- United States

- /

- Electrical

- /

- NasdaqGS:AMSC

There's Reason For Concern Over American Superconductor Corporation's (NASDAQ:AMSC) Massive 29% Price Jump

Despite an already strong run, American Superconductor Corporation (NASDAQ:AMSC) shares have been powering on, with a gain of 29% in the last thirty days. The last month tops off a massive increase of 131% in the last year.

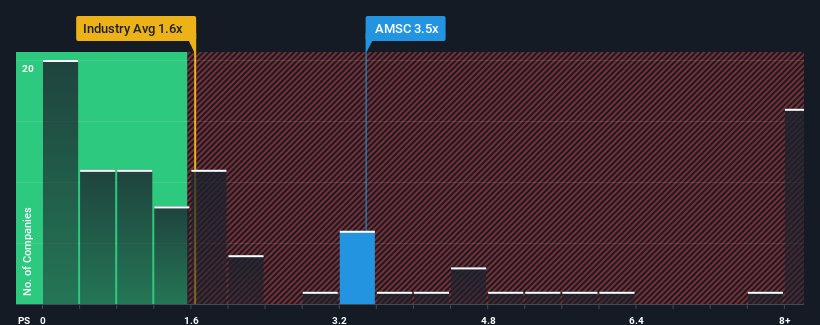

Since its price has surged higher, you could be forgiven for thinking American Superconductor is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.5x, considering almost half the companies in the United States' Electrical industry have P/S ratios below 1.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for American Superconductor

What Does American Superconductor's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, American Superconductor has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on American Superconductor will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For American Superconductor?

The only time you'd be truly comfortable seeing a P/S as high as American Superconductor's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 32% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 61% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 11% as estimated by the three analysts watching the company. With the industry predicted to deliver 17% growth, the company is positioned for a weaker revenue result.

In light of this, it's alarming that American Superconductor's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On American Superconductor's P/S

American Superconductor shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see American Superconductor trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you settle on your opinion, we've discovered 3 warning signs for American Superconductor that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AMSC

American Superconductor

Provides megawatt-scale power resiliency solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives