- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:BYRN

Should Forbes Recognition and Investor Outreach Signal a New Chapter for Byrna Technologies (BYRN) Investors?

Reviewed by Sasha Jovanovic

- Byrna Technologies recently announced its management will participate in several prominent investor conferences through November and December 2025, providing opportunities for one-on-one and small-group meetings.

- The company was also recognized by Forbes as one of America's Most Successful Small-Cap Companies, highlighting its strong revenue growth, expanded retail partnerships, and greater consumer awareness in non-lethal self-defense products.

- We'll explore how national recognition from Forbes and strong third-quarter growth influence the outlook for Byrna Technologies.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Byrna Technologies Investment Narrative Recap

To own Byrna Technologies, an investor really has to believe in the company’s ability to keep growing its share of the non-lethal self-defense market, while successfully balancing cost concerns from US supply chain moves. The recent recognition by Forbes and management’s investor conference participation may boost Byrna’s credibility, but the ongoing challenge of keeping gross margins healthy while wholesale continues to drive sales remains the key short-term catalyst, with competitive cost pressure still the biggest risk, these news items do not change that equation in a material way.

The most relevant announcement here is Byrna’s surge in wholesale revenue, which now makes up 41% of total sales. This growth has been fueled by expanded distribution partnerships and retail reach, key factors highlighted by Forbes in naming Byrna a top small-cap company; driving further wholesale expansion may lift revenue, but margin pressure tied to cost structure shifts is still front-of-mind for investors.

However, investors should also be aware that increased US sourcing, while reducing tariff risk, has led to a 16% rise in launcher production costs, so if competitors undercut on price...

Read the full narrative on Byrna Technologies (it's free!)

Byrna Technologies' outlook calls for $198.0 million in revenue and $22.8 million in earnings by 2028. This projection is based on a 24.1% annual revenue growth rate and a $8 million earnings increase from $14.8 million today.

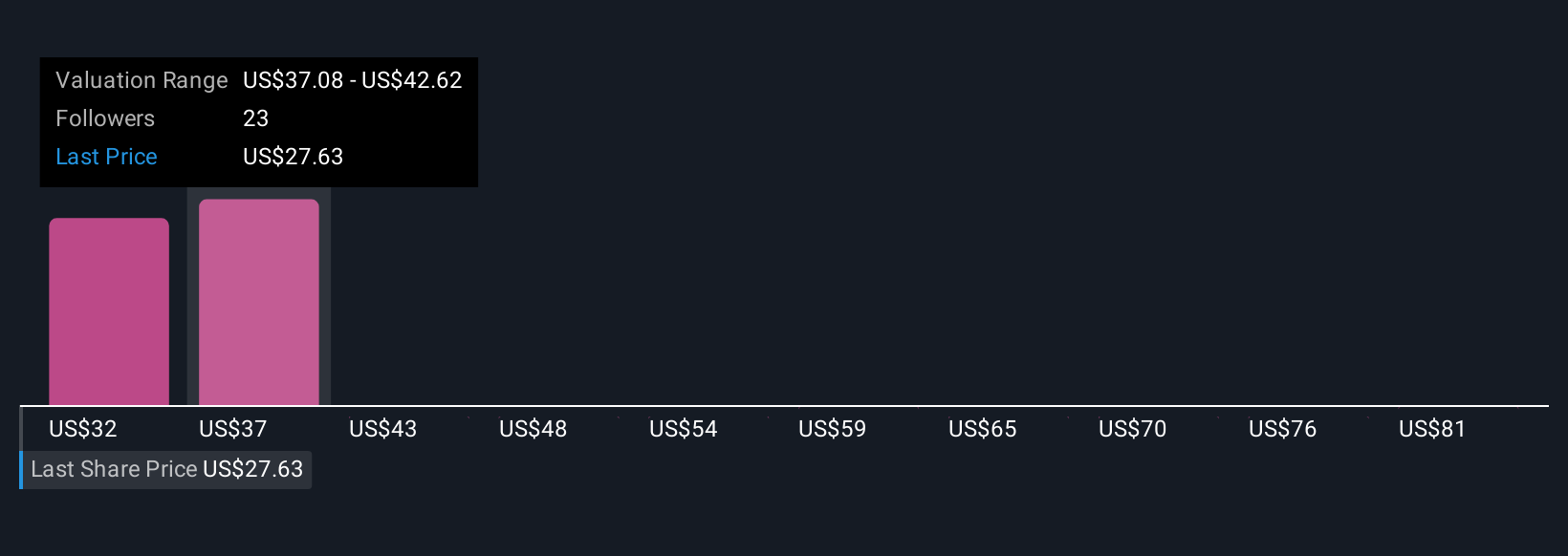

Uncover how Byrna Technologies' forecasts yield a $38.50 fair value, a 119% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community put Byrna’s value between US$35.55 and US$63.47 per share. While many see upside, competitive cost risks could weigh on future profit growth, so explore several viewpoints before deciding what you think.

Explore 6 other fair value estimates on Byrna Technologies - why the stock might be worth over 3x more than the current price!

Build Your Own Byrna Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Byrna Technologies research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Byrna Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Byrna Technologies' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Byrna Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BYRN

Byrna Technologies

A less-lethal self-defense technology company, develops, manufactures, and sells less-lethal personal security solutions in the United States, South Africa, Europe, South America, Asia, and Canada.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives