- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AXON

Is Axon's Recent Drop a Buying Opportunity or Does Sentiment Outpace the Fundamentals?

Reviewed by Bailey Pemberton

- Wondering if Axon Enterprise is trading at a fair price, or if there's hidden value waiting to be unearthed? You're not alone, and today's market makes this question more interesting than ever.

- The stock has seen a wild ride lately, down 5.1% over the last week and falling 20.9% over the past month. Viewed over a longer period, it is still an impressive 190% higher than three years ago.

- Recent headlines have focused on Axon's advances in public safety technology and high-profile law enforcement partnerships, fueling speculation and sometimes sharp reactions among investors. Market sentiment seems to shift rapidly as innovations and policy news evolve in the sector.

- According to our valuation checks, Axon Enterprise scores just 1 out of 6 for being undervalued, but there is more to this story than just a single score. Let’s break down the traditional valuation approaches, and keep reading to discover a smarter way to gauge Axon's true value.

Axon Enterprise scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Axon Enterprise Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's underlying value by projecting its future cash flows and then discounting those amounts back to today at an appropriate rate. This approach aims to calculate what the business is truly worth, based on anticipated performance rather than market mood swings.

For Axon Enterprise, the most recent twelve months saw Free Cash Flow of $147.7 million. Analysts project that cash flows will climb steadily, reaching around $836.3 million by 2027 and, by extrapolation, nearly $1.8 billion by 2035. The first five years are based on analyst consensus, with later years estimated by Simply Wall St using growth assumptions as the business matures.

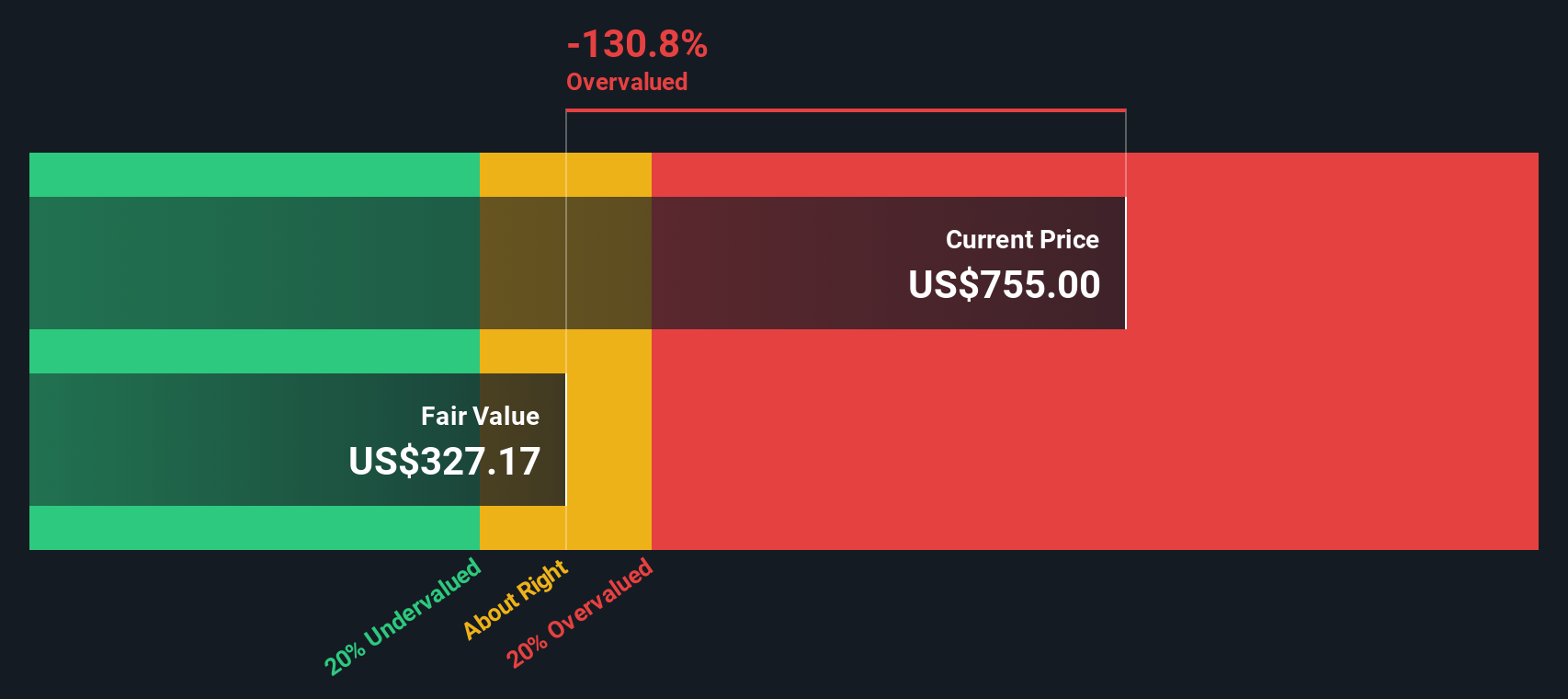

After factoring in these projections, the DCF model arrives at an intrinsic value of $365.37 per share. However, the current market valuation stands over 52.5% above this estimate, implying that Axon Enterprise stock is significantly overvalued relative to its cash flow outlook.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Axon Enterprise may be overvalued by 52.5%. Discover 870 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Axon Enterprise Price vs Sales

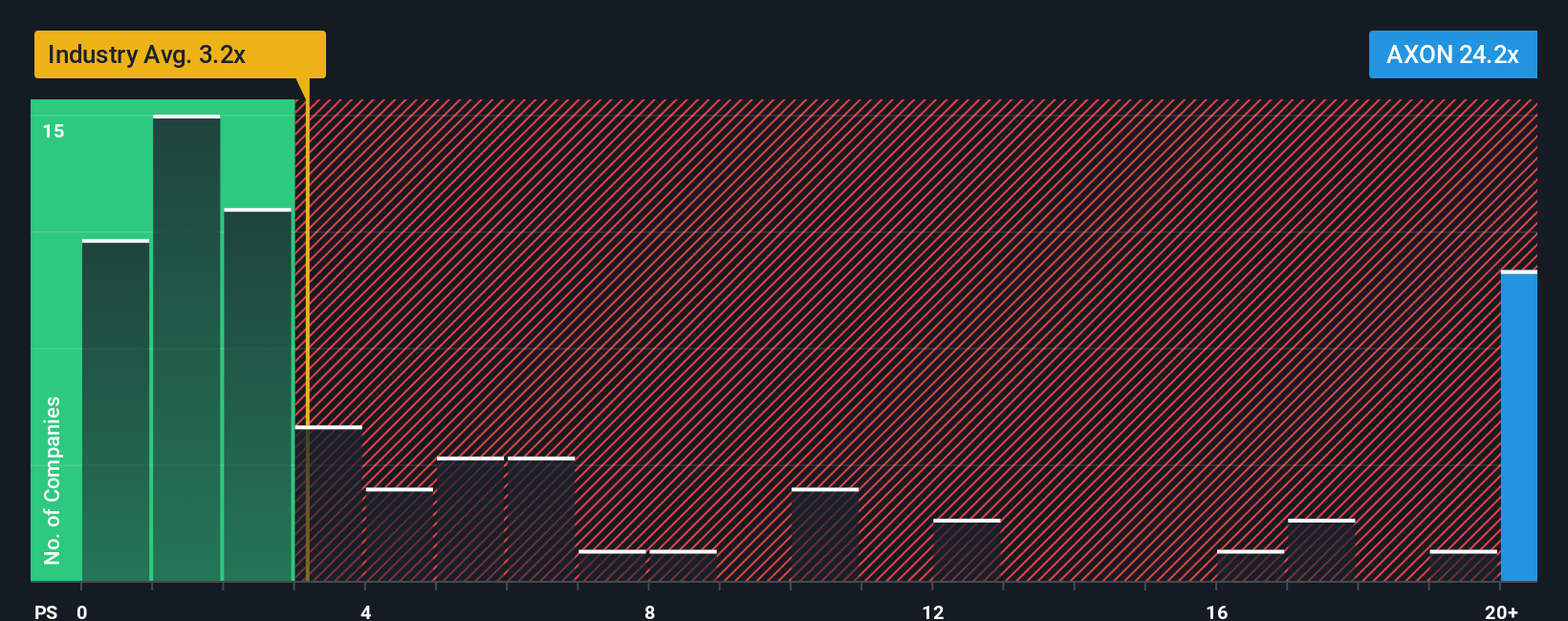

For profitable companies with substantial revenues like Axon Enterprise, the Price-to-Sales (P/S) ratio offers a straightforward way to gauge valuation. The P/S ratio compares the company’s market cap to its total sales, which helps investors understand how much they are paying for every dollar the company brings in. This is especially insightful when profits may be impacted by growth investments or industry cycles.

Growth expectations and risk play a big part in what a "normal" or "fair" P/S ratio should be. High-growth firms often command premium multiples because investors are anticipating future gains, while more mature or riskier businesses typically trade at lower ratios. Evaluating P/S in context is key to separating short-term market noise from long-term value.

Currently, Axon Enterprise trades at a P/S ratio of 17.19x. This is notably higher than the Aerospace & Defense industry average of 3.01x and also above its peer group average of 16.20x. Simply Wall St's proprietary “Fair Ratio,” calculated from a blend of the company’s expected growth, profitability, industry, market cap, and risk factors, is 15.71x. This Fair Ratio adjusts for Axon's unique position and prospects, making it a more nuanced benchmark than industry or peer comparisons.

When comparing Axon’s actual P/S multiple to the Fair Ratio, the difference is only 1.48x. This indicates that while the current valuation is slightly ahead of what’s suggested by fundamentals, it is not dramatically out of line. This suggests the market price is close to fair when all factors are weighed together.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1398 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Axon Enterprise Narrative

Earlier we mentioned that there is an even smarter way to understand valuation, so let's introduce you to Narratives.

A Narrative connects the story you believe about a company, such as how Axon's expansion into advanced technologies or exposure to government risks might play out, to financial forecasts and fair value estimates. This approach allows you to see clearly how your view translates into a buy or sell decision.

Unlike traditional models that focus purely on numbers, Narratives let you build your own forecast by combining your assumptions about Axon's future revenue, earnings, and margins with the specific business drivers you believe matter most.

Available within the Community page on Simply Wall St, Narratives are a practical, approachable tool used by millions of investors to put their perspective front and center, track how their story evolves, and easily compare Fair Value to the current price.

Narratives are updated dynamically whenever new data or news emerges, ensuring your view adapts as the facts change and helping you stay ahead of the market.

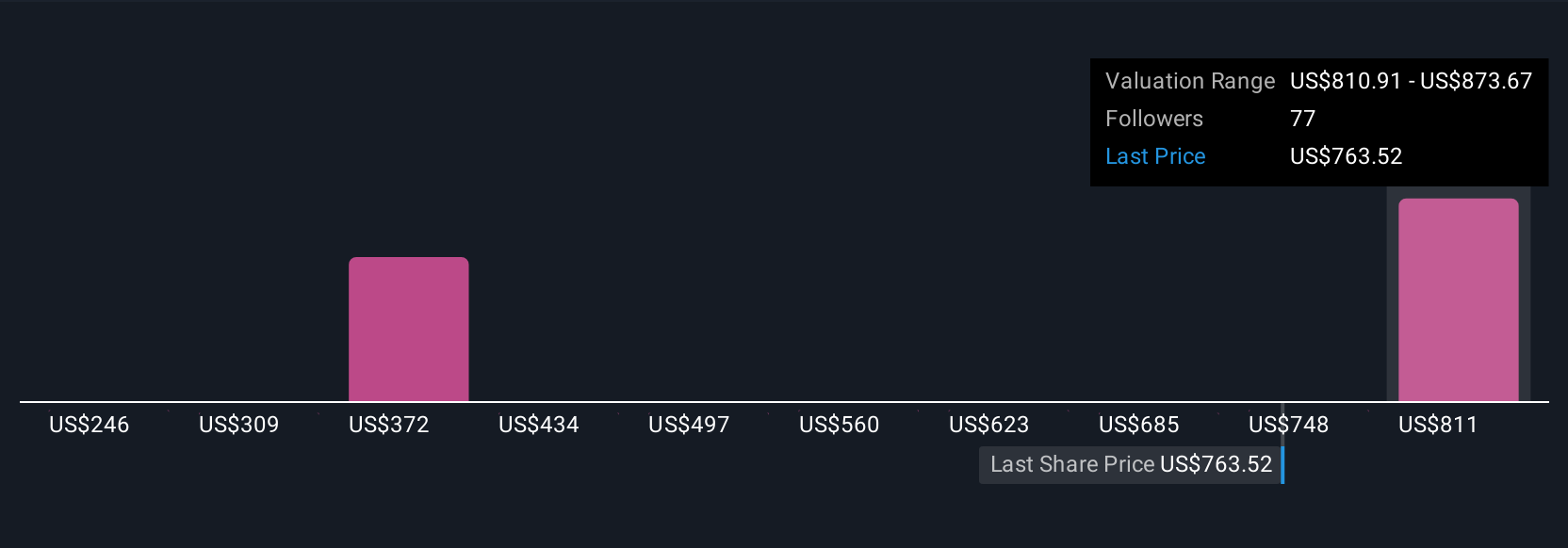

For example, some investors use Axon's Narrative to project rapid global growth driven by AI and drones, creating a high fair value of $1,000 per share, while others focus on execution risks or tightening margins, landing at a more cautious $800 per share. This demonstrates how your chosen Narrative translates directly into a personal investment strategy.

Do you think there's more to the story for Axon Enterprise? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AXON

Axon Enterprise

Develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives