- United States

- /

- Electrical

- /

- NasdaqGS:AMSC

Consistent Revenue Surprises Could Be a Game Changer for American Superconductor (AMSC)

Reviewed by Simply Wall St

- American Superconductor reported its Q2 earnings this past Wednesday, with analysts having projected year-over-year revenue growth of 61.2% and highlighting the company’s strong record of surpassing expectations.

- This consistent pattern of outperforming Wall Street revenue estimates underscores growing optimism among investors about American Superconductor’s operational momentum and expansion potential.

- We'll examine how anticipation for robust revenue growth, fueled by upbeat analyst forecasts, shapes the latest view of American Superconductor’s investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

American Superconductor Investment Narrative Recap

To be a shareholder of American Superconductor, you need to believe in its ability to capture growth from industrial grid modernization, renewable energy, and a robust order pipeline. While the company's better-than-expected revenue growth continues to boost short-term optimism, its reliance on key customers, particularly Inox Wind, remains the most immediate risk, as any disruption to order flow could directly impact earnings. The recent earnings update reinforces existing catalysts but does not materially shift the primary risks at play.

Among recent announcements, the $12 million order from Inox Wind stands out, as it directly supports both current revenue expectations and the longer-term outlook for the wind business segment. This order highlights continued demand from major clients, underscoring how these relationships support positive forecasts, while also revealing the company's concentrated risk in this customer base.

By contrast, investors should be aware that even with strong bookings, any interruption in orders or payments from Inox Wind could quickly…

Read the full narrative on American Superconductor (it's free!)

American Superconductor's outlook anticipates $345.6 million in revenue and $40.8 million in earnings by 2028. This scenario involves an annual revenue growth rate of 15.8% and a $34.8 million increase in earnings from the current $6.0 million.

Uncover how American Superconductor's forecasts yield a $41.00 fair value, a 6% downside to its current price.

Exploring Other Perspectives

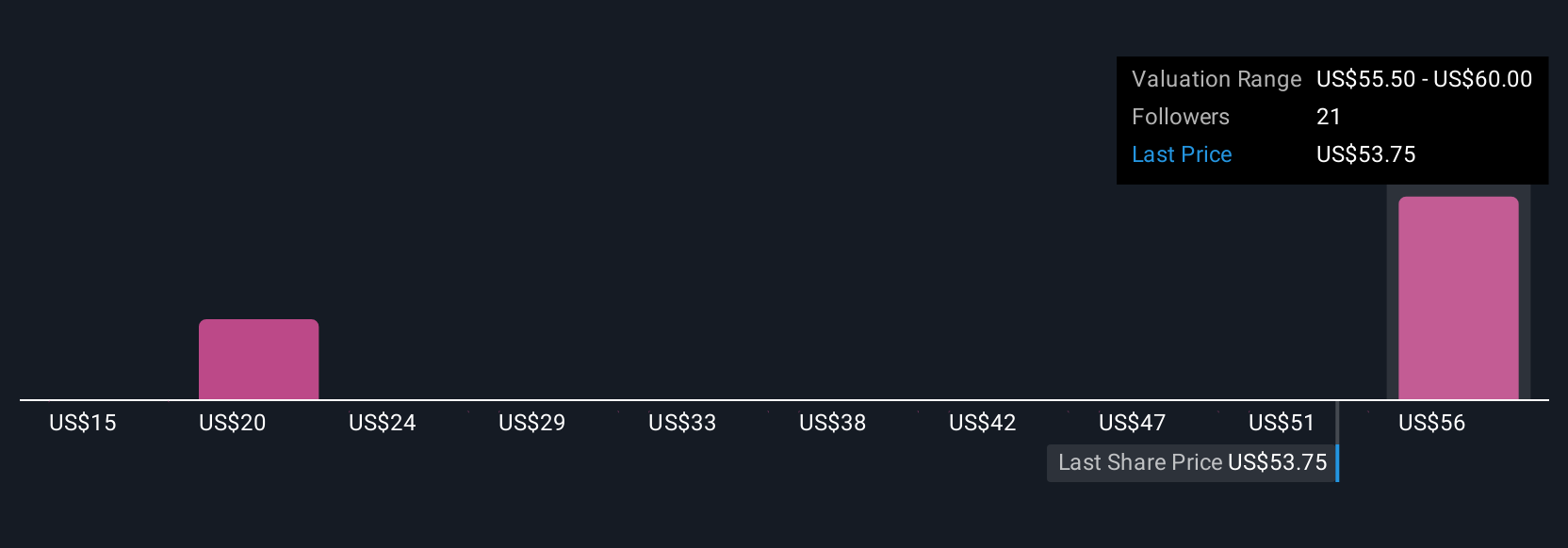

Community members at Simply Wall St estimate AMSC’s fair value from US$15 to US$60 across four analyses. As new contracts arrive and customer concentration remains a risk, opinions vary widely on future performance, consider reviewing several viewpoints before deciding where you stand.

Explore 4 other fair value estimates on American Superconductor - why the stock might be worth as much as 37% more than the current price!

Build Your Own American Superconductor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Superconductor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American Superconductor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Superconductor's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMSC

American Superconductor

Provides megawatt-scale power resiliency solutions worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives