- United States

- /

- Banks

- /

- OTCPK:SABK

South Atlantic Bancshares (SABK) Profit Margin Surge Challenges Cautious Bank Sector Narratives

Reviewed by Simply Wall St

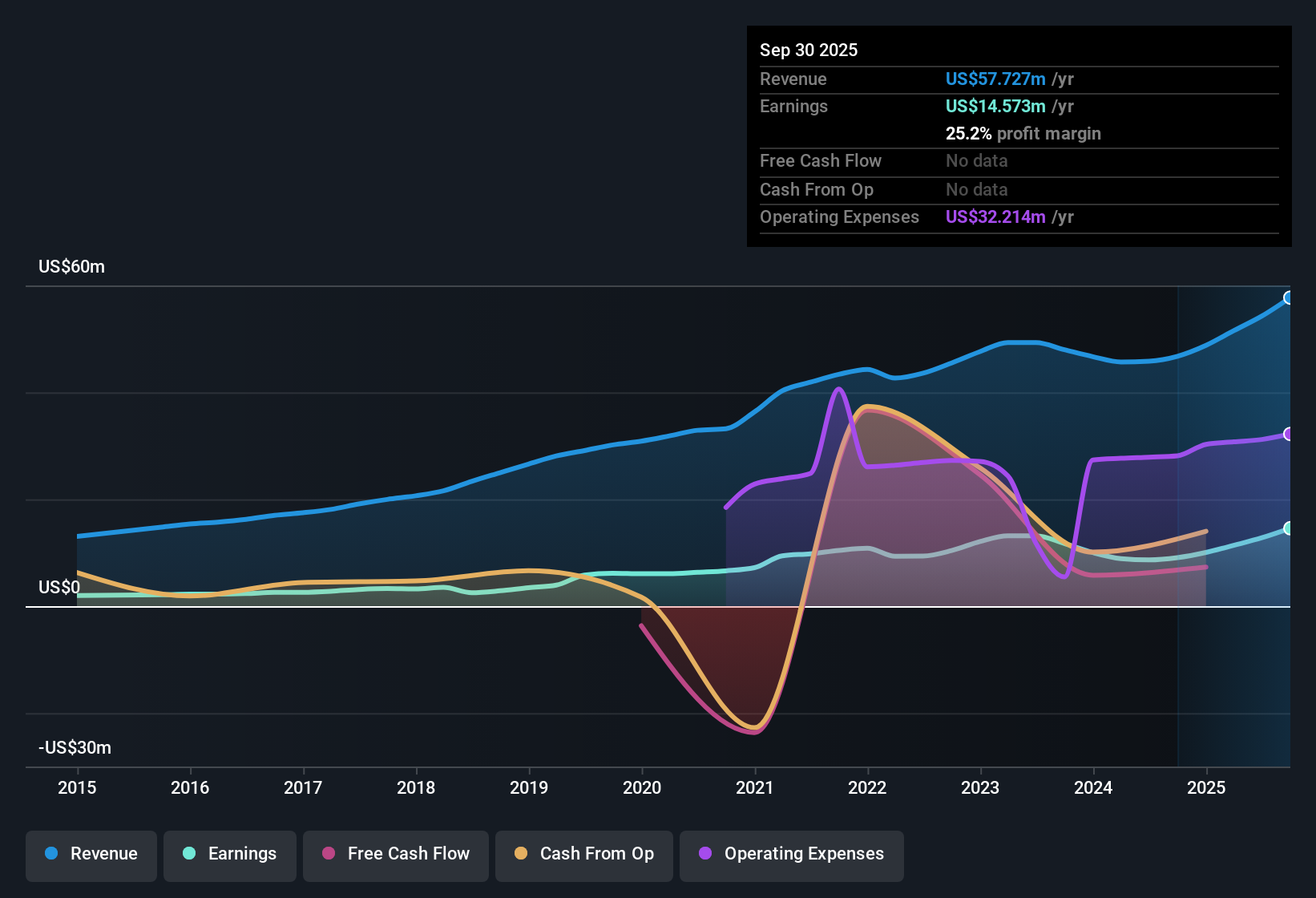

South Atlantic Bancshares (SABK) reported a net profit margin of 25.2%, up from 19.4% a year ago, with EPS climbing 60.5% over the past year. This is well above its five-year average annual growth rate of 6.6%. The stock currently trades at a Price-To-Earnings ratio of 9.3x, lower than both peer and industry averages, and its $18.10 share price sits below an estimated fair value of $22.75. With consistent earnings growth and no major risks identified, investors are likely to see the combination of robust profitability and perceived undervaluation as a constructive signal.

See our full analysis for South Atlantic Bancshares.Next, we will see how these headline numbers compare with the wider market narrative to test whether the results support or challenge the prevailing views among investors.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Climb Above Sector Trend

- South Atlantic Bancshares achieved a net profit margin of 25.2%, marking a substantial jump from last year's 19.4% and outpacing the mid-single digit margin expansion seen at many regional banks.

- In light of these figures, the prevailing market view emphasizes that:

- Rapid expansion of margins not only underscores robust cost controls but also positions SABK as more resilient than peers where margin gains have lagged, according to industry comparisons.

- Investors tracking margin trajectory in the sector may be encouraged that SABK’s improvement bucks the more cautious sentiment surrounding regional banks and signals differentiated management effectiveness for this reporting period.

Five-Year Growth Rate Supports Durable Upside

- The bank’s five-year annualized earnings growth rate stands at 6.6%, showing it has maintained steady expansion despite a challenging operating environment for many peer banks.

- According to the prevailing market view, this trend:

- Heavily supports the notion that SABK is a defensive growth story, matching bullish claims that long-term compounding is possible in regional banking when management keeps a consistent growth trajectory.

- By staying above sector averages on a multi-year basis, SABK appears better positioned to navigate near-term macro or regulatory shifts than banks with more volatile earnings patterns.

Shares Trade at Deep Valuation Discount

- SABK’s $18.30 share price trades at a Price-To-Earnings ratio of 9.3x, meaningfully lower than the US Banks industry average of 11.2x and the peer average of 12.9x. Meanwhile, its price is also 20% below the DCF fair value of $22.75.

- What’s notable from the prevailing market view is that:

- This valuation gap makes the stock stand out among regional bank peers, challenging critics who might argue the entire sector is overextended and underscoring a potential mispricing for investors seeking value plays.

- Constructive sentiment in the numbers is reinforced by the lack of flagged risks and by high-quality earnings, so the discount appears less about company fundamentals and more linked to broader market hesitancy in the banking space.

To see more perspectives that tie these results into the broader story, get a deeper breakdown of the latest narratives and valuation context on South Atlantic Bancshares. Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on South Atlantic Bancshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While South Atlantic Bancshares stands out for earnings growth and valuation, its rate of expansion has not reached the high levels seen in top-performing peers.

If you want to focus on companies with even more consistent and reliable performance, check out stable growth stocks screener (2099 results) that deliver steady results across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:SABK

South Atlantic Bancshares

Operates as the bank holding company for South Atlantic Bank that provides various banking products and services to individuals and small businesses in the United States.

Undervalued with solid track record.

Market Insights

Community Narratives