- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:EH

A Look at EHang Holdings (NasdaqGM:EH) Valuation After VT35 eVTOL Launch and New Partnership Deals

Reviewed by Kshitija Bhandaru

EHang Holdings (NasdaqGM:EH) has rolled out its VT35 pilotless eVTOL aircraft, marking a step forward with longer range and compatibility with established vertiport networks. Notably, the launch coincides with new partnership deals and purchase commitments.

See our latest analysis for EHang Holdings.

Following the VT35 launch and fresh partnership agreements, momentum is building for EHang Holdings. While the share price recently climbed over 10% in the past month, the bigger story is its 16% year-to-date rise and a remarkable 351% total shareholder return over three years. This highlights renewed investor optimism in EHang's growth prospects as commercial opportunities expand.

If this surge in urban air mobility has you watching for the next breakout, now’s a smart time to broaden your search and discover fast growing stocks with high insider ownership.

With shares still trading at a notable discount to analyst price targets, the question for investors now is whether EHang's growth runway is undervalued or if the market is already factoring in these future gains.

Most Popular Narrative: 23% Undervalued

With EHang Holdings' last close at $18.23 and the most widely followed fair value estimate at $23.71, sentiment is leaning positively. The narrative frames this opportunity in the context of high growth potential, rooted in key partnerships and technical advances.

The company's deepening partnerships with municipal governments (such as Hefei's RMB 500 million support for the VT35 hub) and involvement in setting regulatory and safety standards enhances regulatory acceptance and ecosystem integration. This supports wider market entry, improved top-line growth, and improved long-term earnings visibility.

Curious why the outlook is so bullish? The game-changing factors baked into this narrative center on an unprecedented leap in profitability and rapidly scaling revenues over the next few years. Want to see which bold projections fuel this discounted valuation? The full narrative breaks down the numbers and catalysts driving this estimate.

Result: Fair Value of $23.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower international expansion and ongoing high operating expenses could challenge EHang’s growth momentum and threaten the bullish outlook.

Find out about the key risks to this EHang Holdings narrative.

Another View: Is the Price Already Too High?

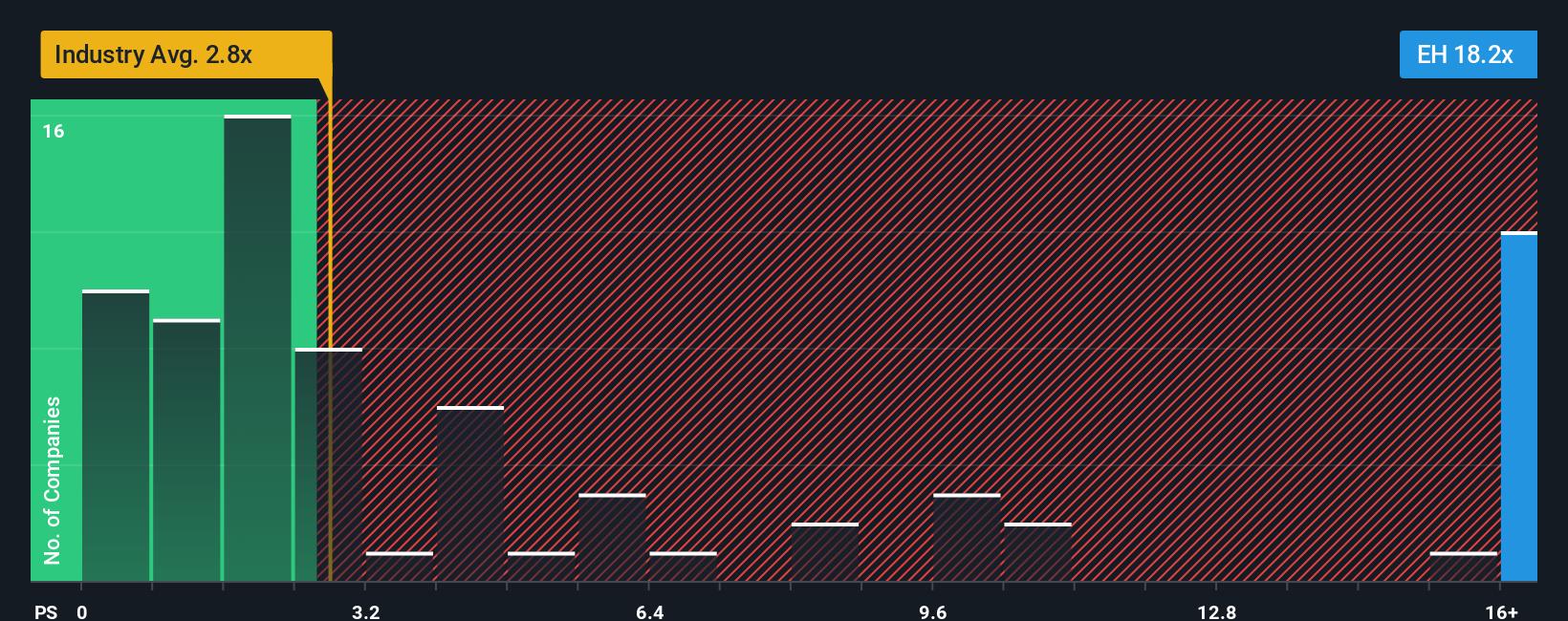

While analyst projections suggest EHang Holdings is undervalued, looking at its price-to-sales ratio reveals a less optimistic picture. EHang trades at 20.1x sales, much higher than the US Aerospace & Defense industry average of 3.3x and its fair ratio of 10.5x. This significant gap suggests investors may be paying a premium for future growth that might not fully materialize. Could this optimism be overdone, or does it signal conviction in EHang’s unique position?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EHang Holdings Narrative

If these conclusions don’t reflect your perspective or you want to follow your own data-driven path, you can build a personalized view of EHang Holdings in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding EHang Holdings.

Looking for More Investment Ideas?

Why settle for just one opportunity when you can tap into a world of promising investments? Take charge and boost your portfolio by exploring these standout trends right now:

- Capitalize on artificial intelligence breakthroughs and spot emerging winners with these 25 AI penny stocks. These are reshaping entire industries through innovation and efficiency.

- Unlock potential value by targeting these 881 undervalued stocks based on cash flows. These offer attractive upside based on strong fundamentals and market mispricing.

- Secure reliable income streams by screening for these 18 dividend stocks with yields > 3%. These deliver consistent yields above 3% and reward shareholders over the long term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EHang Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EH

EHang Holdings

Operates as an urban air mobility (UAM) technology platform company in the People’s Republic of China, East Asia, West Asia, North America, South America, West Africa, and Europe.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives