- United States

- /

- Electrical

- /

- NasdaqGM:ARRY

A Look At Array Technologies (ARRY) Valuation After Baird Downgrade And Recent Rally

Baird’s downgrade of Array Technologies (ARRY) from Outperform to Neutral, following a strong recent rally and concerns about future margins as competition increases, has become the key focus for investors assessing the stock.

See our latest analysis for Array Technologies.

Array Technologies’ 90 day share price return of 46.51% and 30 day gain of 16.99% suggest recent momentum has been strong. The 61.32% 1 year total shareholder return contrasts with weaker 3 and 5 year outcomes, which hints that sentiment has only turned more constructive relatively recently.

If the solar rally has your attention, it could be a useful moment to broaden your watchlist and check out high growth tech and AI stocks as potential next ideas to research.

With ARRY trading close to its analyst price target and carrying a loss of US$92.105 million on revenue of US$1.333b, is the recent surge leaving upside on the table, or is the market already pricing in future growth?

Most Popular Narrative: 3.2% Overvalued

With Array Technologies’ fair value estimate at $10.97 versus a last close of $11.33, the most widely followed narrative sees only a modest gap to the current price, and anchors that view in a detailed set of growth and profitability assumptions.

Continued industry tailwinds from large-scale decarbonization initiatives, falling solar power costs, and heightened corporate ESG/net-zero commitments signal robust multi-year demand for utility-scale solar and tracking solutions, providing a favorable backdrop for long-term revenue, backlog growth, and sustained earnings momentum.

Curious what kind of revenue path, margin reset, and future earnings multiple are baked into that fair value line, and how sensitive it is to those assumptions? The full narrative lays out a detailed financial roadmap that goes well beyond a headline price target.

Result: Fair Value of $10.97 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still the risk that shifting tariffs and policy rules, as well as a tougher pricing backdrop in trackers, could undermine the margin and earnings recovery that this narrative assumes.

Find out about the key risks to this Array Technologies narrative.

Another View on Value

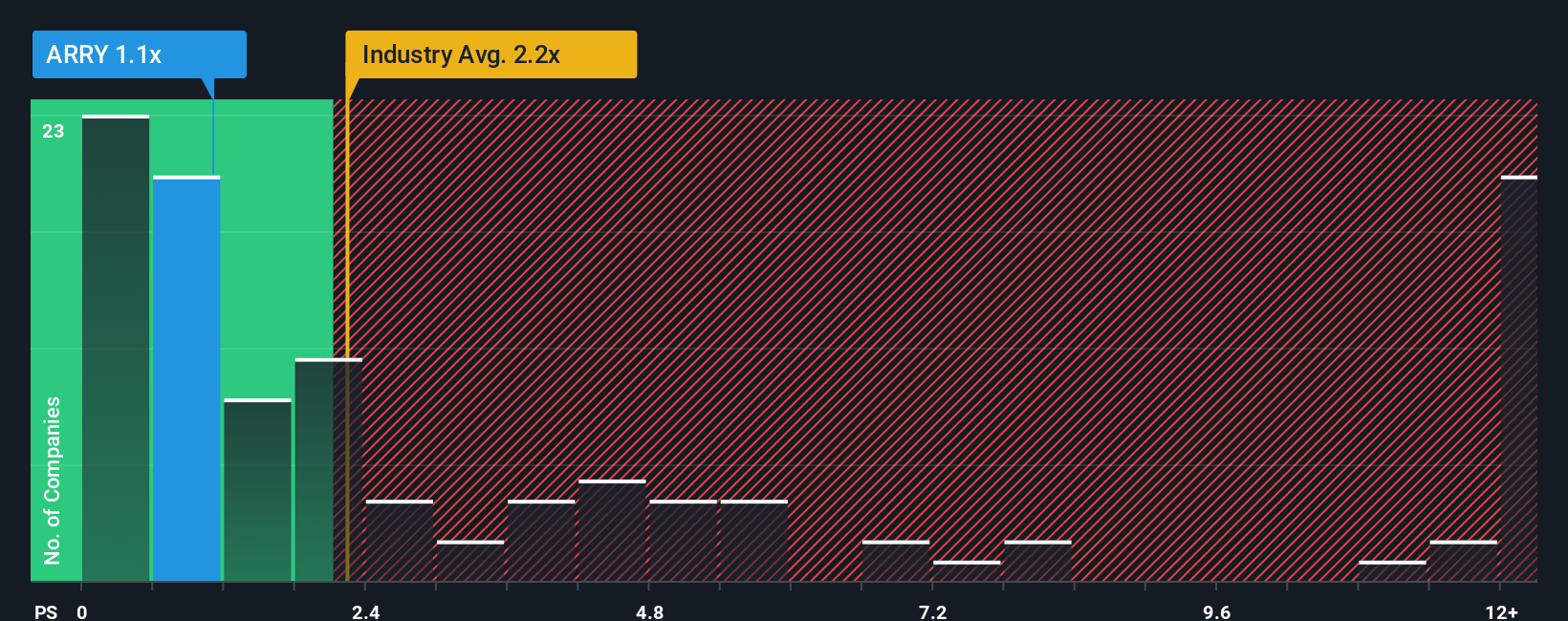

While the fair value estimate of $10.97 suggests Array Technologies is about 3.2% overvalued, the current P/S of 1.3x screens as cheap next to both peers at 2.3x and the US Electrical industry at 2.4x, and below a fair ratio of 1.7x, which raises the question of whether sentiment or fundamentals are driving that gap.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Array Technologies Narrative

If you look at the numbers and come to a different conclusion, or simply like to test your own thesis against the market, you can build a fresh narrative for Array Technologies in just a few minutes using Do it your way.

A great starting point for your Array Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Array Technologies is on your radar, do not stop there. A broader watchlist can help you spot opportunities sooner and avoid chasing yesterday’s moves.

- Zero in on potential value candidates by screening for these 887 undervalued stocks based on cash flows that might warrant a closer look based on their cash flow profiles.

- Tap into the growth story around artificial intelligence by scanning these 24 AI penny stocks that are tied directly to this technology theme.

- Add income angles to your research by checking out these 12 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ARRY

Array Technologies

Manufactures and sells solar tracking technology products in the United States, Spain, Brazil, Australia, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

The Green Consolidator

EDP as a safe capital allocation with a potential upside of 28% with steady dividends

#1 Silver Play with Positive Cashflow Gold Miner (Top Notch Team)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I wrote the latest analysis on DSV, all I can say this is my #1 stock pick, my largest hold. Latest : https://simplywall.st/community/narratives/ca/materials/tsx-dsv/discovery-silver-shares/ha9axhmi-1-silver-play-with-positive-cashflow-gold-miner-top-notch-team-moui/updates/5-discovery-silver-corp-tsx-dsv-discovery-silver-is-now?utm_source=share&utm_medium=web