- United States

- /

- Trade Distributors

- /

- NasdaqGS:FAST

Fastenal (FAST): Evaluating Valuation After Recent Share Price Dip

Reviewed by Simply Wall St

Shares of Fastenal (FAST) dipped slightly this week, as the stock showed a modest decline over the past month. Investors are taking a closer look at the company’s recent performance and considering the factors that could be influencing its valuation at this time.

See our latest analysis for Fastenal.

While Fastenal’s share price has slipped 14.1% over the past month, it’s important to keep the broader context in mind. Momentum is cooling after a strong start to the year, but long-term holders have still enjoyed a 7.4% total shareholder return over the past twelve months and nearly doubled their money over five years.

If you’re curious about other opportunities, now is the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership.

Given Fastenal’s recent dip and robust long-term track record, the key question is whether the stock is now undervalued based on its fundamentals or if investors have already factored in all future growth prospects. Is this the right moment to buy, or is the market simply reflecting Fastenal’s true outlook?

Most Popular Narrative: 7.2% Undervalued

Fastenal’s narrative-driven fair value of $44.35 is modestly above the last close of $41.15, suggesting there may be untapped upside that has not yet been reflected in the price. Here is the perspective fueling this current outlook.

The company is expanding its Fastenal Managed Inventory (FMI) technology, which currently represents over 43% of revenue, aiming to enhance revenue growth by increasing efficiency in customer supply chains. Fastenal aims to increase its digital footprint to represent 66-68% of sales, up from 61%, potentially boosting revenue by optimizing purchasing and operational efficiency.

What is the rationale behind Fastenal’s current price target? The narrative highlights a significant shift: digital expansion, major supply chain initiatives, and the potential for improved margins in the future. Interested in identifying the specific factors supporting this outlook? Review the precise drivers guiding this target.

Result: Fair Value of $44.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade tensions and rising supply chain costs could still undermine Fastenal’s progress and challenge its margin expansion story.

Find out about the key risks to this Fastenal narrative.

Another View: Multiples Paint a Pricier Picture

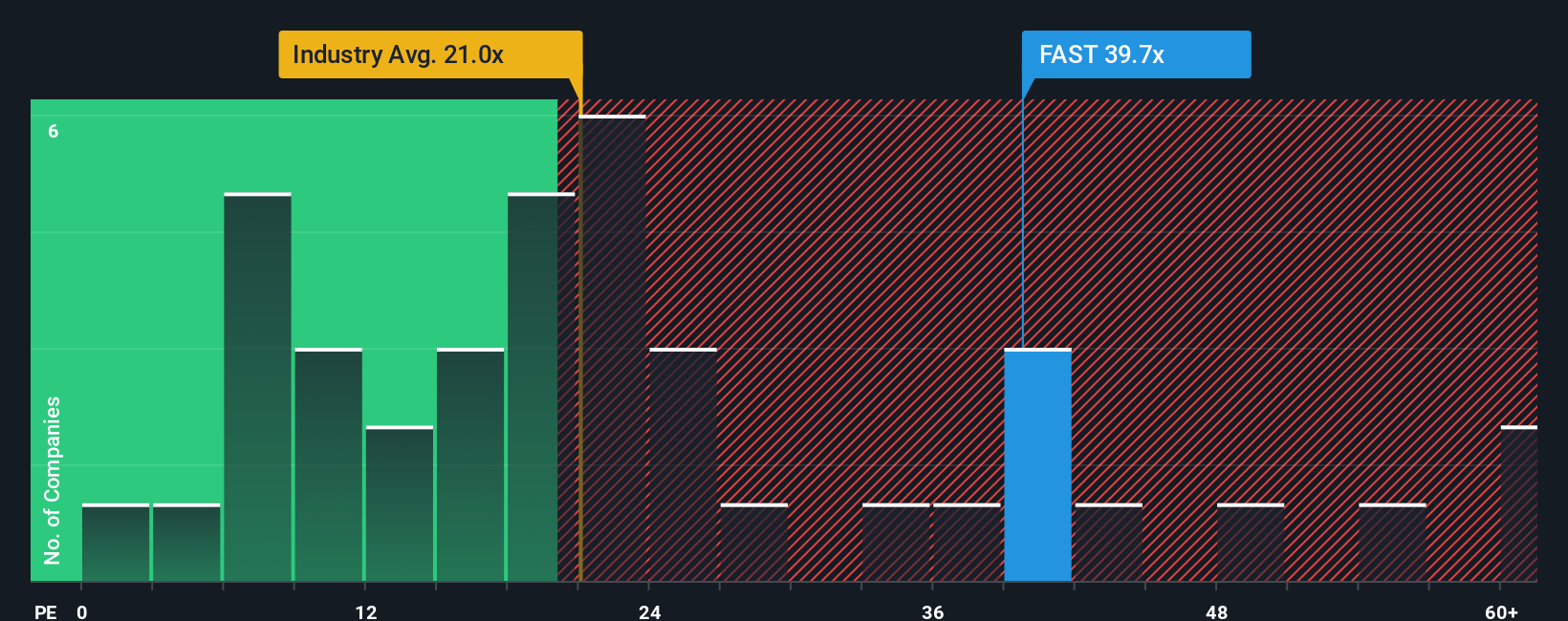

While the narrative-driven fair value suggests Fastenal may be undervalued, a look at the current earnings multiple raises tough questions. Fastenal trades at a price-to-earnings ratio of 38.5x, which is well above the US Trade Distributors industry average of 21.8x, the peer group average of 21x, and even the fair ratio of 26.5x. This gap suggests investors are paying a premium for expectations that may already be priced in. Could this higher valuation indicate more risk than reward moving forward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fastenal Narrative

If you have a different point of view or would rather dig into the numbers yourself, you can shape your own Fastenal story in just a few minutes, and Do it your way.

A great starting point for your Fastenal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't let exceptional opportunities slip by while you focus on just one stock. Make your next smart move: expand your search to top companies riding today's most powerful trends.

- Unlock growth potential by targeting high-yield investments. Check out these 22 dividend stocks with yields > 3% and find stocks generating reliable returns above 3%.

- Get ahead of the curve in artificial intelligence with these 26 AI penny stocks, featuring companies at the forefront of game-changing automation and advanced computing.

- Capitalize on unrecognized value opportunities by scanning these 840 undervalued stocks based on cash flows for stocks that the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FAST

Fastenal

Engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives