- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:ATRO

How Investors Are Reacting To Astronics (ATRO) Securing a US$300 Million Revolving Credit Facility

Reviewed by Sasha Jovanovic

- On October 22, 2025, Astronics Corporation announced a new US$300 million senior secured, cash flow-based revolving credit facility, replacing its previous asset-based facility and extending maturity to October 2030.

- This expanded credit arrangement provides Astronics with increased financial flexibility and an accordion feature for additional borrowing, supporting its ongoing growth initiatives.

- Next, we'll explore how enhanced borrowing capacity from the new credit facility could influence Astronics' capital structure and growth outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Astronics Investment Narrative Recap

To be a shareholder in Astronics, you need to believe that the company can capitalize on commercial aerospace production growth and retrofit demand, while successfully managing cost pressures and execution risks. The new US$300 million revolving credit facility increases financial flexibility, which could support margin-boosting initiatives, but immediate impacts on volatile commercial aerospace cycles and tariff risks are likely limited in the near term.

Among recent announcements, Astronics’ decision to raise its 2025 revenue guidance to US$840 million–US$860 million stands out. While the new credit arrangement improves liquidity and supports potential investment in growth opportunities, the biggest upside remains tied to sustaining higher commercial production rates and converting backlog into revenue.

However, with greater borrowing capacity comes the need for investors to closely monitor debt service costs and exposure to variable interest rates in the months ahead...

Read the full narrative on Astronics (it's free!)

Astronics' narrative projects $956.5 million in revenue and $86.1 million in earnings by 2028. This requires 5.1% yearly revenue growth and a $89.8 million increase in earnings from the current -$3.7 million.

Uncover how Astronics' forecasts yield a $54.33 fair value, a 7% upside to its current price.

Exploring Other Perspectives

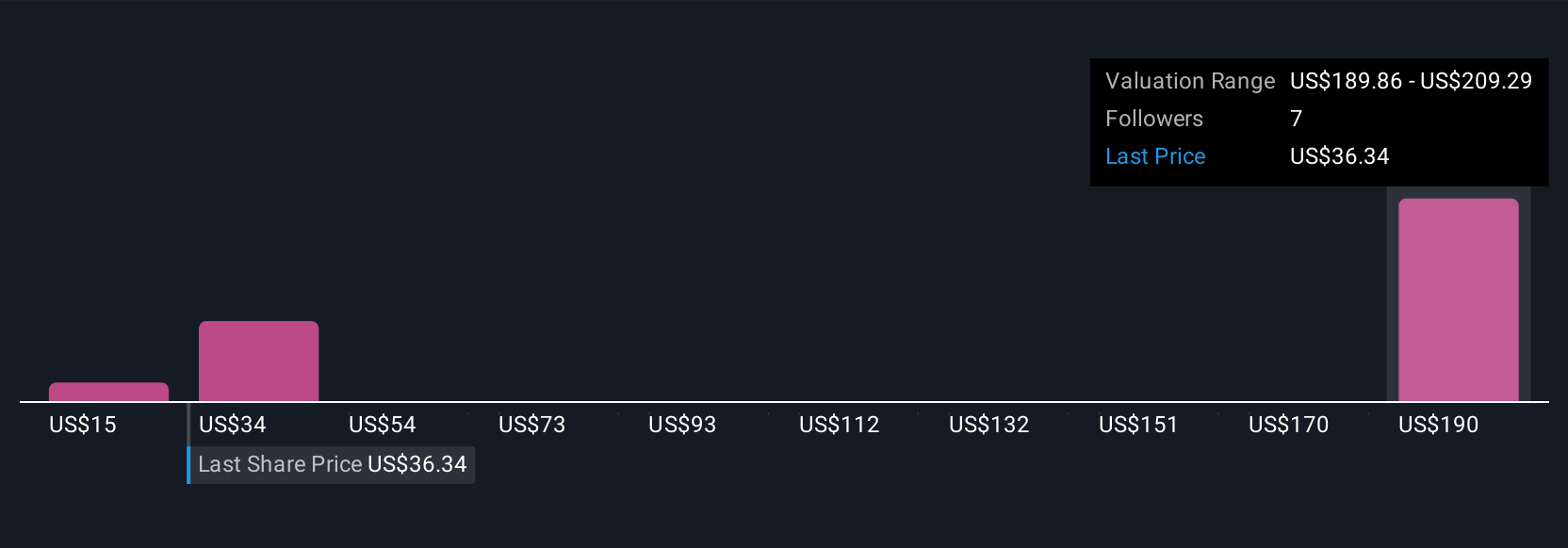

Four Simply Wall St Community fair value estimates range widely from US$15 to US$236.70, revealing sharply different outlooks. You should consider that much of Astronics' upside outlook is still tied to recovery in commercial aerospace production volumes and industry cyclicality, so exploring several viewpoints is essential.

Explore 4 other fair value estimates on Astronics - why the stock might be worth less than half the current price!

Build Your Own Astronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Astronics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Astronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Astronics' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATRO

Astronics

Through its subsidiaries, designs and manufactures products for the aerospace, defense, and electronics industries in the United States, rest of North America, Asia, Europe, South America, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives