- United States

- /

- Machinery

- /

- NasdaqGS:CECO

CECO Environmental (CECO): Evaluating Valuation Following Notable Revenue Growth and Strengthened Outlook

Reviewed by Simply Wall St

CECO Environmental (CECO) just reported a 19% jump in annual revenue over the last two years, showing real progress in gaining market share and executing its business plan. The company’s projected 18% revenue growth through next year continues to draw investor attention as confidence in its outlook rises.

See our latest analysis for CECO Environmental.

Momentum has been steadily building for CECO Environmental, with the share price climbing 58% year-to-date and the total shareholder return hitting an eye-catching 64% over the past 12 months. This strong run suggests investors are optimistic about the company maintaining its growth trajectory and capitalizing on recent gains.

If CECO’s breakout growth has you thinking bigger, this is a great opportunity to discover other fast-growing stocks that insiders are backing. Check out fast growing stocks with high insider ownership.

With such sizable gains and strong revenue growth projections, investors are left to consider whether CECO Environmental is still trading at an attractive valuation or if the market has already factored in all future upside potential.

Most Popular Narrative: 15.6% Undervalued

With CECO Environmental’s most widely followed narrative, the projected fair value sits noticeably above its last close, signaling a significant perceived upside relative to current trading levels.

Record-high backlog and robust pipeline growth, especially in power generation, industrial water, and natural gas infrastructure, suggest that increasing global enforcement of environmental regulations is translating into sustained demand and forward visibility for CECO's solutions. This supports topline revenue growth over the next 18 to 24 months. CECO's ongoing expansion into high-growth international markets such as the Middle East, Southeast Asia, and India, supported by new offices and recent acquisitions, positions the company to benefit from rapid industrialization in these regions. This further diversifies revenue streams and reduces reliance on North America.

Want to know what financial tailwinds drive such bullish upside? Here’s a hint: the narrative banks on relentless international expansion, a surging regulatory pipeline, and a bold forecast for top-line acceleration. What numbers tie it all together? Discover the narrative’s blueprint for a premium valuation; there’s more beneath the surface.

Result: Fair Value of $58.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising expenses from aggressive growth investments and potential slowdowns in international markets could put pressure on margins and challenge the current upbeat outlook.

Find out about the key risks to this CECO Environmental narrative.

Another View: Expensive on Earnings Multiples

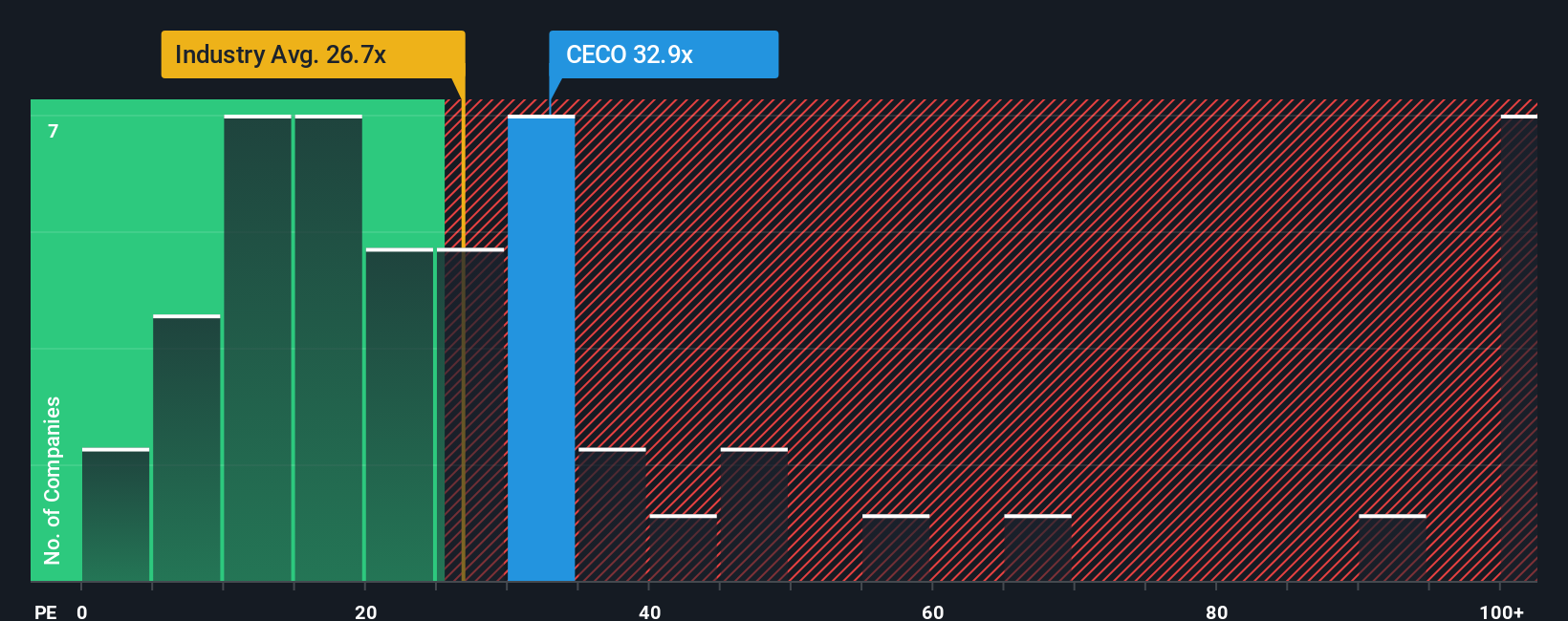

While the fair value estimate suggests CECO Environmental is undervalued, a look at its current price-to-earnings ratio tells a different story. The company's P/E stands at 34.1x, substantially above both the US Machinery industry average of 23.3x and its own fair ratio of 19.6x. This sizeable premium indicates that investors are paying up for growth expectations, but it also heightens the risk if targets are missed. Will the market reward this optimism, or are expectations running too far ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CECO Environmental Narrative

If you see the story unfolding differently, or want to test your own perspective, you can quickly craft your own insights in just a few minutes using Do it your way.

A great starting point for your CECO Environmental research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your research to just one stock. Explore powerful trends and opportunities by checking out these targeted picks that could transform your portfolio next.

- Spot high-yield potential when you scan these 16 dividend stocks with yields > 3%, giving your portfolio an income advantage in addition to basic growth prospects.

- Target tomorrow’s big disruptors by reviewing these 26 AI penny stocks with a focus on cutting-edge tech powered by artificial intelligence innovation.

- Catalyze your search for value with these 919 undervalued stocks based on cash flows, connecting you to under-the-radar stocks trading below fair value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CECO

CECO Environmental

Provides critical solutions in industrial air quality, industrial water treatment, and energy transition solutions in the United States, the United Kingdom, the Netherlands, China, and internationally.

Proven track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives