- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:AIRO

Is AIRO Group Holdings (AIRO) Shifting From Growth to Efficiency With Its Narrowed Net Losses?

Reviewed by Sasha Jovanovic

- AIRO Group Holdings announced its third quarter 2025 results, reporting US$6.28 million in sales and a net loss of US$7.96 million, both significantly lower than the prior year's figures for the same period.

- The company's ability to substantially reduce losses despite experiencing lower sales highlights a shift in operational efficiency that may alter future expectations.

- We will explore how AIRO Group Holdings' progress in narrowing its net loss shapes its current investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is AIRO Group Holdings' Investment Narrative?

For anyone considering AIRO Group Holdings today, the big-picture bet is really on whether the company’s sharper focus on operational efficiency and its expanding defense and industrial drone partnerships can drive a sustainable turnaround. The latest quarterly results mark a pronounced shift: lowering the net loss to US$7.96 million even as sales dropped steeply to US$6.28 million. That ability to cut losses quickly supports the case for improved cost control but also raises fresh questions about revenue consistency and contract pipelines in a volatile sector. Before this update, the main catalysts were AIRO’s rapid revenue growth prospects and new defense alliances, counterbalanced by risks like board inexperience, volatile share prices, and concerns over going concern status flagged by auditors. The recent results may temporarily ease some financial risk perceptions but have not substantially reduced the company’s biggest challenges, its need to rebuild consistent sales and deliver on growth forecasts. On the other hand, board turnover and a short track record remain crucial risk factors investors should be aware of.

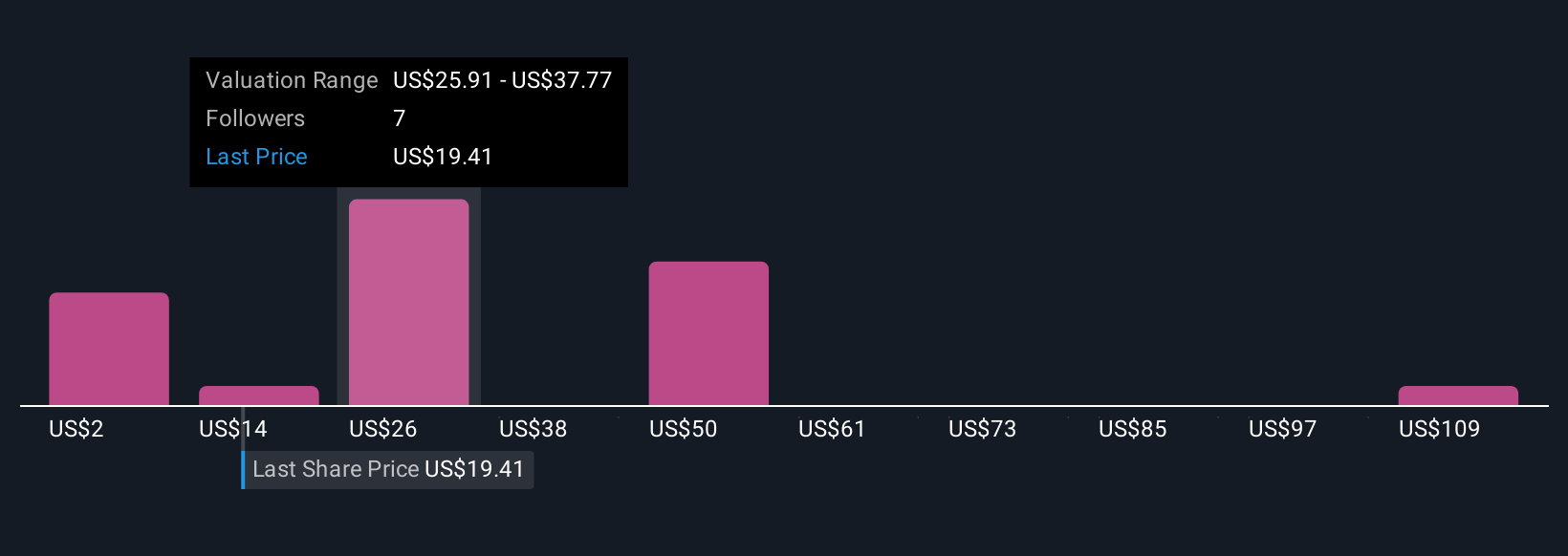

Despite retreating, AIRO Group Holdings' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 9 other fair value estimates on AIRO Group Holdings - why the stock might be a potential multi-bagger!

Build Your Own AIRO Group Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AIRO Group Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AIRO Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AIRO Group Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AIRO

AIRO Group Holdings

A multi-faceted advanced Aerospace and Defense company.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives