- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:ATRO

Astronics (ATRO): Evaluating Valuation After Strong Share Price Momentum

Reviewed by Simply Wall St

Astronics (ATRO) has been trading with some momentum, which has caught the attention of investors keeping an eye on the capital goods sector. The stock’s recent performance offers a few trends that are worth a closer look.

See our latest analysis for Astronics.

Astronics’ recent run has shown some real strength, with momentum building on top of a standout 1-day share price return of 6.02% and a 90-day return nearing 56%. Over the past year, shareholders have enjoyed a remarkable 215% total return, which highlights the growing optimism around the company’s recovery and future prospects.

If Astronics’ momentum has you considering broader opportunities in capital goods, it could be a great time to discover See the full list for free.

But with such extraordinary gains in the rearview, the real question now is whether Astronics is still trading at a discount or if the market has already factored in all its future growth. Is there still value for new investors, or is everything priced in?

Most Popular Narrative: 4% Undervalued

With Astronics’ last close at $52.15 and the most popular narrative placing fair value at $54.33, sentiment suggests there is still some upside built into the price. This perspective hinges on specific growth catalysts and operational improvements that investors are watching closely.

Production rate increases for major commercial aircraft platforms (such as Boeing 737, Airbus A320, and expected ramp-ups for 787, A350, and new programs like the A220) are likely to drive continued growth in demand for Astronics' power, lighting, and connectivity solutions. These increases are expected to support both revenue acceleration and operating leverage through 2025 and beyond.

Why are analysts so bullish on this potential? The narrative is grounded in bold growth assumptions for revenue, climbing margins, and a future profit multiple that is rarely seen outside tech giants. What is fueling these expectations, and could it justify this premium? Dive in to see the numbers that could change everything.

Result: Fair Value of $54.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain challenges and unpredictable defense sector demand could easily disrupt Astronics’ impressive growth momentum in the year ahead.

Find out about the key risks to this Astronics narrative.

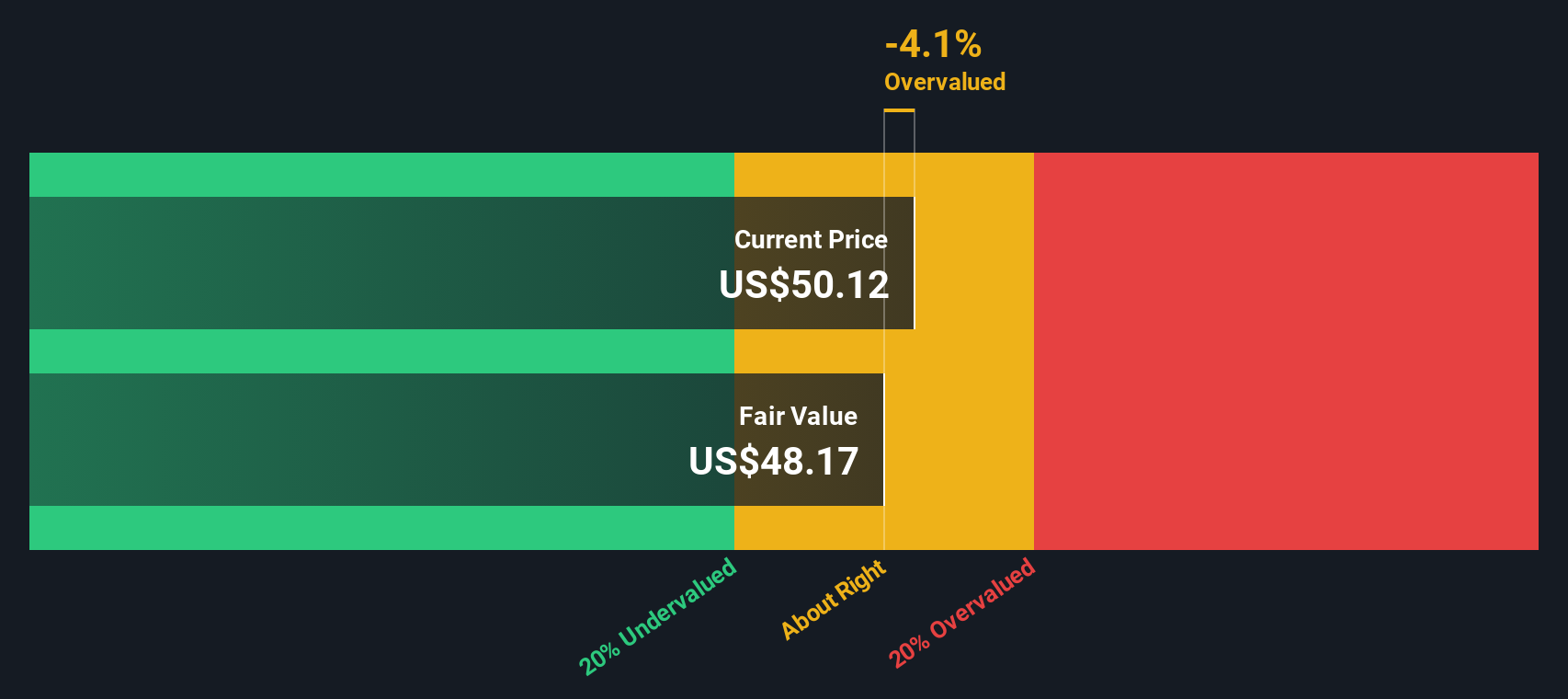

Another View: The SWS DCF Model Weighs In

While current valuations suggest Astronics might be trading below its fair value based on future earnings multiples, our DCF model paints a different picture. The SWS DCF model estimates a fair value of $47.83 per share, which is actually below today’s price. This raises questions about whether optimism is running a bit ahead of reality.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Astronics Narrative

If you’d rather take a hands-on approach, you can examine the latest data and shape your own perspective about Astronics in just a few minutes. Do it your way

A great starting point for your Astronics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means staying ahead of the crowd. Amplify your portfolio by checking out other compelling stocks and trends you may be overlooking right now.

- Tap into powerful growth potential by reviewing these 879 undervalued stocks based on cash flows that are currently flying under the radar and could offer real upside.

- Supercharge your returns with passive income by assessing these 16 dividend stocks with yields > 3% that reward shareholders with yields over 3%.

- Ride the wave of market innovation by scouting these 25 AI penny stocks built around artificial intelligence transformation and industry disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATRO

Astronics

Through its subsidiaries, designs and manufactures products for the aerospace, defense, and electronics industries in the United States, rest of North America, Asia, Europe, South America, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives