- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:ATRO

Could Renewed Analyst Attention at Astronics (ATRO) Reveal a Shift in Its Competitive Strategy?

Reviewed by Sasha Jovanovic

- Earlier this month, Astronics Corporation presented at the Baird 55th Annual Global Industrial Conference in Chicago, highlighting its latest developments to investors and industry peers.

- The event attracted renewed analyst interest and strong broker sentiment, reflecting heightened expectations for the company's near-term performance and growth prospects.

- We'll next explore how this surge in positive analyst coverage may reinforce Astronics' ongoing investment narrative and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Astronics Investment Narrative Recap

To be a shareholder in Astronics, you need to believe in the continued recovery of commercial aerospace, along with the company's ability to benefit from major aircraft production ramp-ups and ongoing fleet upgrades. While the recent surge in positive analyst coverage following the Baird conference signals increased confidence, this sentiment does not materially lessen the most pressing short-term risk: potential execution challenges and project overruns in Astronics’ Test segment, which has strained financial stability in recent quarters. Among Astronics’ recent announcements, the award of the US$215 million contract with the U.S. Army for radio test set production stands out. This supply contract highlights the company's efforts to diversify revenues and could become a catalyst for improved results, especially if Astronics successfully reduces execution risk in its historically weak Test segment. However, looking beneath the surface, investors should not overlook the ongoing uncertainties tied to persistent execution challenges in Test and...

Read the full narrative on Astronics (it's free!)

Astronics' outlook anticipates $956.5 million in revenue and $86.1 million in earnings by 2028. This scenario requires 5.1% annual revenue growth and an $89.8 million increase in earnings from the current $-3.7 million.

Uncover how Astronics' forecasts yield a $60.67 fair value, a 11% upside to its current price.

Exploring Other Perspectives

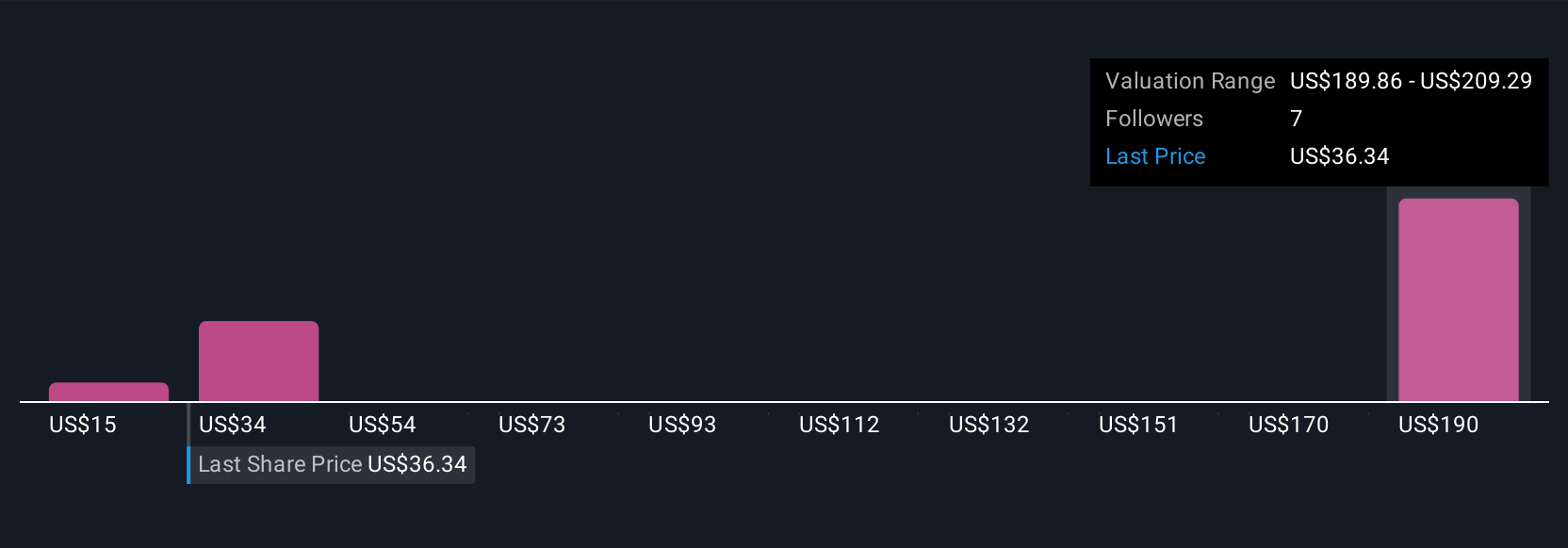

Four private investor fair value estimates from the Simply Wall St Community span a wide range, from US$15 to US$74.37 per share. As you consider these perspectives, keep in mind that recent execution risks in the Test segment may continue to shape expectations and future outcomes; explore the full spectrum of investor opinions.

Explore 4 other fair value estimates on Astronics - why the stock might be worth as much as 36% more than the current price!

Build Your Own Astronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Astronics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Astronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Astronics' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATRO

Astronics

Through its subsidiaries, designs and manufactures products for the aerospace, defense, and electronics industries in the United States, rest of North America, Asia, Europe, South America, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success