- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:BYRN

Strong Q3 Results and Investor Outreach Could Be a Game Changer for Byrna Technologies (BYRN)

Reviewed by Sasha Jovanovic

- Byrna Technologies Inc. recently presented at the 16th Annual Craig-Hallum Alpha Select Conference in New York and the Furey Hidden Gems Corporate Access Conference, following the announcement of revenue growth of 35.1% and a beat of analysts’ EPS and EBITDA estimates for Q3.

- This combination of strong financial performance and active engagement with investors at major conferences has fueled questions about the factors influencing the company's market performance.

- We'll now explore how Byrna Technologies' robust quarterly revenue growth amid increased investor engagement shapes its current investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Byrna Technologies Investment Narrative Recap

To be a shareholder in Byrna Technologies today, you need confidence in its ability to sustain recent strong revenue growth and margin expansion, particularly through product innovation and e-commerce execution. While the company's recent financial results exceeded expectations and several positive catalysts remain, the short-term price reaction, down 23.7% post-earnings, suggests broader market skepticism is still focused on profitability pressures, especially from rising US supply chain costs and potential gross margin impact. This news does not materially accelerate or diminish those fundamental catalysts or risks; execution remains key.

Among recent company announcements, the April launch of the Byrna Compact Launcher stands out as especially relevant, aligning closely with the e-commerce and gross margin catalysts referenced. The Compact Launcher's higher profit margins and appeal to new customer segments can drive near-term revenue growth, but its success will be a critical test of Byrna’s ability to manage cost pressures and realize its growth ambitions. Contrast that, however, with ongoing margin challenges investors should be aware of, including...

Read the full narrative on Byrna Technologies (it's free!)

Byrna Technologies is projected to reach $198.0 million in revenue and $22.8 million in earnings by 2028. This forecast assumes annual revenue growth of 24.1% and an earnings increase of $8.0 million from the current $14.8 million.

Uncover how Byrna Technologies' forecasts yield a $38.50 fair value, a 116% upside to its current price.

Exploring Other Perspectives

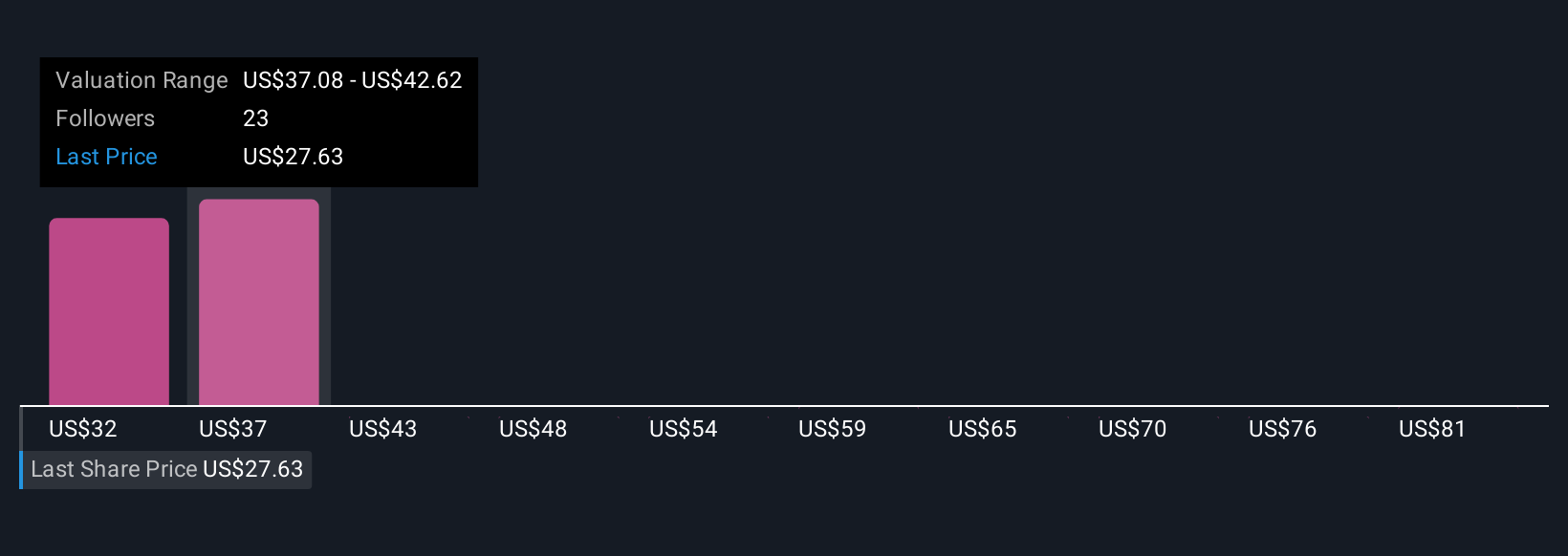

Six members of the Simply Wall St Community place Byrna’s fair value between US$35.78 and US$63.47 per share. While most see substantial upside, cost risks from US-based supply chain shifts loom and could influence the company’s trajectory. Consider these varied perspectives as you weigh Byrna’s outlook.

Explore 6 other fair value estimates on Byrna Technologies - why the stock might be worth over 3x more than the current price!

Build Your Own Byrna Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Byrna Technologies research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Byrna Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Byrna Technologies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Byrna Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BYRN

Byrna Technologies

A less-lethal self-defense technology company, develops, manufactures, and sells less-lethal personal security solutions in the United States, South Africa, Europe, South America, Asia, and Canada.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success