- United States

- /

- Building

- /

- NasdaqGS:CSTE

Caesarstone Ltd. (NASDAQ:CSTE) Shares Fly 29% But Investors Aren't Buying For Growth

The Caesarstone Ltd. (NASDAQ:CSTE) share price has done very well over the last month, posting an excellent gain of 29%. Looking back a bit further, it's encouraging to see the stock is up 45% in the last year.

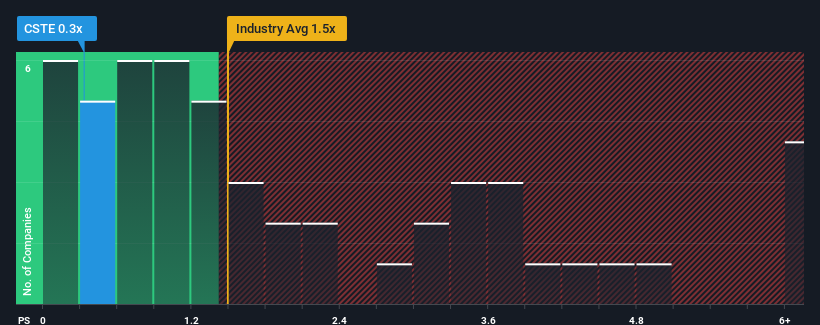

Even after such a large jump in price, Caesarstone's price-to-sales (or "P/S") ratio of 0.3x might still make it look like a buy right now compared to the Building industry in the United States, where around half of the companies have P/S ratios above 1.5x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Caesarstone

What Does Caesarstone's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Caesarstone's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Caesarstone's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Caesarstone's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. Regardless, revenue has managed to lift by a handy 16% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 6.3% as estimated by the two analysts watching the company. Meanwhile, the broader industry is forecast to expand by 6.9%, which paints a poor picture.

With this in consideration, we find it intriguing that Caesarstone's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

The latest share price surge wasn't enough to lift Caesarstone's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Caesarstone's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Caesarstone with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CSTE

Caesarstone

Designs, develops, manufactures, and sells engineered stone and porcelain products under Caesarstone and other brands in the United States, Canada, Latin America, Australia, Asia, Europe, the Middle East and Africa, and Israel.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives