- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:ATRO

Astronics (ATRO): Evaluating Valuation Following $300 Million Credit Facility Boost for Growth Plans

Reviewed by Simply Wall St

Astronics (ATRO) just secured a new $300 million revolving credit facility that will run through 2030, replacing its older agreement. This move strengthens Astronics’ balance sheet and provides greater financial flexibility for the company in the future.

See our latest analysis for Astronics.

Astronics’ share price has been on a remarkable run, up over 218% year-to-date and hitting fresh highs as the company’s momentum in aerospace and defense technology gathers steam. With strong revenue gains and recent wins like this new revolving credit facility, investor enthusiasm has only grown. This is reflected in a five-year total shareholder return of more than 680%.

If this kind of growth story got your attention, now’s the perfect time to discover See the full list for free.

But with shares already up more than 200% this year and trading near record highs, investors have to wonder if the market has already priced in Astronics’ future growth or if there is still room to run from here.

Most Popular Narrative: 7.4% Undervalued

With Astronics’ fair value pegged at $54.33 and the last close at $50.31, the most followed narrative points to the stock trading at a moderate discount. The story behind this pricing centers on a mix of upbeat sector momentum and calculated long-term forecasts.

Production rate increases for major commercial aircraft platforms (such as Boeing 737, Airbus A320, and expected ramp-ups for 787, A350, and new programs like the A220) are likely to drive continued growth in demand for Astronics' power, lighting, and connectivity solutions, supporting both revenue acceleration and operating leverage through 2025 and beyond.

Want to know the growth blueprint behind this high valuation? The narrative is built on a bold mix of future profit margins, accelerating sales, and a sector outlook that rivals the hottest names in aerospace. Curious which one assumption moves the needle most? Dive deeper and see what could push these shares even higher if these projections become reality.

Result: Fair Value of $54.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain challenges or new legal setbacks could quickly upend Astronics’ outlook and put pressure on its impressive recent gains.

Find out about the key risks to this Astronics narrative.

Another View: Multiples Tell a Different Story

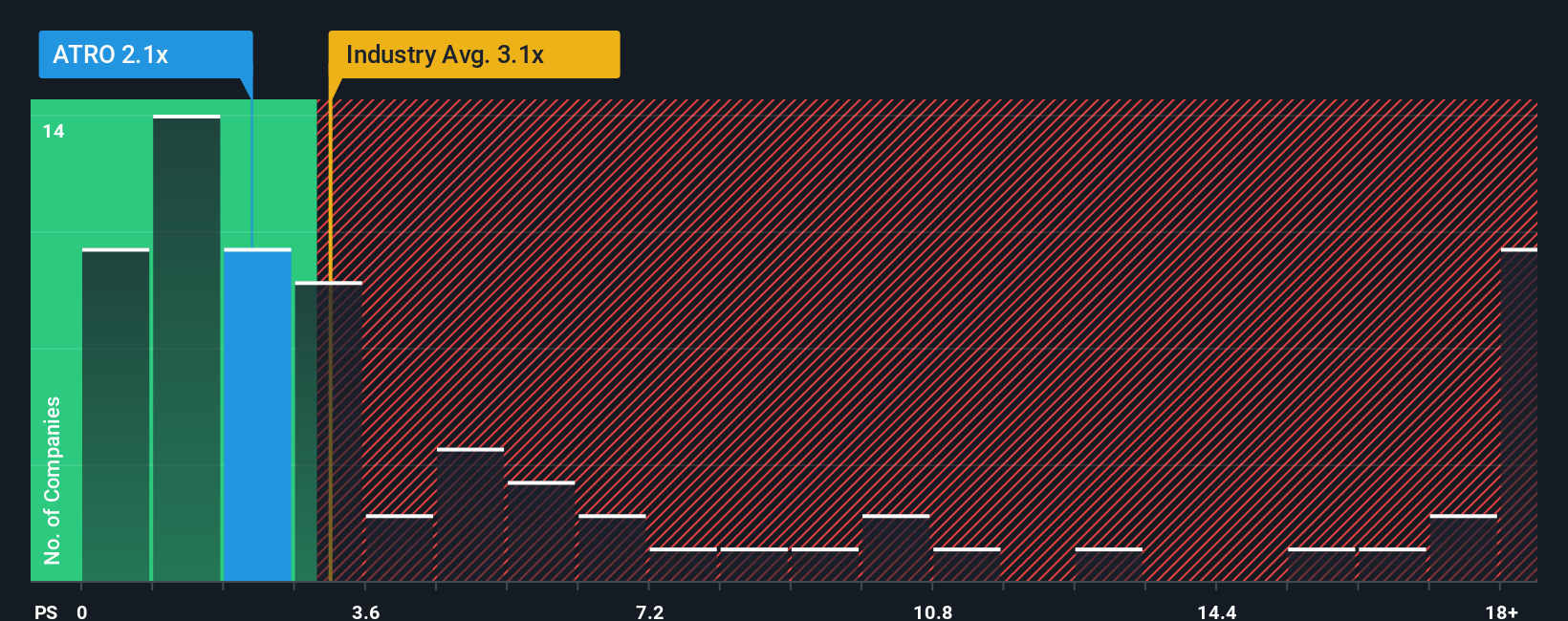

While the dominant narrative points to Astronics as undervalued based on its future cash flows, a look at its price-to-sales ratio offers a counterpoint. The company trades at 2.2 times sales, cheaper than the sector's 3.2 and its peer group's 2.6, but notably higher than its fair ratio of 1.1. This premium could signal optimism built into the current price. Is there untapped upside, or are investors leaning too far forward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Astronics Narrative

If you have a different take or want to dig into the numbers yourself, you can build your own perspective in just a few minutes, starting with Do it your way.

A great starting point for your Astronics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Your next big win could be just a click away. Don’t let standout opportunities pass you by. Get started now with these powerful research lists from Simply Wall Street:

- Unlock the potential of early-stage innovators by scanning these 3566 penny stocks with strong financials set to shake up the market with fresh business models and strong financials.

- Capitalize on transformative technologies by evaluating the competitive edge of companies at the forefront with these 27 AI penny stocks in artificial intelligence advancements.

- Secure reliable income and growth by reviewing these 17 dividend stocks with yields > 3% that consistently reward investors with yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATRO

Astronics

Through its subsidiaries, designs and manufactures products for the aerospace, defense, and electronics industries in the United States, rest of North America, Asia, Europe, South America, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives