- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:EH

Why Investors Shouldn't Be Surprised By EHang Holdings Limited's (NASDAQ:EH) 46% Share Price Surge

EHang Holdings Limited (NASDAQ:EH) shares have had a really impressive month, gaining 46% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 2.5% isn't as impressive.

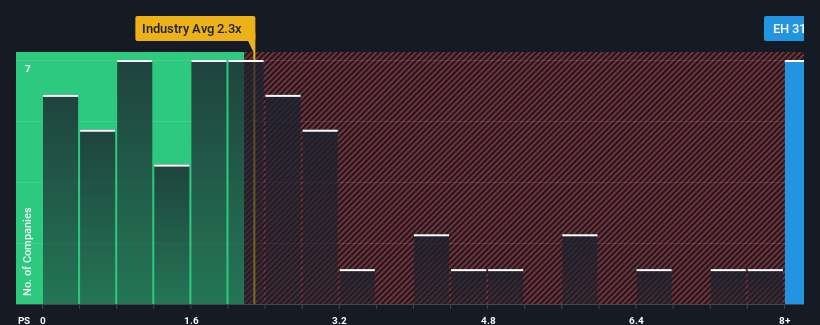

After such a large jump in price, when almost half of the companies in the United States' Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider EHang Holdings as a stock not worth researching with its 31.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for EHang Holdings

How EHang Holdings Has Been Performing

With revenue growth that's superior to most other companies of late, EHang Holdings has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on EHang Holdings.Is There Enough Revenue Growth Forecasted For EHang Holdings?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like EHang Holdings' to be considered reasonable.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The latest three year period has also seen an excellent 55% overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 78% each year as estimated by the ten analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 2.9% per annum, which is noticeably less attractive.

With this in mind, it's not hard to understand why EHang Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does EHang Holdings' P/S Mean For Investors?

The strong share price surge has lead to EHang Holdings' P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that EHang Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Aerospace & Defense industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for EHang Holdings that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if EHang Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:EH

EHang Holdings

Operates as an urban air mobility (UAM) technology platform company in the People’s Republic of China, East Asia, West Asia, North America, South America, West Africa, and Europe.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026