- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:DRS

Leonardo DRS (DRS): Valuation Insights Following Strong Q3 Results and Leadership Transition Announcement

Reviewed by Simply Wall St

Leonardo DRS (DRS) delivered third-quarter results that exceeded expectations, highlighted by strong revenue growth and a record order backlog. The company also announced CEO Bill Lynn’s upcoming retirement. John Baylouny has been named as his successor, effective January 2026.

See our latest analysis for Leonardo DRS.

Despite upbeat earnings and a raised revenue outlook, Leonardo DRS’s short-term share price has pulled back, dropping nearly 18% over the last month, as investors reacted to margin pressures and a slightly cautious profit forecast. Still, the 1-year total shareholder return of almost 20% underscores the company’s solid long-term trajectory, with demand and a growing backlog supporting confidence for 2026 and beyond.

If sector momentum and recent leadership changes have your attention, it’s a great time to discover other opportunities in aerospace and defense. See the full list here: See the full list for free.

With shares trading well below analyst price targets despite strong financial results and a robust outlook, investors may wonder if Leonardo DRS is a value opportunity or if the market is already factoring in all the anticipated growth ahead.

Most Popular Narrative: 23.8% Undervalued

With Leonardo DRS closing at $36.56 and the most popular narrative assigning a fair value of $48, the stock is currently trading at a notable discount. This sets up an intriguing divergence between market sentiment and consensus projections, prompting a closer look at the underlying assumptions driving this narrative.

The company's strategic alignment with national priorities, including investments in naval modernization, next-generation air and missile defense (such as the Golden Dome initiative), and counter-UAS capabilities, sets the stage for premium contract awards and program expansions, benefiting both revenue and net margins over the next several years. Leonardo DRS is increasing its R&D investment to accelerate innovation in critical areas such as space sensing, advanced infrared technologies, and force protection. This should support the company's competitive positioning and allow for participation in higher-margin, next-generation defense programs. These factors may improve long-term earnings and margin trajectories.

Want to know which bold growth assumptions power this valuation? The real eye-opener is in the narrative’s forecast for margin expansion and multi-year earnings. Curious how analyst consensus expects DRS to outperform? Find out which future profit milestones are setting this high bar. Click through to see the financial drivers behind the fair value now.

Result: Fair Value of $48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing raw material cost pressures and heavy reliance on U.S. government contracts could limit upside if supply or budget trends shift unexpectedly.

Find out about the key risks to this Leonardo DRS narrative.

Another View: Multiples Bring a Reality Check

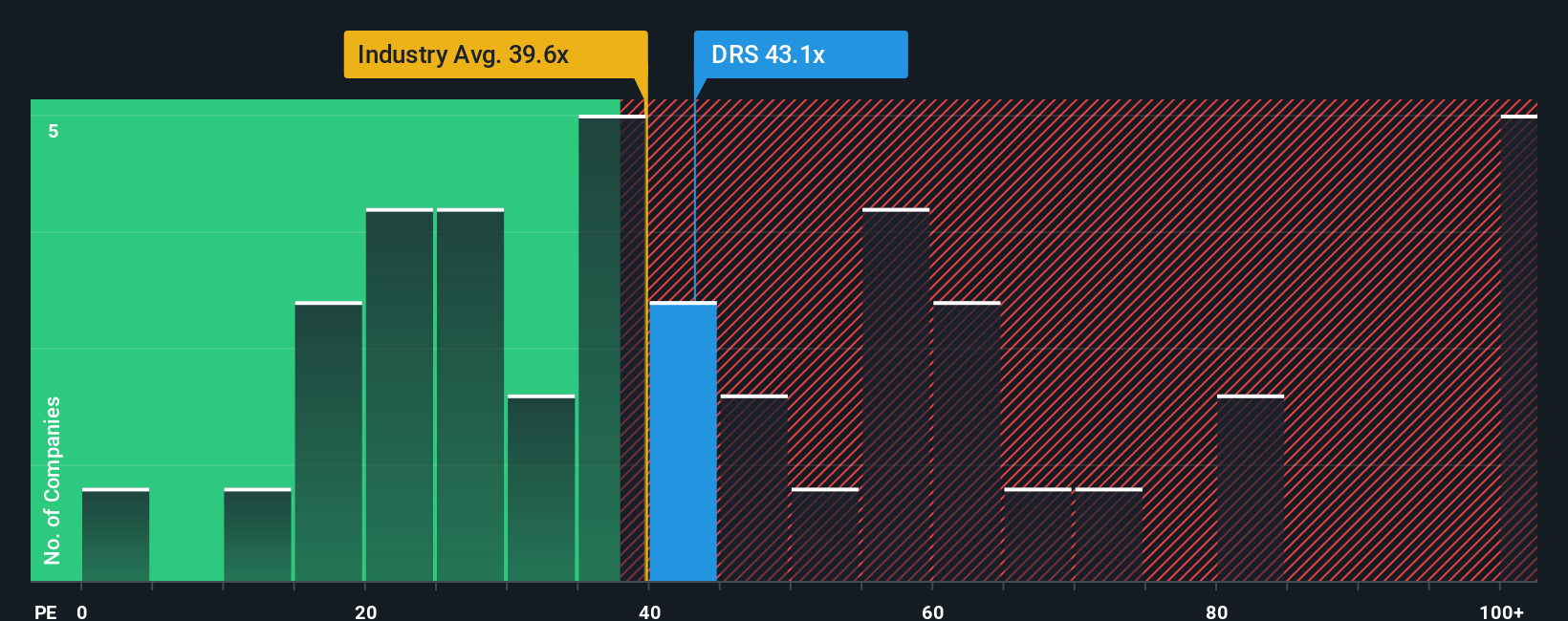

While the prevailing narrative suggests Leonardo DRS is undervalued, a look at the current earnings multiple offers a more nuanced story. DRS trades at 36.7 times earnings, which is pricier than its fair ratio of 30.4 times but just below the industry average of 38.9 times. This means the stock looks slightly expensive compared to where the market could head, and even more so relative to its peers. Are investors ready for these high expectations, or could sentiment shift if growth stutters?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Leonardo DRS Narrative

If the current story doesn’t quite fit your perspective, why not dive into the numbers yourself and craft your own take in just a few minutes? Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Leonardo DRS.

Looking for more investment ideas?

Seeking your next smart move? The best investors never settle for one opportunity. Uncover fresh strategies with these unique screens before the crowd catches on.

- Target consistent income with reliable yields by checking out these 22 dividend stocks with yields > 3%, where top stocks offer attractive payouts beyond the market average.

- Spot tomorrow’s disruptors now by seeing which companies are harnessing artificial intelligence advancements with the help of these 26 AI penny stocks.

- Capitalize on undervalued gems by tapping into these 832 undervalued stocks based on cash flows, surfacing stocks the market might be missing based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DRS

Leonardo DRS

Provides defense electronic products and systems, and military support services worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives