- United States

- /

- Banks

- /

- OTCPK:SLBK

Skyline Bankshares (SLBK): Profit Margin Expansion Reinforces Value Narrative for Investors

Reviewed by Simply Wall St

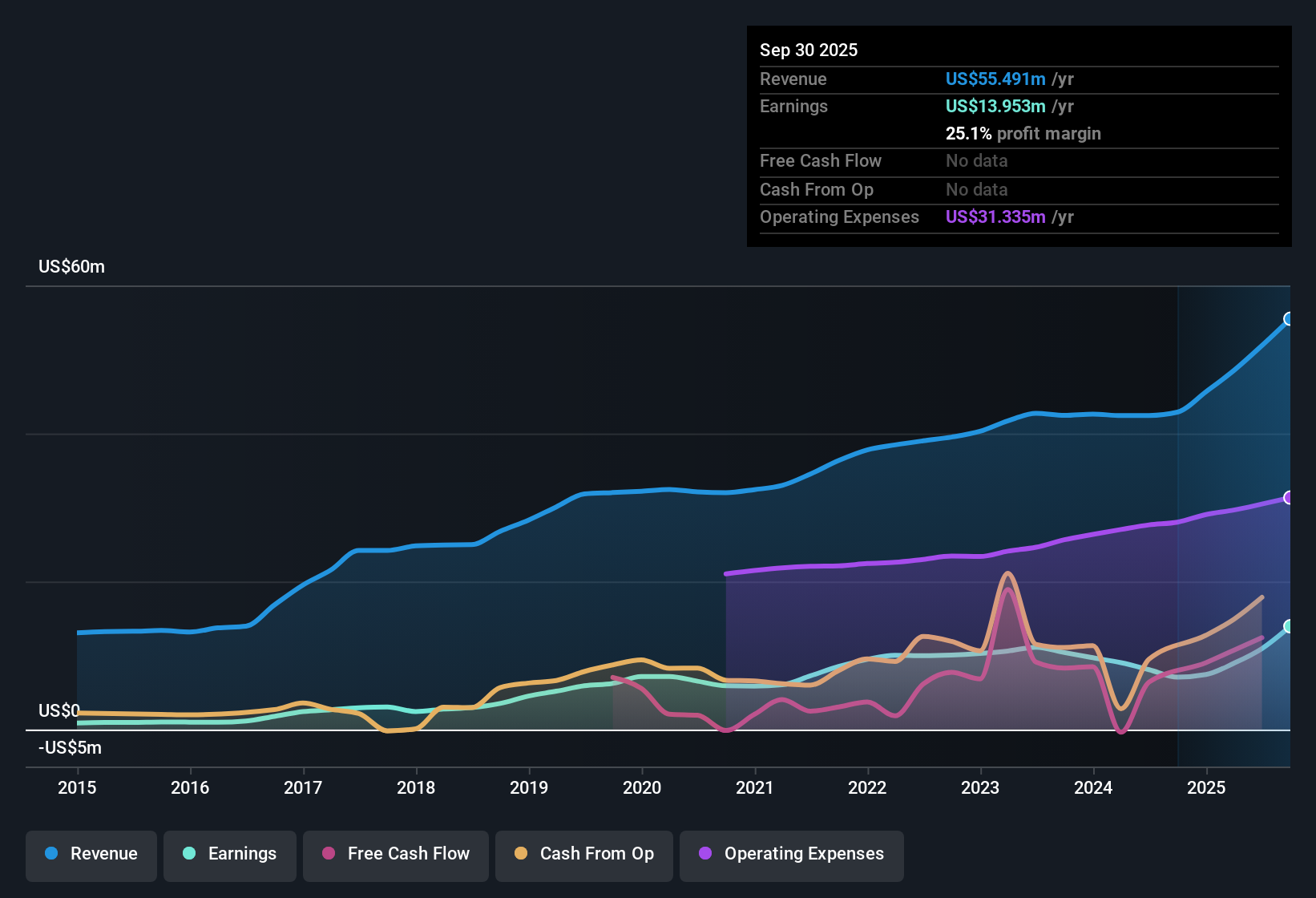

Skyline Bankshares (SLBK) posted a net profit margin of 25.1% this year, increasing from 16.5% a year ago, with earnings growing 97.2% over the past twelve months. This growth far outpaces its five-year average annual growth rate of 7.5%. The company’s price-to-earnings ratio now sits at 7.5x, below the peer average of 7.9x and the US Banks industry average of 11.2x. With higher margins, rapid recent earnings growth, and a valuation that looks attractive compared to peers, Skyline Bankshares may catch the eye of investors looking for both momentum and value in the banking sector.

See our full analysis for Skyline Bankshares.Up next, we will see how this set of results aligns with the stories and narratives investors are already tracking for Skyline Bankshares. Some perspectives may be confirmed, while others could be in for a surprise.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Drives Efficiency Story

- Net profit margins climbed to 25.1% this year from 16.5% a year ago, signaling a substantial boost in operational efficiency not seen in the past five years.

- Rapid margin improvement heavily supports the view that investors are rewarding stability and prudent management, especially in cases where:

- The 25.1% margin is well above the prior five-year average annual earnings growth rate of 7.5%, showing rare momentum for a regional bank.

- Compared to industry peers, Skyline’s margin outperformance underscores a positive narrative around the company’s recent expense control and focus on profitability.

Growth Surges Well Above Average Pace

- Earnings growth of 97.2% over the last twelve months is nearly thirteen times faster than the company’s own five-year annual average of 7.5%.

- This breakaway trajectory reinforces optimism that Skyline Bankshares is delivering results that could reset expectations, given that:

- Such an outsized earnings jump contrasts with typical sector performance and puts Skyline in a select group of banks outpacing industry norms.

- Continued acceleration is expected to keep the stock in focus for investors who value strong recent operational gains.

Valuation Discount Versus Peers and Industry

- The company’s price-to-earnings ratio of 7.5x sits below both its peer group average of 7.9x and the 11.2x sector average, placing Skyline at a notable discount despite its robust growth trends.

- This relative undervaluation puts a spotlight on the company’s momentum, since:

- Investors seeking value and upside potential may see the low P/E as a signal that the market still underestimates the impact of recent margin and earnings expansions.

- Strong recent fundamentals, combined with below-average multiples, suggest there may be room for re-rating if bank sector sentiment improves.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Skyline Bankshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While earnings and margins have leapt ahead recently, the sharp pace may not be sustainable if long-term growth proves inconsistent with past trends.

If reliable track records matter to you, use stable growth stocks screener (2122 results) to surface companies that have delivered steady growth and resilience across multiple cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:SLBK

Skyline Bankshares

Operates as the holding company for the Skyline National Bank that provides a range of retail and commercial banking services to individuals, and small and medium sized businesses in the United States.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives