- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AXON

What Does Axon’s Soaring 65% Gain Mean After Major Police Contracts?

Reviewed by Bailey Pemberton

Thinking about what to do with Axon Enterprise stock? You are not alone. With the share price finishing most recently at $735.95, investors are taking a fresh look at whether the run can keep going or whether the valuation has outrun the story. Over the past year, Axon has soared by 65.6%, and, impressively, it is up a whopping 418.0% over three years. Even just in the past week, the stock gained nearly 10% as confidence around Axon's leadership in the public safety technology sector remains solid. Those returns do not come by accident, and they have certainly caught Wall Street's eye.

Recent developments highlight Axon's momentum beyond just the numbers. The company secured new contracts with several large municipal police departments and continues to expand the reach of its TASER devices and cloud services globally. These milestones underscore a growing gap between how quickly Axon's business is compounding and how the market values it. This is positive for investors who were already on board, but a challenge for anyone debating an entry today.

So, how does the valuation stack up given this dramatic price movement? If you rate Axon Enterprise using six classic undervaluation checks, it passes just one, resulting in a value score of 1. At a glance, that score seems to signal a premium stock, but raw numbers rarely tell the whole story. Different methods can lead to very different conclusions. Up next, we will break down what each key valuation approach says about Axon's current price, before showing you an even smarter way to make sense of it all.

Axon Enterprise scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Axon Enterprise Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. For Axon Enterprise, this approach analyzes how much cash the company is expected to generate and what that stream is worth in present terms.

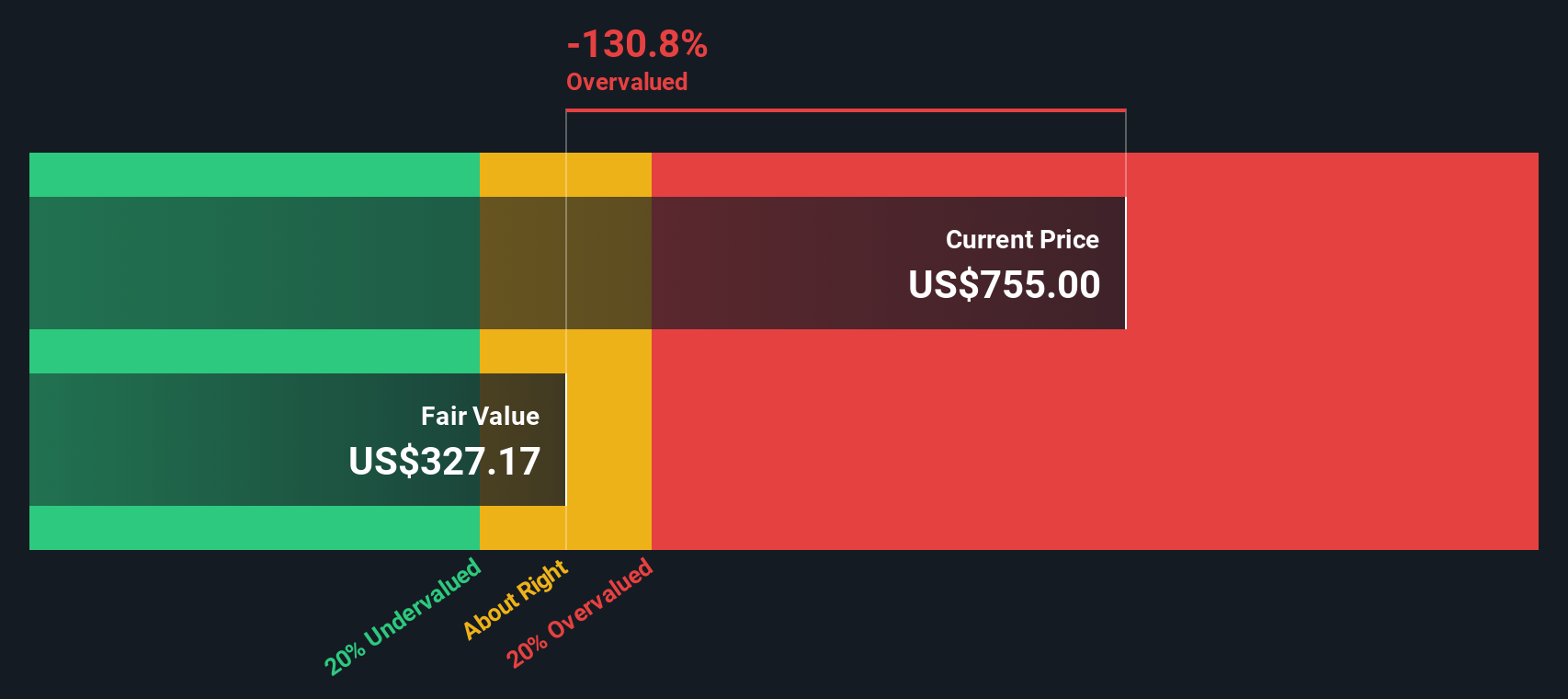

Axon's latest twelve-month free cash flow was $184.1 million. Analysts forecast robust growth, with estimates projecting annual free cash flow to reach over $820 million by the end of 2027. While only the next five years of forecasts come directly from analyst research, cash flows beyond that are extrapolated to project out a full decade.

Based on these projections using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value per share is $328.03. With Axon Enterprise shares trading at $735.95, the DCF model suggests the stock is currently about 124.4% above its fair value. This evidence points to the shares being significantly overvalued using this methodology.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Axon Enterprise may be overvalued by 124.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Axon Enterprise Price vs Sales

The Price-to-Sales (P/S) ratio is a favored metric for valuing growth-oriented, profitable companies like Axon Enterprise because it offers a clear view of how much investors are paying for every dollar of the company’s revenue. Unlike profit-based multiples, P/S is particularly useful for firms reinvesting heavily in expansion or innovation, as it focuses on total sales without being affected by short-term fluctuations in profit margins or accounting charges.

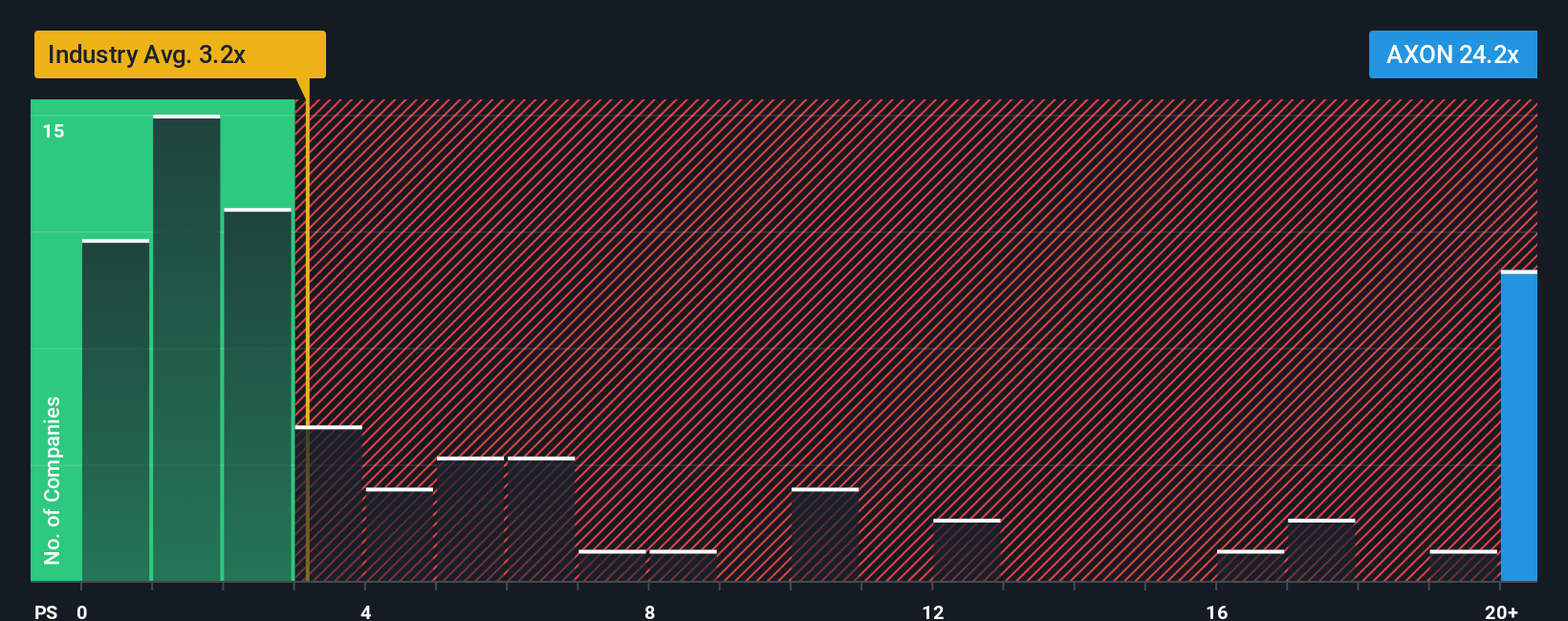

Growth expectations and risk both influence what constitutes a “normal” or “fair” P/S ratio. Higher expected growth or exceptional profitability can justify a premium, while greater uncertainty or risk usually drives the fair value lower. For Axon, the current P/S ratio stands at 24.2x, noticeably above the Aerospace & Defense industry average of 3.2x and also above the peer average of 20.9x.

Simply Wall St introduces a “Fair Ratio,” which, for Axon, is calculated at 16.2x. This tailored benchmark is considered more insightful than industry or peer comparisons because it factors in Axon’s expected earnings growth, profit margins, unique risks, and its standing in the broader market. By benchmarking the current P/S of 24.2x to the Fair Ratio of 16.2x, the evidence suggests Axon is trading well above what fair value would warrant on a risk-adjusted, forward-looking basis.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Axon Enterprise Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company like Axon Enterprise, combining what you believe about its future with your own assumptions about fair value, revenue, earnings, and margins.

Unlike static models or one-size-fits-all ratios, a Narrative helps you connect the company’s unique journey by considering the growth catalysts, risks, and industry changes you see ahead. This allows for a customized financial forecast and a fair value that actually reflects your perspective. Narratives allow you to make decisions not just based on the numbers, but on the reasons behind those numbers.

This approach is simple and accessible on Simply Wall St’s Community page, where millions of investors compare Narratives, create their own, and see updated analysis whenever key news or financial results are released. Narratives help you sense-check your view by showing whether your calculated fair value is above or below today’s price, highlighting if you think it’s a buy, hold, or sell right now.

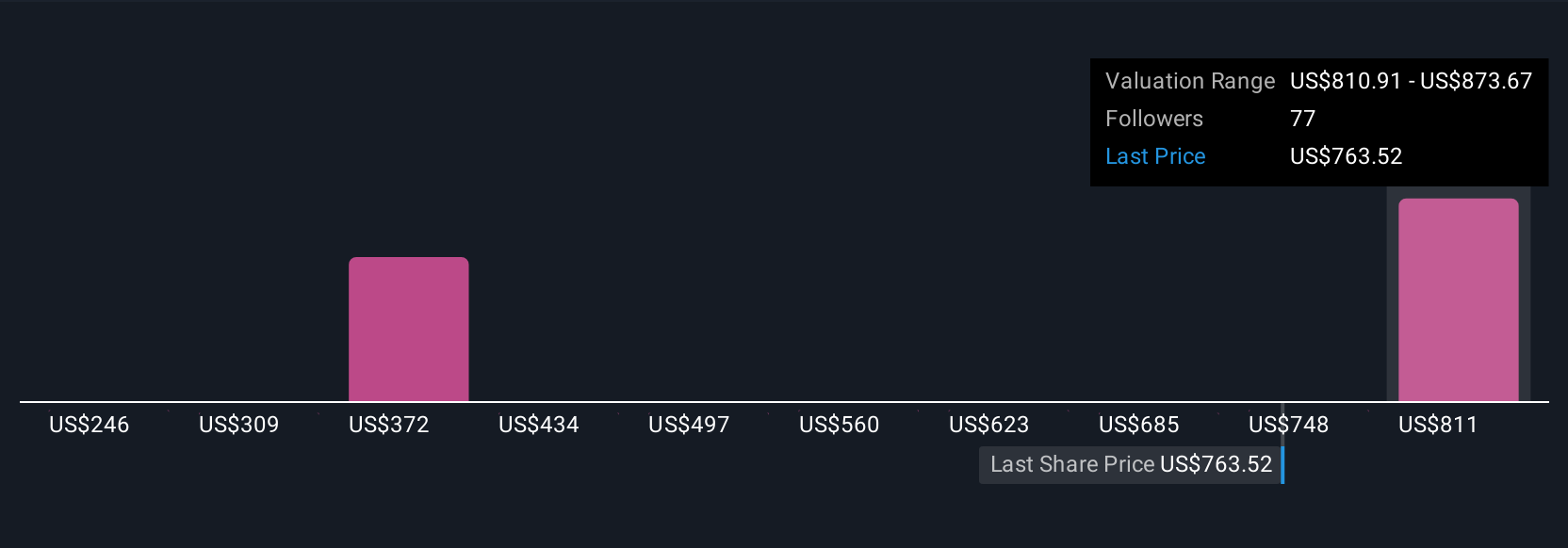

For Axon Enterprise, you will find a range of Narratives. Some are bullish, reflecting high price targets and fast adoption of AI and international products. Others are more cautious, pointing to risks like regulatory obstacles or margin pressure. Narratives let you easily compare these perspectives and update your strategy as the facts evolve.

Do you think there's more to the story for Axon Enterprise? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AXON

Axon Enterprise

Develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives