- United States

- /

- Semiconductors

- /

- NasdaqGS:HIMX

Undiscovered Gems in the United States to Explore This October 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, though it is up 30% over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying undiscovered gems that can offer potential growth opportunities requires a keen eye for companies with solid fundamentals and innovative prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| River Financial | 122.41% | 16.43% | 18.50% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

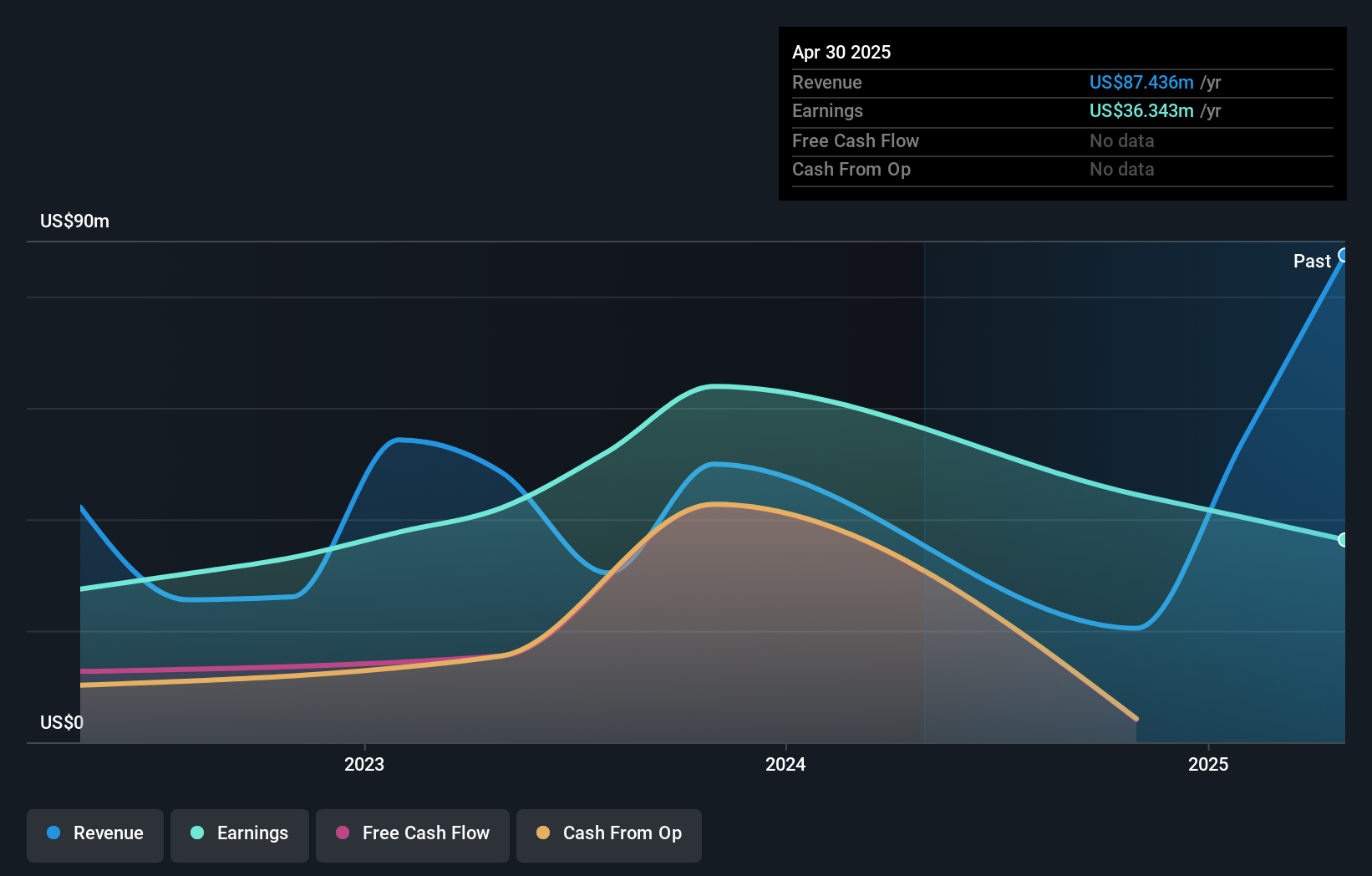

Apogee Enterprises (NasdaqGS:APOG)

Simply Wall St Value Rating: ★★★★★★

Overview: Apogee Enterprises, Inc. specializes in providing architectural products and services for building enclosures, as well as glass and acrylic products for preservation and enhanced viewing across the United States, Canada, and Brazil, with a market cap of approximately $1.73 billion.

Operations: Apogee Enterprises generates revenue primarily from its Architectural Framing Systems and Architectural Services segments, contributing $553.30 million and $397.99 million, respectively. The company also earns from Architectural Glass at $363.96 million and Large-Scale Optical at $94.16 million, with intersegment eliminations of -$33.88 million impacting overall figures.

Apogee Enterprises, a notable player in the building industry, has shown resilience with earnings growing 26.6% annually over the past five years. Despite a recent dip in quarterly sales to US$342 million from US$354 million last year, net income for the six months rose to US$61.58 million from US$56.9 million previously. The company repurchased 170,498 shares recently and maintains a satisfactory debt-to-equity ratio of 2%, supporting its robust financial standing and potential future growth prospects.

- Delve into the full analysis health report here for a deeper understanding of Apogee Enterprises.

Evaluate Apogee Enterprises' historical performance by accessing our past performance report.

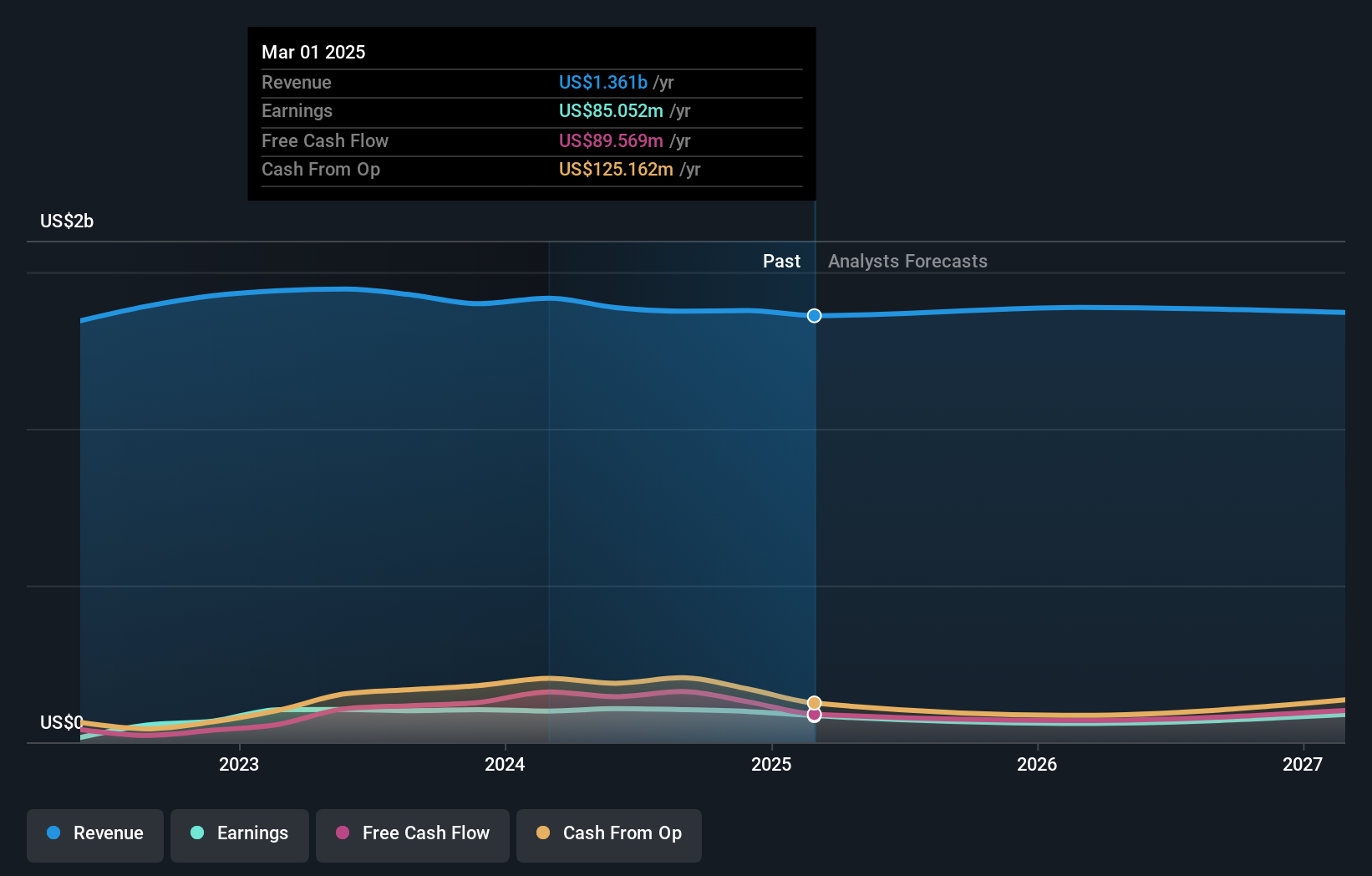

Himax Technologies (NasdaqGS:HIMX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Himax Technologies, Inc. is a fabless semiconductor company specializing in display imaging processing technologies across various regions including China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States with a market cap of approximately $1.03 billion.

Operations: Himax generates revenue primarily from its display imaging processing technologies. The company's net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

Himax Technologies, a semiconductor player, has shown impressive earnings growth of 16% over the past year, outpacing the broader semiconductor industry. The company sports a price-to-earnings ratio of 13.7x, which is attractive compared to the US market average of 18.2x. Despite an increase in debt to equity from 55% to 56.7%, its net debt to equity ratio remains satisfactory at 27.4%. Recent collaborations like the T2000 ePaper controller with E Ink highlight innovation potential and energy efficiency advancements in their product line-up.

- Take a closer look at Himax Technologies' potential here in our health report.

Explore historical data to track Himax Technologies' performance over time in our Past section.

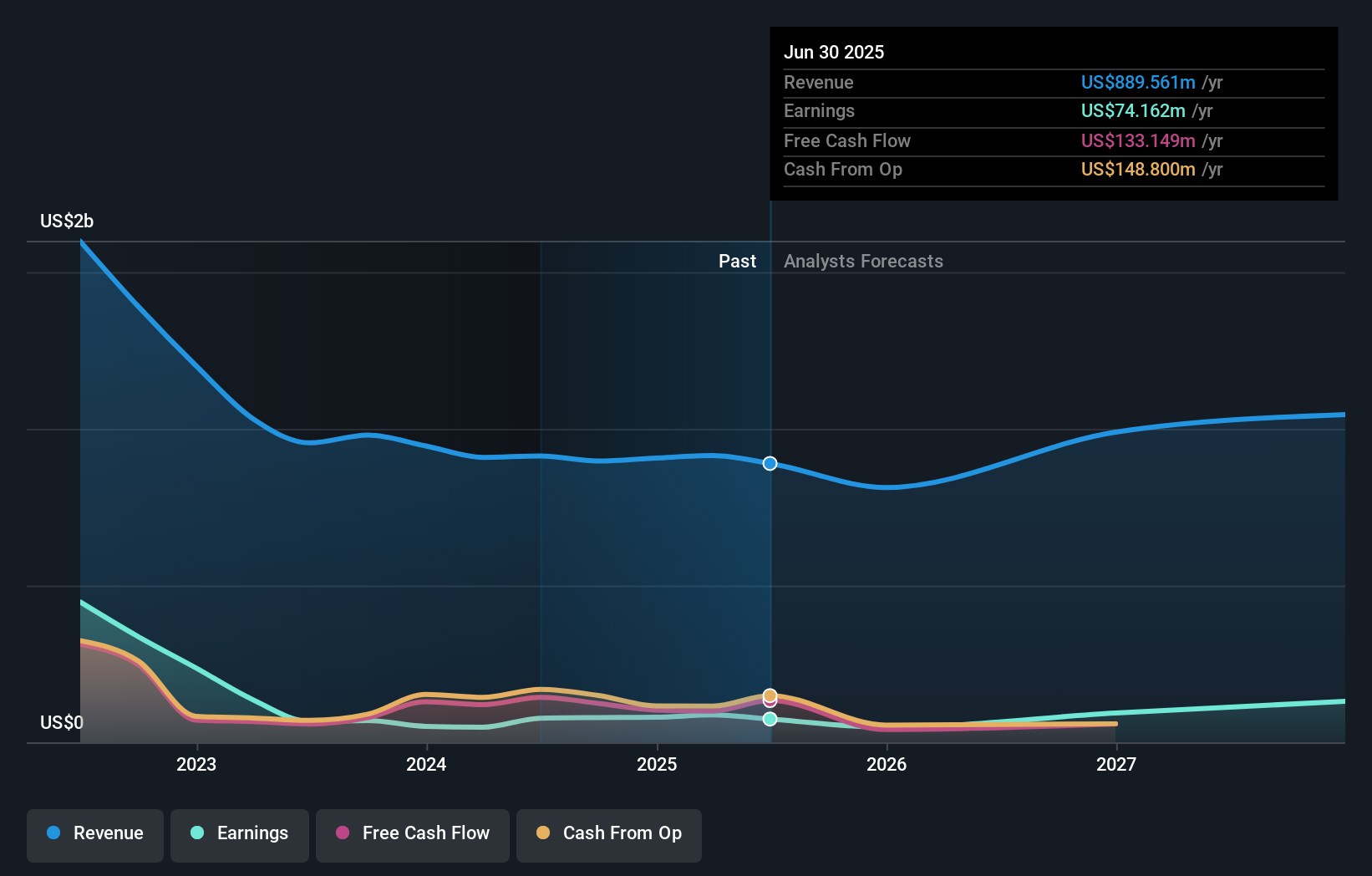

AMTD Digital (NYSE:HKD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: AMTD Digital Inc. operates through its subsidiaries to offer digital solutions in financial and non-financial services, digital media, content and marketing services, as well as hotel operations and VIP services across Asia, with a market capitalization of approximately $1 billion.

Operations: AMTD Digital generates revenue through digital solutions in financial and non-financial services, digital media, content and marketing services, along with hotel operations and VIP services in Asia. The company's market capitalization is approximately $1 billion.

AMTD Digital, a nimble player in the tech space, has seen its earnings surge by 88.6% over the past year, outpacing industry averages. Despite a volatile share price recently, it holds a competitive edge with a Price-To-Earnings ratio of 13.6x, undercutting the US market's average of 18.3x. The company boasts more cash than total debt and reported a significant one-off gain of US$46 million in October 2023 impacting its financial results positively.

- Navigate through the intricacies of AMTD Digital with our comprehensive health report here.

Gain insights into AMTD Digital's historical performance by reviewing our past performance report.

Make It Happen

- Click here to access our complete index of 220 US Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Himax Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HIMX

Himax Technologies

A fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States.

Solid track record with excellent balance sheet and pays a dividend.