- United States

- /

- Chemicals

- /

- NasdaqCM:ASPI

September 2025's Top Growth Companies With Insider Influence

Reviewed by Simply Wall St

In September 2025, U.S. stock markets have experienced a downturn, with major indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq all closing lower due to declines in tech shares following Federal Reserve Chair Jerome Powell's comments on interest rates. Amidst this backdrop of fluctuating market conditions and high valuations, growth companies with significant insider ownership can offer a unique perspective on potential resilience and strategic direction in uncertain times.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 93.2% |

| Prairie Operating (PROP) | 31.3% | 86.6% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.3% | 68% |

| Hippo Holdings (HIPO) | 14.0% | 41.2% |

| Hesai Group (HSAI) | 15.5% | 41.5% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.3% | 33% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.5% |

| Astera Labs (ALAB) | 12.1% | 36.8% |

Let's take a closer look at a couple of our picks from the screened companies.

ASP Isotopes (ASPI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ASP Isotopes Inc. is a development stage advanced materials company focused on the production, distribution, marketing, and sale of isotopes with a market cap of $1.03 billion.

Operations: The company generates revenue primarily from its Specialist Isotopes and Related Services segment, amounting to $4.38 million.

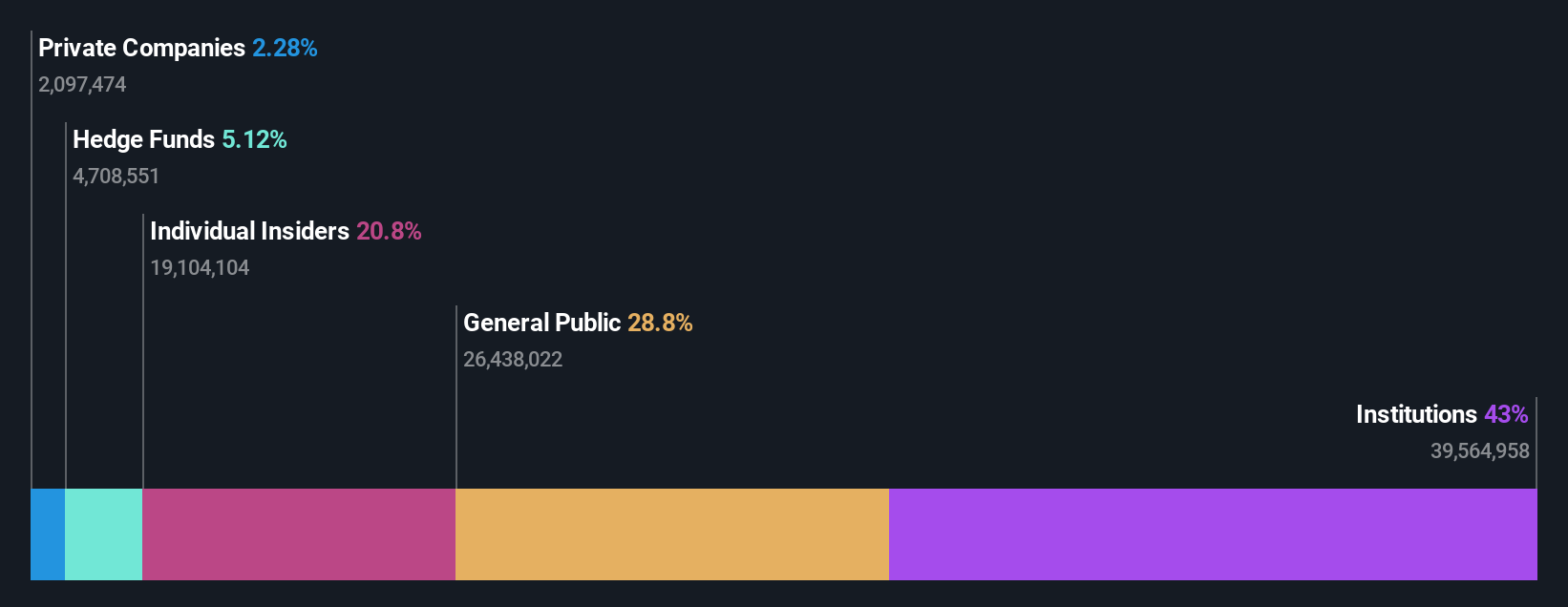

Insider Ownership: 20.9%

Revenue Growth Forecast: 68% p.a.

ASP Isotopes is poised for significant growth with its forecasted revenue increase of 68% per year, outpacing the US market. Despite recent insider selling, the company has engaged in strategic initiatives like a joint venture with Fermi America to develop advanced nuclear fuels. The appointment of Ralph L. Hunter, Jr., brings valuable expertise in nuclear technology development to the board. However, ASP Isotopes faces challenges such as substantial shareholder dilution and limited current revenue at US$5 million.

- Unlock comprehensive insights into our analysis of ASP Isotopes stock in this growth report.

- The analysis detailed in our ASP Isotopes valuation report hints at an inflated share price compared to its estimated value.

Clover Health Investments (CLOV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Clover Health Investments, Corp. offers Medicare Advantage plans in the United States and has a market cap of approximately $1.54 billion.

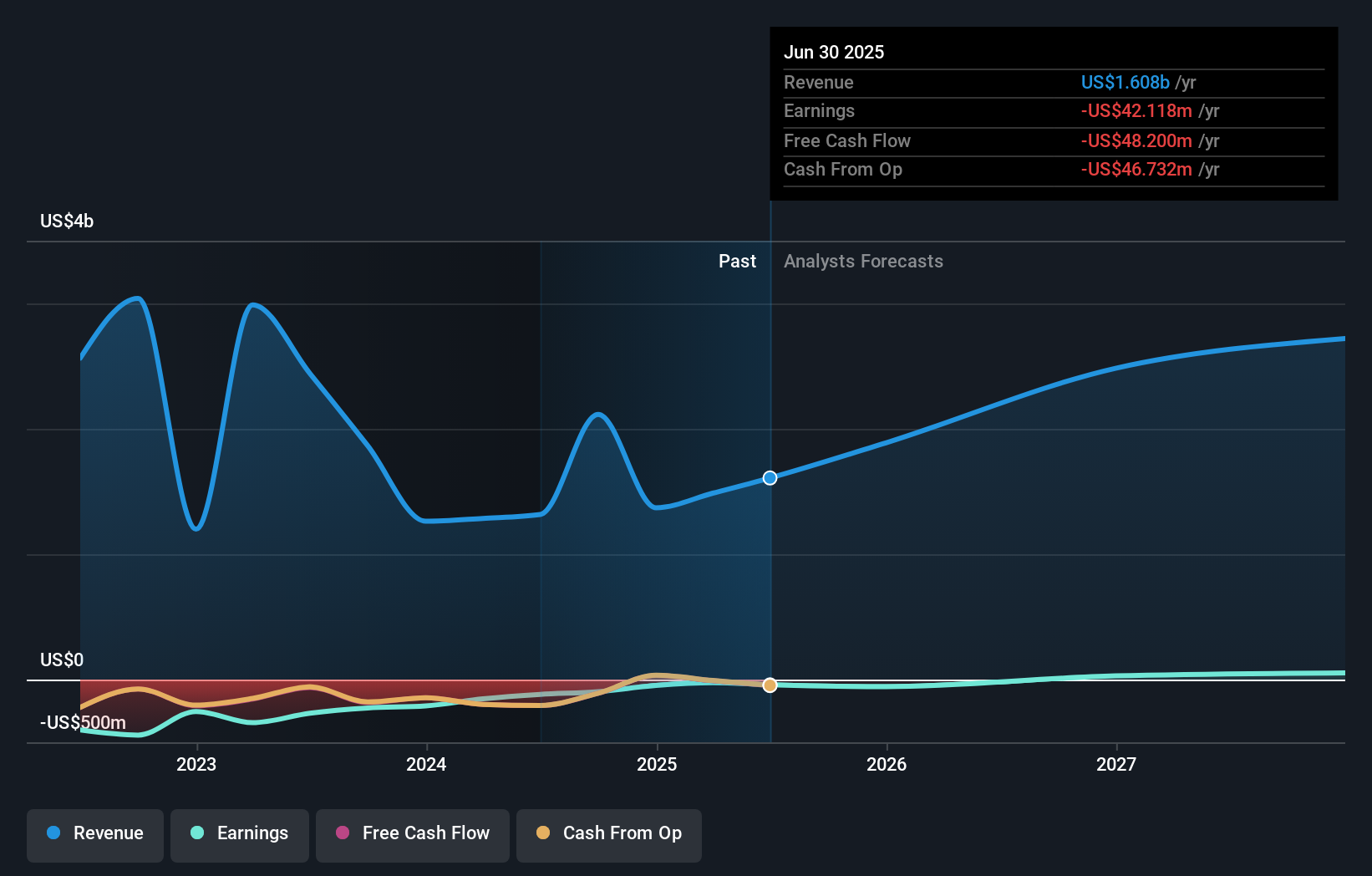

Operations: The company's revenue primarily comes from its insurance segment, which generated $1.61 billion.

Insider Ownership: 21.5%

Revenue Growth Forecast: 17.6% p.a.

Clover Health Investments is set for substantial growth, with revenue projected to rise 17.6% annually, surpassing the US market average. The company has seen significant insider buying recently, reflecting confidence in its strategic direction. Clover's initiatives include leveraging Availity to enhance operational efficiency and improve patient care access. Despite a net loss of US$10.58 million in Q2 2025, Clover remains committed to becoming profitable within three years and offers good value compared to peers.

- Click here to discover the nuances of Clover Health Investments with our detailed analytical future growth report.

- Our expertly prepared valuation report Clover Health Investments implies its share price may be lower than expected.

Enovix (ENVX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Enovix Corporation designs, develops, and manufactures lithium-ion battery cells both in the United States and internationally, with a market cap of approximately $2.05 billion.

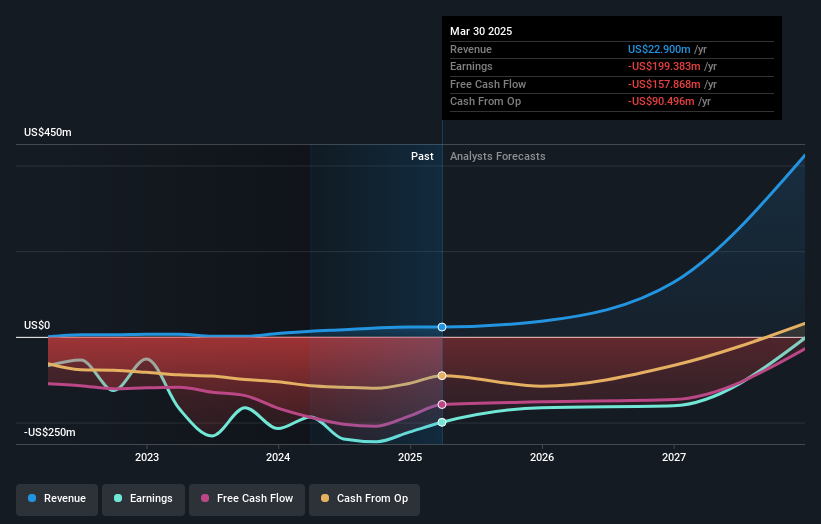

Operations: The company's revenue is primarily derived from its Batteries / Battery Systems segment, totaling $26.60 million.

Insider Ownership: 12.1%

Revenue Growth Forecast: 42.6% p.a.

Enovix Corporation is poised for significant growth, with revenue expected to increase 42.6% annually, outpacing the US market. Despite recent volatility and index delistings, Enovix's strategic initiatives include a $300 million fixed-income offering and expanding its R&D capabilities in India. The company aims to leverage its innovative AI-2 battery platform for future advancements. With insider ownership remaining stable, Enovix is trading at a substantial discount compared to its estimated fair value while targeting profitability within three years.

- Dive into the specifics of Enovix here with our thorough growth forecast report.

- Our expertly prepared valuation report Enovix implies its share price may be too high.

Turning Ideas Into Actions

- Dive into all 202 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Curious About Other Options? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ASPI

ASP Isotopes

A development stage advanced materials company, engages in the production, distribution, marketing, and sale of isotopes.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives