- United States

- /

- Banks

- /

- OTCPK:SBNC

Southern BancShares (N.C.) (SBNC) Profit Margin Decline Reinforces Bearish Narratives on Valuation

Reviewed by Simply Wall St

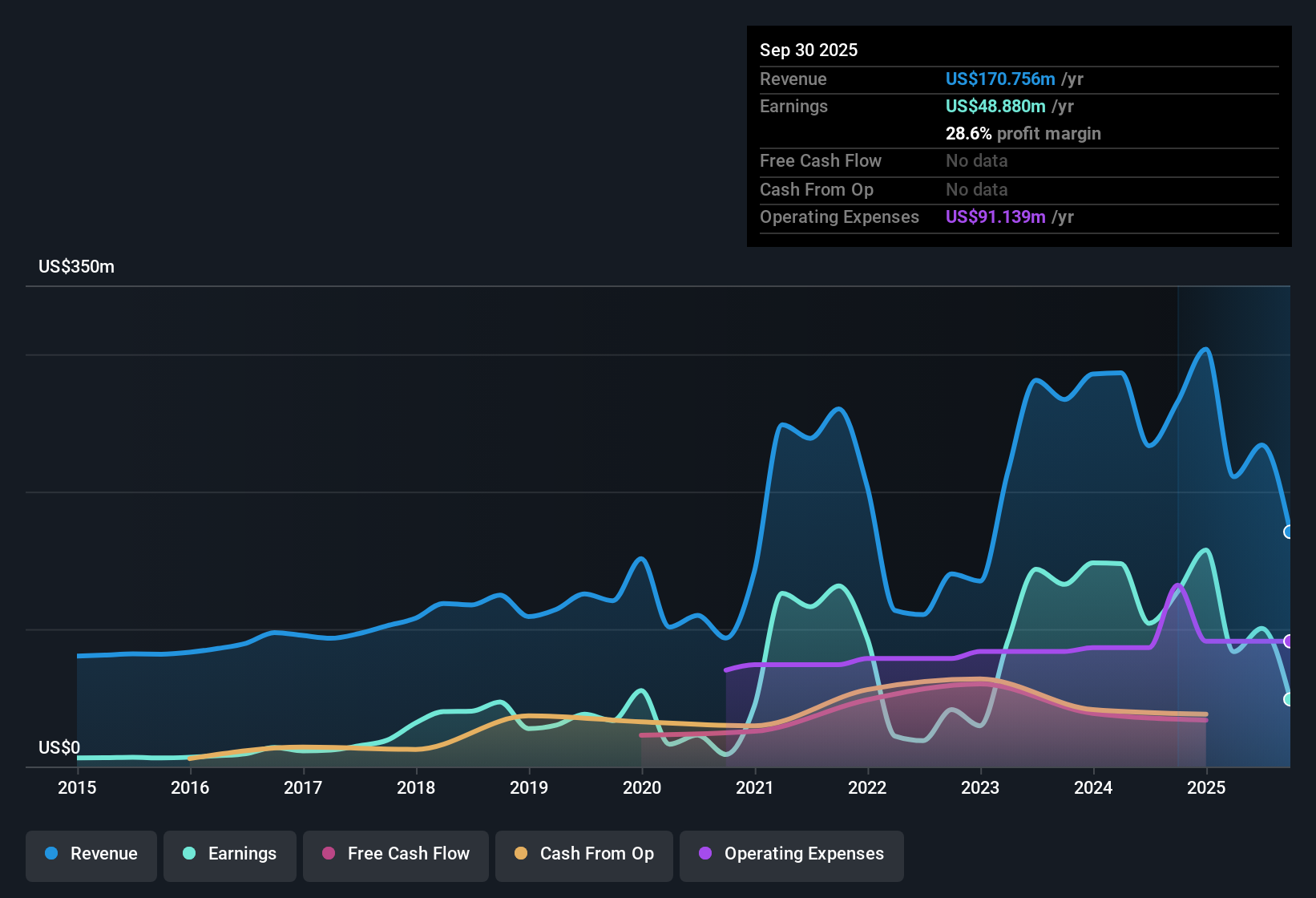

Southern BancShares (N.C.) (SBNC) posted an 11.8% annual earnings growth rate over the last five years, with its net profit margin coming in at 28.6%, a sharp drop from 47.9% a year ago. While the company reports what is considered high earnings quality, shares are currently trading at $9,705, well below the estimated fair value of $31,495.45. The decline in profitability is the main risk that investors are weighing against SBNC’s strong historical growth and the stock’s apparent value discount.

See our full analysis for Southern BancShares (N.C.).The next section takes these numbers head-to-head with the dominant narratives about SBNC, putting the results in context so you can see which market views hold up and which ones could be shifting.

Curious how numbers become stories that shape markets? Explore Community Narratives

P/E Ratio Sits Above Peers

- SBNC's price-to-earnings (P/E) ratio is 15x, which is more expensive than both its peer average of 11.9x and the US Banks industry average of 11.2x.

- Despite this premium valuation, the most recent market perspective emphasizes the company’s historically high earnings quality and the perceived value gap, as shares trade at $9,705 compared to a DCF fair value of $31,495.45.

- What is surprising is that the higher P/E has not translated into a higher trading price. The market seems skeptical about SBNC's ability to sustain past profitability.

- At the same time, bulls might point to the longstanding growth rate of 11.8% per year as a reason to justify the premium, but recent margin compression raises valid questions around future performance at this valuation.

Margins Narrow, Profit Quality Remains Strong

- Net profit margin fell to 28.6% from 47.9% the previous year, a decrease of more than 19 points, even as overall earnings quality is described as high.

- Prevailing analysis highlights an important tension: while the drop in margins confirms bearish concerns about near-term profitability pressure,

- Critics argue this sharp decline means risks around sustainability are front and center. The margin contraction is a key factor pushing the market to discount the share price more heavily.

- However, recurring mentions of high earnings quality add nuance, suggesting that even as margins slip, core business fundamentals may still be outperforming less-disciplined peers.

DCF Fair Value Suggests Deep Discount

- The latest DCF calculation puts fair value at $31,495.45, which is more than triple the current share price of $9,705.

- Market watchers note this wide gap as a material feature for investors, supporting the notion that SBNC could represent a compelling value play if the company stabilizes margins.

- Bulls would see the substantial discount as an opportunity, but uncertainty around whether the recent profitability dip is temporary tempers the case for an immediate rebound.

- Consensus among prevailing analysis is that the value argument hinges not just on price disparity, but on whether SBNC can restore its margin profile to prior levels.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Southern BancShares (N.C.)'s growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

SBNC’s recent earnings reveal shrinking profit margins and persistent doubts about its ability to sustain historical growth at current valuation levels.

If steady performance matters to you, use stable growth stocks screener (2102 results) to discover companies delivering reliable earnings and revenue growth through changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:SBNC

Southern BancShares (N.C.)

Southern BancShares, (N.C.), Inc. operates as the bank holding company for Southern Bank and Trust Company that provides banking services to consumers and businesses in Eastern North Carolina and southeastern Virginia.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives