- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:DRS

Leonardo DRS (DRS) Earnings Growth Surges 33.8%, Reinforcing Bullish Community Narrative

Reviewed by Simply Wall St

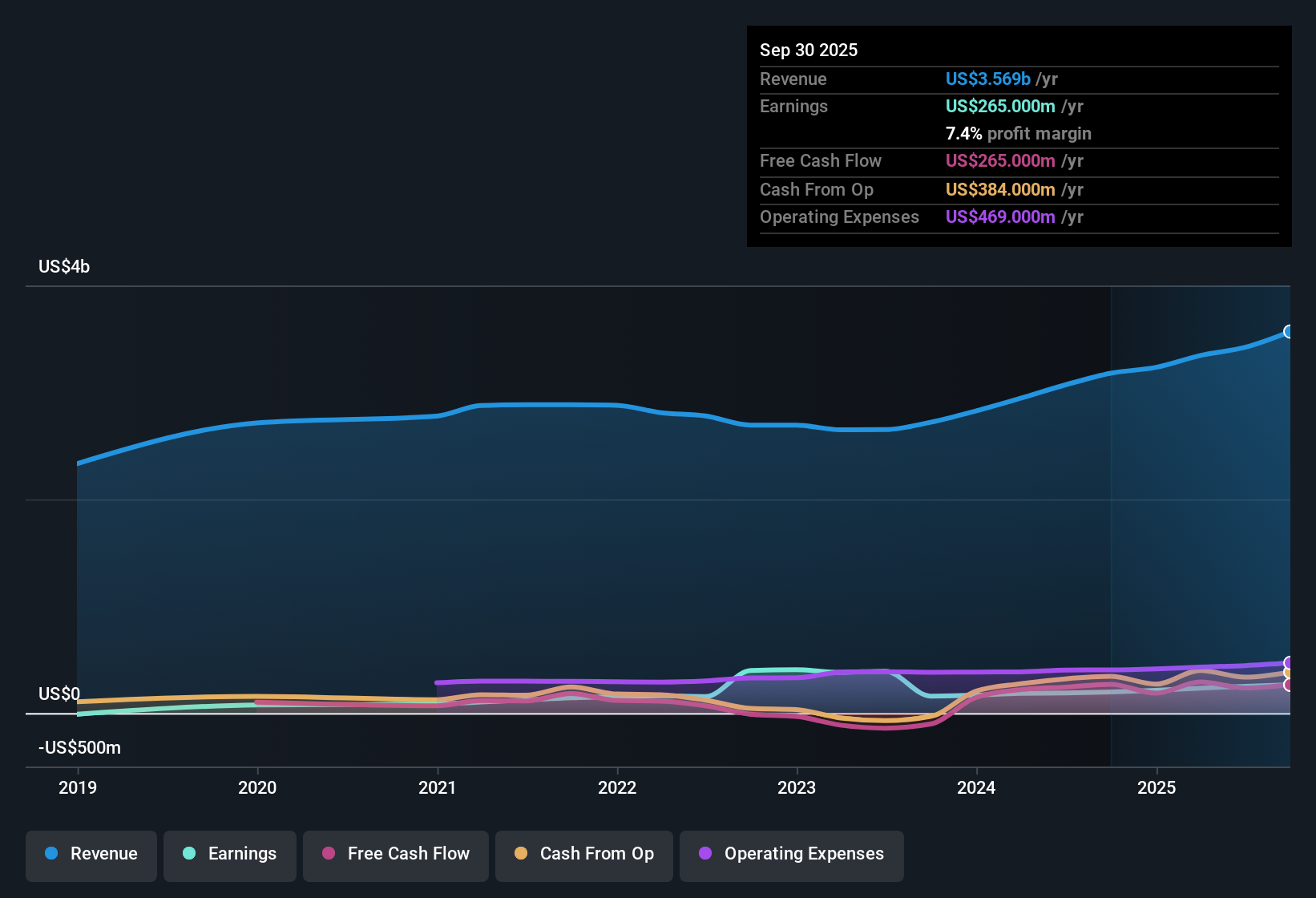

Leonardo DRS (DRS) delivered a standout 33.8% earnings growth over the last year, handily beating its 5-year average annual pace of 10.4%. Net profit margins rose to 7.4%, up from 6.2% last year, pointing to improved profitability. Looking ahead, the company expects earnings to increase 15.8% per year, with more modest revenue gains of 5.6% annually. This rate is slower than the US market’s 10.3% average. DRS trades at a Price-to-Earnings ratio of 36.2x, below the US Aerospace & Defense industry average but slightly above the estimated fair value of $31.60, with shares priced at $36.05. For investors, the key rewards include sustained earnings momentum, stronger margins, and a valuation that looks attractive within the sector.

See our full analysis for Leonardo DRS.Next, we will see how these results compare against the most widely discussed narratives in the market and whether the community views are supported or challenged by the latest numbers.

See what the community is saying about Leonardo DRS

Net Margins Rise Against Industry Challenges

- Leonardo DRS's net profit margins climbed to 7.4%, up from 6.2% the prior year, even as the consensus narrative points to ongoing raw material constraints and margin pressures in the broader industry.

- Analysts' consensus view highlights that, despite concerns over supply chain constraints and escalating costs, increased investment in proprietary technologies and persistent defense sector demand are expected to drive further margin improvement.

- Consensus notes margin gains have come alongside higher R&D spending, which rose from 2.8% to 3.5% of revenue, supporting innovation and longer-term competitive positioning.

- The narrative also points to program expansions and a growing international backlog as key offsetting factors to margin headwinds.

Strong operating margins are outpacing industry cost pressures, bringing DRS’s innovation and contract wins into focus. See what the wider market thinks in the consensus narrative. 📊 Read the full Leonardo DRS Consensus Narrative.

Profit Growth Outpaces the US Market

- DRS's earnings have grown 33.8% in the last year, far exceeding the 5-year annual average of 10.4%, while guidance points to a forward annual earnings growth rate of 15.8%, versus the US market's projected 10.3% average rate.

- Analysts' consensus view emphasizes that alignment with US and NATO defense priorities, plus increased global defense budgets, are catalysts for continued above-market profit expansion.

- Consensus notes that exposure to high-margin defense programs, such as space sensing and electronic warfare, is likely to sustain profit trajectory.

- The narrative also flags that anticipated backlog growth and international diversification help buffer against US budget dependency, supporting long-term upward momentum.

Sector Valuation Discount with Fair Value Gap

- Leonardo DRS trades at a P/E ratio of 36.2x, below the Aerospace & Defense industry average of 41x, but its present share price of $36.05 remains above the DCF fair value of $31.60, while still trailing the consensus analyst price target of $48.00.

- Analysts' consensus view believes DRS's relative valuation offers room for re-rating if high earnings quality and margin gains persist.

- Consensus suggests that, for analyst expectations to be met, earnings must rise to about $351.1 million and the company must trade at a future P/E of 47.2x, placing the stock in favored territory if forecast growth materializes.

- The narrative also signals that while sector multiples are high, DRS’s momentum in innovative defense programs and margin strength may justify a premium over DCF fair value in the eyes of some long-term investors.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Leonardo DRS on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the numbers? Share your perspective and craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Leonardo DRS.

See What Else Is Out There

Although Leonardo DRS delivered robust earnings growth, its current valuation trades above fair value and relies on continued margin expansion to justify a premium.

If you want to focus on companies with more compelling prices right now, check out these 848 undervalued stocks based on cash flows that are still trading below what their cash flows suggest they're worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DRS

Leonardo DRS

Provides defense electronic products and systems, and military support services worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives