- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:EH

Could The EHang Holdings Limited (NASDAQ:EH) Ownership Structure Tell Us Something Useful?

If you want to know who really controls EHang Holdings Limited (NASDAQ:EH), then you'll have to look at the makeup of its share registry. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

With a market capitalization of US$574m, EHang Holdings is a small cap stock, so it might not be well known by many institutional investors. Taking a look at our data on the ownership groups (below), it seems that institutional investors have not yet purchased shares. Let's delve deeper into each type of owner, to discover more about EHang Holdings.

Check out our latest analysis for EHang Holdings

What Does The Lack Of Institutional Ownership Tell Us About EHang Holdings?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to funds under management, so the institution does not bother to look closely at the company. It is also possible that fund managers don't own the stock because they aren't convinced it will perform well. EHang Holdings might not have the sort of past performance institutions are looking for, or perhaps they simply have not studied the business closely.

Hedge funds don't have many shares in EHang Holdings. The company's CEO Huazhi Hu is the largest shareholder with 42% of shares outstanding. GGV Capital is the second largest shareholder owning 13% of common stock, and Shang-Wen Hsiao holds about 12% of the company stock.

A more detailed study of the shareholder registry showed us that 2 of the top shareholders have a considerable amount of ownership in the company, via their 55% stake.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

Insider Ownership Of EHang Holdings

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders own more than half of EHang Holdings Limited. This gives them effective control of the company. So they have a US$360m stake in this US$574m business. Most would argue this is a positive, showing strong alignment with shareholders. You can click here to see if those insiders have been buying or selling.

General Public Ownership

With a 17% ownership, the general public have some degree of sway over EHang Holdings. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Equity Ownership

Private equity firms hold a 20% stake in EHang Holdings. This suggests they can be influential in key policy decisions. Some investors might be encouraged by this, since private equity are sometimes able to encourage strategies that help the market see the value in the company. Alternatively, those holders might be exiting the investment after taking it public.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

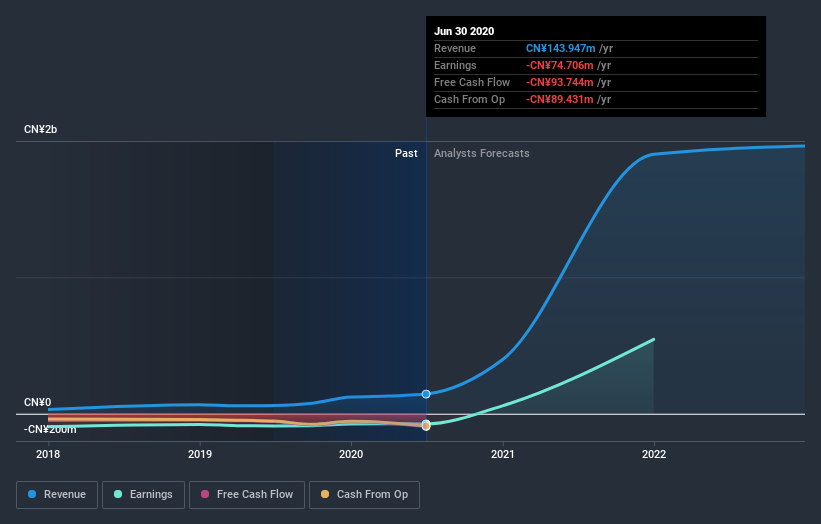

I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow, for free.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade EHang Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EHang Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGM:EH

EHang Holdings

Operates as an urban air mobility (UAM) technology platform company in the People’s Republic of China, East Asia, West Asia, North America, South America, West Africa, and Europe.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives