- United States

- /

- Trade Distributors

- /

- NasdaqGS:FAST

Should Fastenal’s (FAST) New NHL Partnership and Digital Strategy Shift Influence Investor Expectations?

Reviewed by Sasha Jovanovic

- Edmonton Oilers Entertainment Group recently announced a multi-year partnership with Fastenal, making Fastenal the preferred MRO supply partner for Rogers Place and expanding the use of Fastenal Managed Inventory Technology at the venue.

- This agreement strengthens Fastenal's role within the NHL ecosystem and showcases its ability to integrate digital supply chain solutions into large-scale sports and entertainment venues.

- We will explore how the new NHL partnership and management changes might affect Fastenal's investment outlook and long-term execution.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Fastenal Investment Narrative Recap

To be a shareholder in Fastenal, you need to believe in the company’s ability to grow through digital supply chain solutions and operational efficiency, especially as it faces margin and demand pressures. The new partnership with Rogers Place underscores Fastenal’s focus on expanding its managed inventory technology and brand visibility, but it does not fundamentally change the biggest short-term catalyst, gaining share through digital and on-site solutions, or the largest risk, which remains margin pressure from input and freight costs.

Among recent announcements, the appointment of Max Tunnicliff as Chief Financial Officer stands out as most relevant. Effective financial leadership is especially important given Fastenal’s ongoing push to balance growth opportunities, such as partnerships like Rogers Place, with careful margin management and execution, which is crucial to address cost pressures and support consistent earnings performance.

However, investors should be aware that even with high-profile partnerships, rising costs and ongoing margin pressure could...

Read the full narrative on Fastenal (it's free!)

Fastenal's outlook anticipates $9.9 billion in revenue and $1.6 billion in earnings by 2028. This is based on an assumed 8.5% annual revenue growth rate and a $0.4 billion increase in earnings from the current $1.2 billion level.

Uncover how Fastenal's forecasts yield a $43.58 fair value, a 9% upside to its current price.

Exploring Other Perspectives

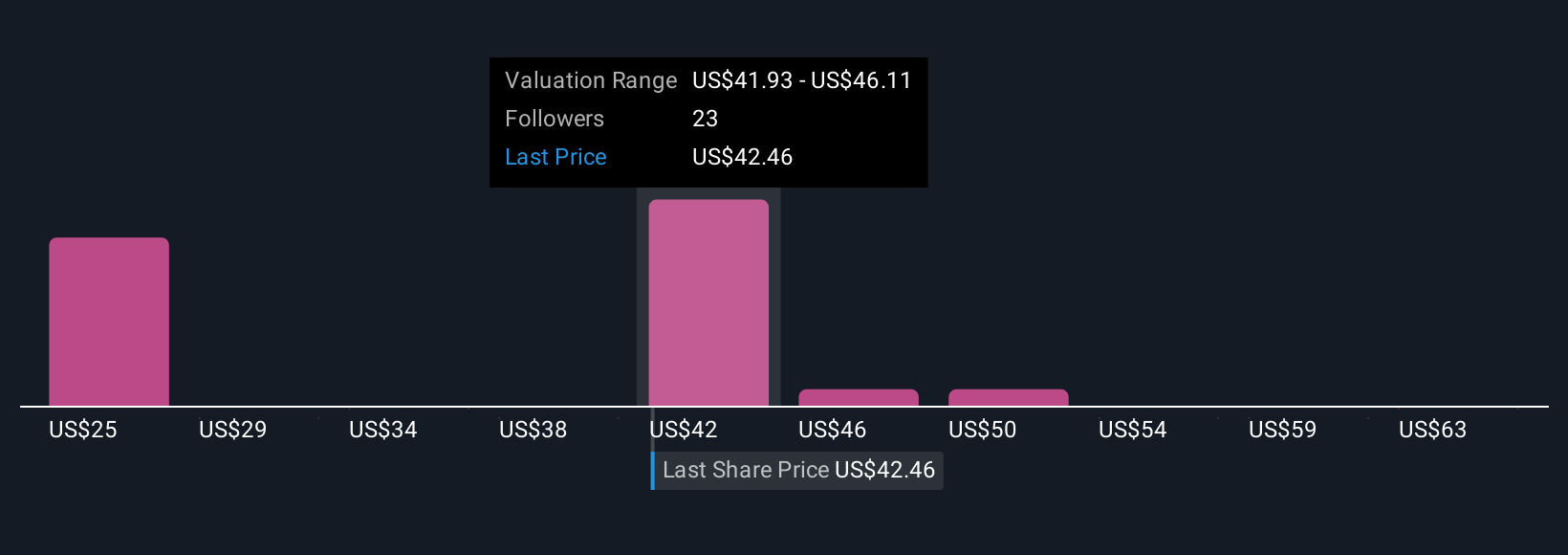

You can find 10 fair value estimates for Fastenal from the Simply Wall St Community, ranging from US$23.53 to US$67 per share. While many see upside in the company’s digital expansion, some remain cautious about ongoing cost pressures and margin risk, underscoring the broad range of opinions available for you to explore.

Explore 10 other fair value estimates on Fastenal - why the stock might be worth 41% less than the current price!

Build Your Own Fastenal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fastenal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fastenal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fastenal's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FAST

Fastenal

Engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives