- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:BYRN

Revenues Not Telling The Story For Byrna Technologies Inc. (NASDAQ:BYRN) After Shares Rise 29%

Byrna Technologies Inc. (NASDAQ:BYRN) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 40% in the last twelve months.

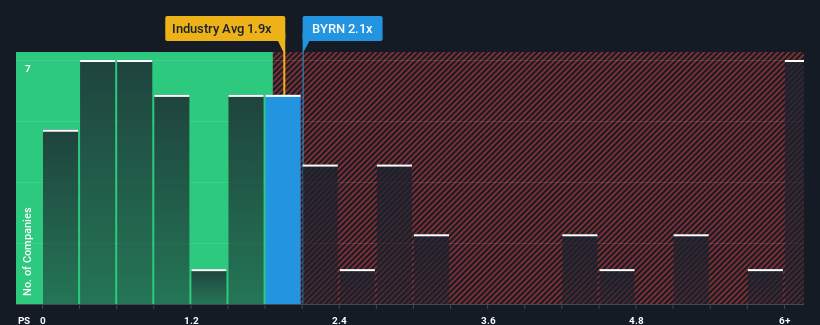

Even after such a large jump in price, it's still not a stretch to say that Byrna Technologies' price-to-sales (or "P/S") ratio of 2.1x right now seems quite "middle-of-the-road" compared to the Aerospace & Defense industry in the United States, where the median P/S ratio is around 1.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Byrna Technologies

How Has Byrna Technologies Performed Recently?

While the industry has experienced revenue growth lately, Byrna Technologies' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Byrna Technologies will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Byrna Technologies' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, even though the last 12 months were nothing to write home about. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it has slowed to such an extent.

Looking ahead now, revenue is anticipated to climb by 0.8% during the coming year according to the three analysts following the company. That's shaping up to be materially lower than the 9.1% growth forecast for the broader industry.

In light of this, it's curious that Byrna Technologies' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Byrna Technologies appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at the analysts forecasts of Byrna Technologies' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

It is also worth noting that we have found 4 warning signs for Byrna Technologies that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Byrna Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BYRN

Byrna Technologies

A less-lethal self-defense technology company, develops, manufactures, and sells less-lethal personal security solutions in the United States, South Africa, Europe, South America, Asia, and Canada.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026