- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:BYRN

Byrna Technologies (BYRN) Rises on Strong Q3 and Upbeat Growth Guidance – What's Driving the Momentum?

Reviewed by Sasha Jovanovic

- Byrna Technologies reported its third-quarter 2025 earnings, showing sales of US$28.18 million and net income of US$2.24 million, both up from a year earlier, and provided full-year revenue growth guidance between 35% and 40%.

- Management credited growth to an expanding dealer network, effective mainstream advertising campaigns, and new product launches that have increased brand adoption and customer engagement.

- We will review how Byrna’s strong sales and upbeat annual outlook could influence the company’s future growth expectations and investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Byrna Technologies Investment Narrative Recap

To be a shareholder in Byrna Technologies, you need to believe in the company's ability to grow sales by expanding its dealer network, boosting brand engagement through advertising, and delivering new products. The strong third-quarter earnings and robust full-year revenue guidance provide support for these growth drivers, though the rapid cost increases from U.S. supply chain shifts remain the most important risk and could impact profitability, recent results do not materially change this risk for now.

Among the latest announcements, Byrna's confirmation of 35% to 40% projected revenue growth for 2025 is tightly linked to its core catalysts of growing e-commerce sales channels and successful product launches. This aligns with management's recent emphasis on increasing brand adoption and reaching new customer segments, reinforcing the significance of continued revenue momentum to the business outlook.

Yet, while sales are up, investors should also recognize that cost pressures linked to supply chain changes could still challenge margins in ways that ...

Read the full narrative on Byrna Technologies (it's free!)

Byrna Technologies is projected to reach $198.0 million in revenue and $22.8 million in earnings by 2028. This outlook assumes a 24.1% annual revenue growth rate and reflects an increase in earnings of $8.0 million from the current level of $14.8 million.

Uncover how Byrna Technologies' forecasts yield a $38.50 fair value, a 82% upside to its current price.

Exploring Other Perspectives

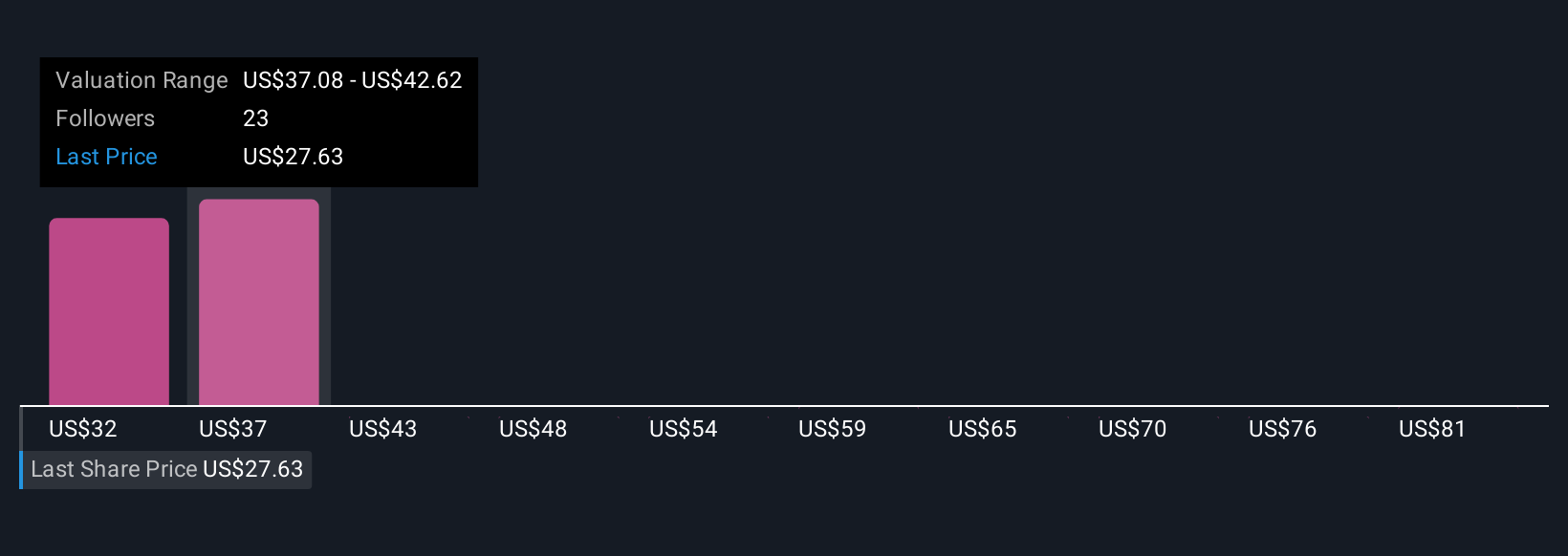

Six different fair value estimates from the Simply Wall St Community put Byrna’s share price potential anywhere between US$32.95 and US$86.95. Despite strong growth guidance, cost concerns from domestic sourcing are a key factor shaping diverging outlooks for the business.

Explore 6 other fair value estimates on Byrna Technologies - why the stock might be worth just $32.95!

Build Your Own Byrna Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Byrna Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Byrna Technologies' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Byrna Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BYRN

Byrna Technologies

A less-lethal self-defense technology company, develops, manufactures, and sells less-lethal personal security solutions in the United States, South Africa, Europe, South America, Asia, and Canada.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives