- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:EH

EHang (NasdaqGM:EH) Net Loss of -82.2m CNY Tests Growth Narratives Despite Revenue Progress

Reviewed by Simply Wall St

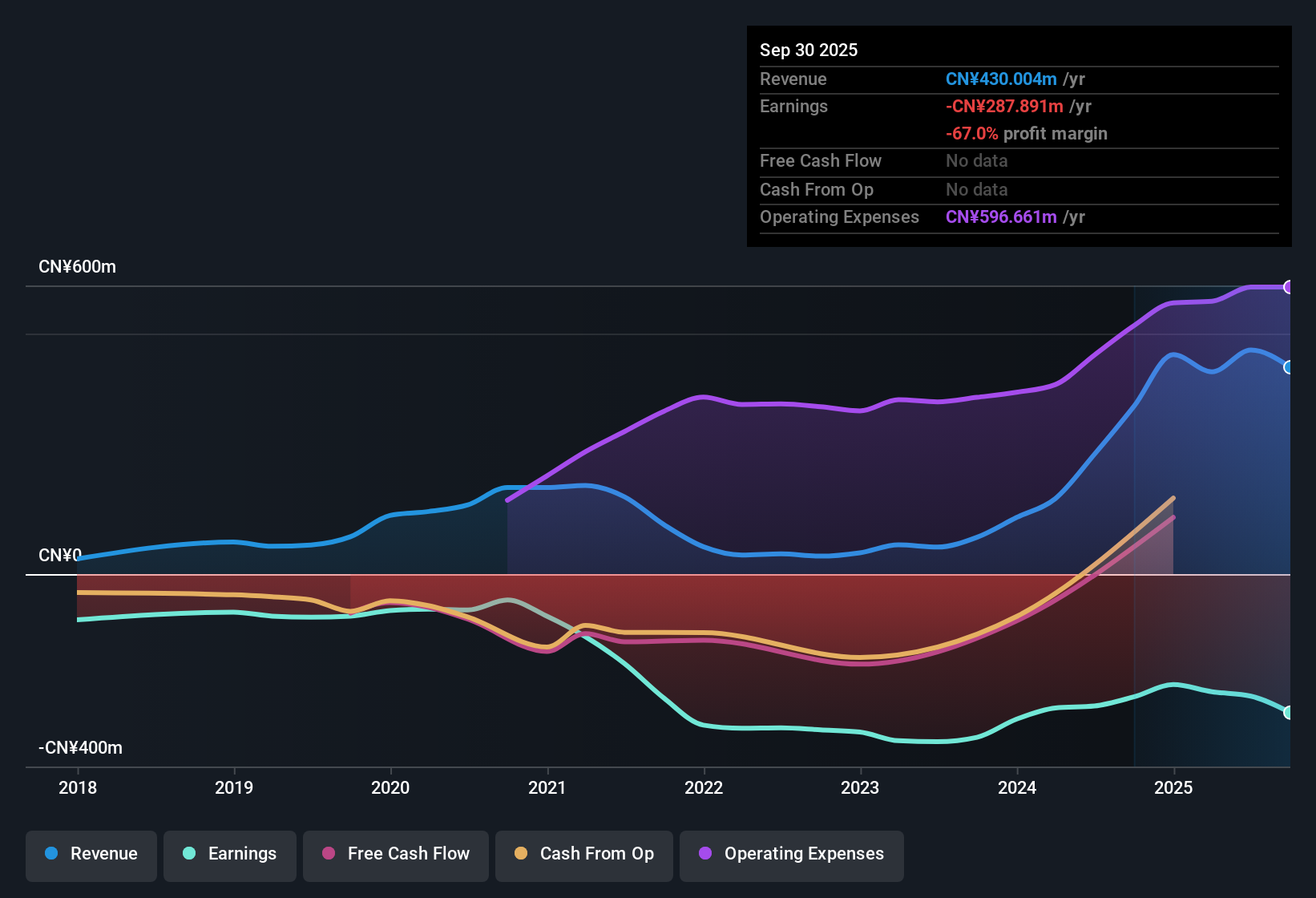

EHang Holdings (NasdaqGM:EH) just announced its Q3 2025 financial results, posting total revenue of 92.5 million CNY and a basic EPS of -1.11 CNY for the quarter. Looking at the bigger picture, the company has seen revenue move from 26.1 million CNY in Q1 2025 to 92.5 million CNY in Q3, while EPS has remained negative throughout. Despite strong top-line momentum, margins remain under pressure as losses have persisted over recent quarters.

See our full analysis for EHang Holdings.Next, we will see how these headline numbers stack up against the most followed market narratives, and where investor stories might get tested by the recent results.

See what the community is saying about EHang Holdings

Net Losses Widen Despite Revenue Surge

- While total revenue for the trailing twelve months rose to 430 million CNY, net losses also expanded, reaching -287.9 million CNY over the same period. This highlights that top-line growth has not translated into profitability.

- The consensus narrative notes that EHang's innovations and government partnerships could boost long-term growth and support margin improvement. However, heavy reliance on China and rising operating costs remain major risks to near-term profitability.

- Total revenue grew 39.4% year-over-year, yet net losses over the last five years have increased at a rate of 9.3% per year.

- Consensus expects improved margins and positive earnings within three years, but this hinges on operational execution in the face of high R&D expenses and slow overseas progress.

- See how analysts weigh future growth against ongoing losses in their balanced take on EHang’s results. 📊 Read the full EHang Holdings Consensus Narrative.

High Price-to-Sales Signals Premium Valuation

- EHang's current Price-To-Sales Ratio of 16.1x stands far above the US Aerospace & Defense industry average of 3x and peer average of 4.8x, showing that investors are paying a steep premium relative to sector norms.

- Consensus commentary highlights how this premium valuation reflects strong growth forecasts but also increases pressure on EHang to execute, as ongoing lack of profitability exposes the stock to more volatility if targets are missed.

- With losses of -287.9 million CNY over the last twelve months and no reported profits, investors are largely betting on future revenue to justify the valuation.

- The expectation for earnings to increase by 68.71% annually and reach profitability within three years sets a high bar that the company needs to clear for continued investor support.

China Dependency Poses Concentration Risk

- Currently, 90% of revenues and future backlog derive from China, while international expansion is limited with very modest deliveries abroad according to the consensus view.

- Consensus narrative stresses that EHang’s dependence on the domestic market makes future earnings vulnerable to regulatory changes or economic shocks in China, potentially overshadowing gains from municipal partnerships.

- With overseas certifications and deliveries still in early stages, any headwinds within China would have an outsized impact on both sales and earnings outlook.

- This concentration could limit the upside impact of global eVTOL adoption until more diversified revenue sources are established.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for EHang Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the data? Shape your personal view and create a narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding EHang Holdings.

See What Else Is Out There

EHang's rapid revenue growth comes with sustained losses, premium valuation, and a heavy reliance on one market. These factors add uncertainty to its investment outlook.

If you want proven value backed by healthier fundamentals, check out these 926 undervalued stocks based on cash flows and discover companies trading at more attractive prices with less downside risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EHang Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EH

EHang Holdings

Operates as an urban air mobility (UAM) technology platform company in the People’s Republic of China, East Asia, West Asia, North America, South America, West Africa, and Europe.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success