- United States

- /

- Machinery

- /

- NasdaqGS:CECO

Will CECO Environmental’s (CECO) Revenue Surge Reinforce Its Edge in the Emissions Solutions Market?

Reviewed by Sasha Jovanovic

- CECO Environmental has achieved annual revenue growth of 19% over the past two years and is expected to see an additional 17.9% rise in revenue in the next year, reflecting growing market demand for its emission reduction and water treatment technologies.

- This strong revenue trajectory suggests increased market share and highlights CECO Environmental’s expanding role amid global interest in industrial environmental solutions.

- We’ll explore how CECO’s ongoing revenue strength and market share gains may influence its long-term investment outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

CECO Environmental Investment Narrative Recap

To be a shareholder in CECO Environmental, you need to believe that industrial demand for emission reduction and water treatment technology remains robust and global trends toward cleaner industry continue to drive growth. The recent revenue gains reinforce this catalyst, but do not materially reduce the risk that earnings could come under pressure if expenses tied to aggressive expansion outpace growth, especially should new bookings slow in key regions.

Among recent company announcements, CECO’s reaffirmed 2025 and new 2026 revenue guidance stands out. The outlook signals management’s confidence in both project pipeline and sector demand, but also comes as expansion investments remain high. If those expected orders materialize, the company’s growth targets are well supported, yet margins will be closely watched in the quarters ahead.

By contrast, if interest payments and debt coverage become challenging, investors should be aware that...

Read the full narrative on CECO Environmental (it's free!)

CECO Environmental's outlook anticipates $977.2 million in revenue and $54.5 million in earnings by 2028. This projection implies a 14.2% annual revenue growth rate and an increase of $2.0 million in earnings from the current $52.5 million level.

Uncover how CECO Environmental's forecasts yield a $58.83 fair value, a 21% upside to its current price.

Exploring Other Perspectives

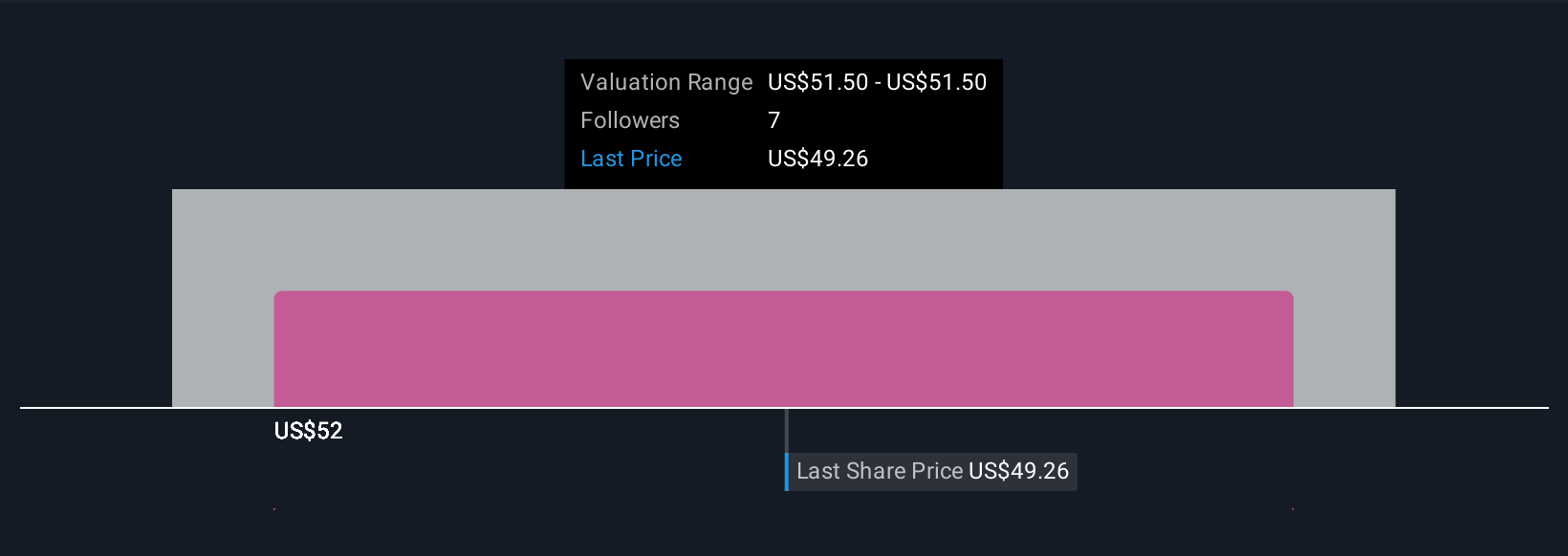

Simply Wall St Community members put CECO Environmental’s fair value between US$58.83 and US$68.64, across two independent estimates. As CECO targets rapid international expansion, these differing views highlight why it’s important to weigh multiple perspectives on future risks and opportunities.

Explore 2 other fair value estimates on CECO Environmental - why the stock might be worth as much as 41% more than the current price!

Build Your Own CECO Environmental Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CECO Environmental research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CECO Environmental research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CECO Environmental's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CECO

CECO Environmental

Provides critical solutions in industrial air quality, industrial water treatment, and energy transition solutions in the United States, the United Kingdom, the Netherlands, China, and internationally.

Proven track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives