.5% annual revenue growth and a $0.4 billion increase in earnings from the current level of $1.2 billion.

Uncover how Fastenal's forecasts yield a $44.35 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Ten members of the Simply Wall St Community have valued Fastenal with estimates ranging from US$25.42 to US$67. Some see cost pressures as an ongoing risk that could affect margin improvement, encouraging you to weigh several viewpoints before forming your view.

Explore 10 other fair value estimates on Fastenal - why the stock might be worth 38% less than the current price!

Build Your Own Fastenal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fastenal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fastenal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fastenal's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FAST

Fastenal

Engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives