- United States

- /

- Electrical

- /

- NasdaqGS:AMSC

How Strong Revenue Growth and Market Share Gains Will Impact American Superconductor (AMSC) Investors

Reviewed by Sasha Jovanovic

- In recent months, American Superconductor has achieved significant gains in market share, buoyed by robust revenue growth and positive free cash flow.

- This momentum highlights the company’s ability to capture demand in competitive end markets, reinforcing its operational execution and financial health.

- We'll explore how American Superconductor's exceptional revenue growth and expanding market share shapes its investment narrative and future outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

American Superconductor Investment Narrative Recap

To be a shareholder in American Superconductor, you need to believe in the company’s continued ability to capture demand across cyclical and transformative energy markets while maintaining profit growth and operational discipline. The recent market share gains and robust revenue growth reinforce the main short-term catalyst, sustained expansion in both semiconductors and energy infrastructure, while offering only modest reprieve from the biggest current risk: the potential for order volatility as sector cycles shift. At this stage, the recent news mainly reinforces momentum but does not materially reduce near-term uncertainties tied to demand timing.

Of the recent company announcements, the follow-on equity offering of US$115.5 million in June 2025 stands out. This move meaningfully bolsters the balance sheet, providing additional firepower for acquisitions or supporting working capital as the business scales to meet new demand, a direct connection to the company’s key catalyst of accelerating infrastructure and technology investment in target sectors. How efficiently this capital is deployed should influence both business resilience and the trajectory of earnings growth in the next phase.

However, if order timing continues to swing in these cyclical end markets, investors should be aware that...

Read the full narrative on American Superconductor (it's free!)

American Superconductor's narrative projects $361.8 million revenue and $43.2 million earnings by 2028. This requires 12.4% yearly revenue growth and a $27.9 million earnings increase from $15.3 million today.

Uncover how American Superconductor's forecasts yield a $66.67 fair value, a 12% upside to its current price.

Exploring Other Perspectives

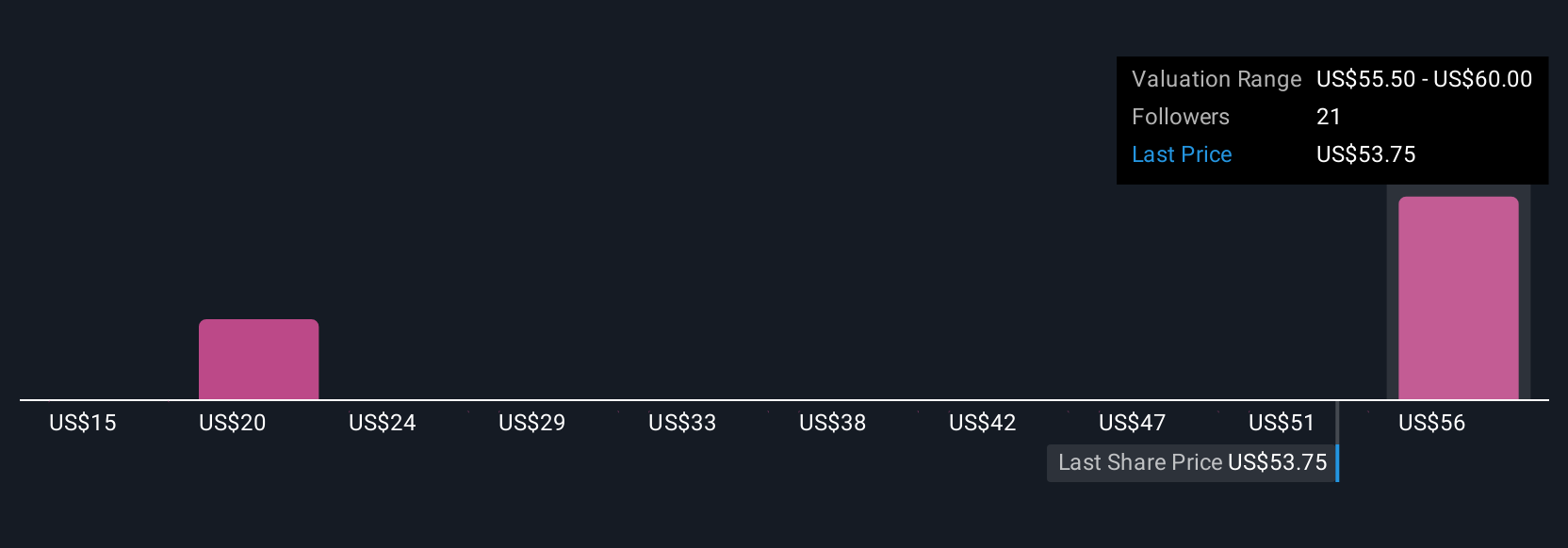

Three Simply Wall St Community fair value estimates for American Superconductor span US$28.59 to US$66.67 per share. While profit growth forecasts remain a prevalent catalyst, differences in opinion show how widely expectations about sector cycles and demand timing can vary, explore these perspectives to inform your own view.

Explore 3 other fair value estimates on American Superconductor - why the stock might be worth as much as 12% more than the current price!

Build Your Own American Superconductor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Superconductor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free American Superconductor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Superconductor's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMSC

American Superconductor

Provides megawatt-scale power resiliency solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives