- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:DRS

Does Leonardo DRS's (DRS) Thai Army Deal Signal Rising Global Ambitions for Its Defense Technology?

Reviewed by Sasha Jovanovic

- Leonardo DRS, Inc. has announced a contract with Chaiseri Defense Systems to deliver its advanced Battle Management System and integration support for the Royal Thailand Army's Stryker situational awareness modernization.

- This collaboration not only underscores Leonardo DRS’s expanding presence in international defense markets, but also highlights the company's focus on next-generation tactical computing and networked solutions.

- We'll examine how this new contract supporting the Royal Thai Army's modernization efforts could influence Leonardo DRS’s overall investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Leonardo DRS Investment Narrative Recap

Leonardo DRS shareholders are typically drawn to the long-term thesis of increasing global defense budgets, international expansion, and growing demand for advanced networked battlefield solutions. The recent Thai Army contract highlights positive international momentum and reinforces Leonardo DRS’s role in next-generation defense tech, but is unlikely to materially shift the main near-term catalyst, persistent contract flow from U.S. military programs, nor alter the largest risk, which remains execution and margin pressure amid supply chain and R&D cost constraints.

Among recent developments, Leonardo DRS’s October contract award from the U.S. Army for prototype Vehicle Integrated Power Kits stands out as relevant to this news, as both contracts align with the push toward advanced vehicle networking and modernization, themes at the core of DRS’s growth story. Acceleration in tactical computing and systems integration across customers could be a supporting tailwind, but primary catalysts are still tied to U.S. contract wins.

Yet despite DRS's growth opportunities abroad, investors should not overlook the possibility that input cost inflation and elevated R&D investment could...

Read the full narrative on Leonardo DRS (it's free!)

Leonardo DRS' narrative projects $4.1 billion revenue and $351.1 million earnings by 2028. This requires 6.6% yearly revenue growth and a $101.1 million earnings increase from $250.0 million today.

Uncover how Leonardo DRS' forecasts yield a $47.30 fair value, a 41% upside to its current price.

Exploring Other Perspectives

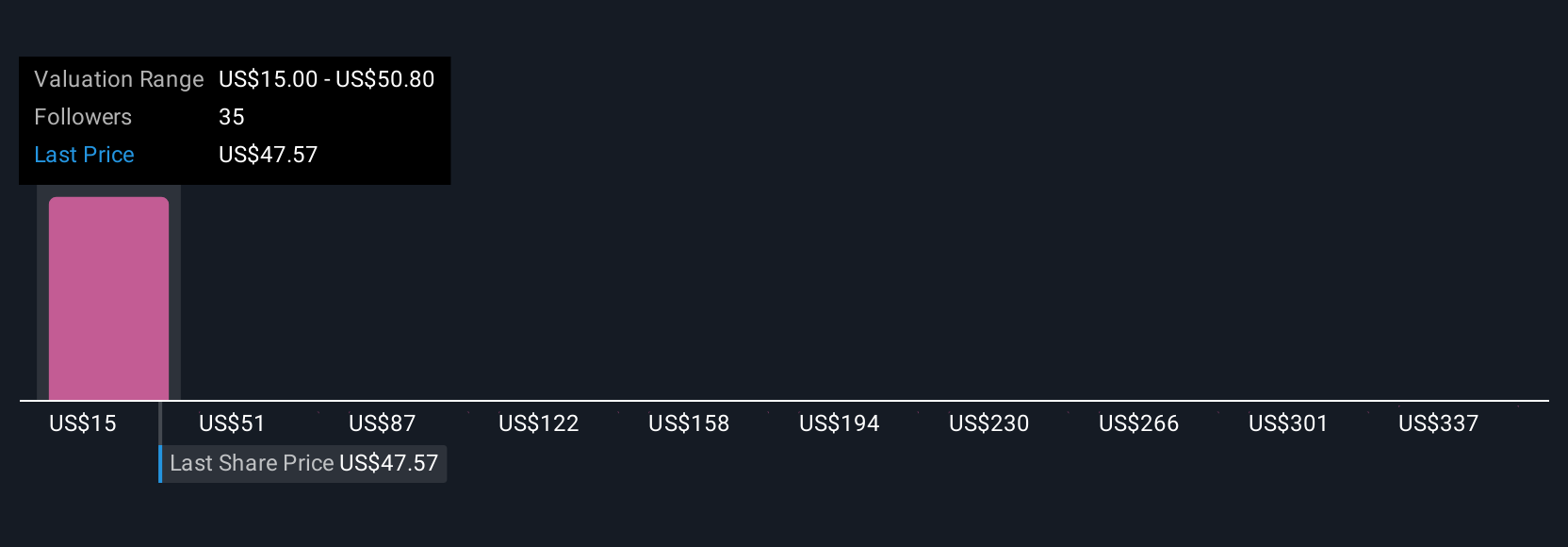

Simply Wall St Community members submitted nine individual fair value estimates for Leonardo DRS, ranging widely from US$15 up to US$372.97 per share. While some believe international contracts expand the company’s market reach, others point to ongoing raw material cost and R&D risks when considering future earnings potential.

Explore 9 other fair value estimates on Leonardo DRS - why the stock might be worth less than half the current price!

Build Your Own Leonardo DRS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leonardo DRS research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Leonardo DRS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leonardo DRS' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DRS

Leonardo DRS

Provides defense electronic products and systems, and military support services worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives